The urgent, shared global race to develop an effective vaccine for the novel coronavirus (Covid-19) dramatically illustrates how the unexpected onset and rapid spread of an infectious disease can upend established biopharmaceutical R&D processes, timetables, and collaborations. It also increases conjecture about other existing and/or emerging forces that may disrupt the biopharma industry’s identification, prevention, and treatment of diseases in the coming decades.

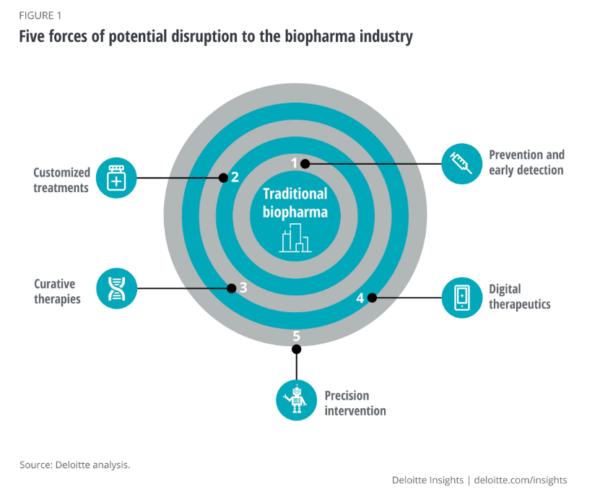

Based on interviews with industry experts, we identified five forces that are likely to alter the course of the biopharmaceutical sector and reshape business models between now and 2040 (figure 1):

These five forces represent both opportunities and threats to biopharma incumbents. Company leaders should consider the trends’ independent and collective potential for disruption as they redefine the types of products and solutions they will offer, where they will compete, and the new capabilities they will require. Those organizations which take steps today to reimagine and reshape their business models are the ones more likely to thrive in the future.

Health Benefit Consultants, Share Your Expert Insights in Our Survey

Tom Yang, Sonal Shah and Christine Chang The research referred to in the post - The future of biopharma: Reimagining business models in 2040 - can be accessed here. Tom Yang is a principal at Deloitte Consulting and assists biopharma and biotech executives deliver growth strategies that adapt to the ever-evolving life sciences and health […]

The five forces of change

Interview participants cited five forces that are already beginning to impact biopharma companies but are likely to disrupt the status quo more dramatically in the years ahead. These forces—driven by players inside and outside biopharma—are listed in order of their potential disruption to the traditional scope of the biopharma sector, are:

- Prevention and early detection

- Customized treatments

- Curative therapies

- Digital therapeutics

- Precision intervention

- Prevention and early detection

The Covid-19 pandemic shines a light on the importance of effective vaccines to prevent the spread of infectious diseases. However, vaccines, genetic testing and improvements in wellness could help prevent disease on a broader basis, making treatment for some illnesses no longer necessary (and reduce or eliminate the demand for some prescription medicines). Advances in early detection will likely enable interventions that halt diseases in the earliest stages—before they progress to more serious conditions. Today, for example, clinicians can detect the initial stages of melanoma much earlier than in the past, and prompt treatment can eliminate the disease completely. Interviewees suggested that other chronic conditions, such as Alzheimer’s disease, diabetes, various forms of cancer, and rheumatoid arthritis, might be treated more effectively if they are identified earlier.

The groundwork is already being laid for a world with a greater ability to detect and prevent disease. Vaccines are being created that include but expand beyond childhood or common infectious diseases to include certain cancers, for example. The ability to use genetic information to identify patients at risk of developing a disease is another step forward. Advanced analytics applied to data collected from diagnostics, combined with patient health records, could help identify patterns related to the causes and early markers of disease. Pharma companies should benefit by leveraging the insights that come from these advances to develop pathways and treatments for early intervention.

- Customized treatments

Personalization in medicine could effectively match patients with customized prescriptions or design therapies that would work for just a few people, or even a particular person (i.e., “n of 1”). Clinicians of the future may be able to examine a range of biomarkers and genetic information—as well as clinical and behavioral digital health data—to determine the appropriate drug combinations for a patient. This level of customization will likely require copious data—either through the use of real-world evidence (RWE) to effectively target or repurpose existing treatments—or new clinical trial paradigms that help identify high responders and optimal dosing. Early advances in customized treatments likely will be seen with generic and late-life cycle medications, which have considerable RWE to inform disease stratification, tailored dosing, and tailored drug regimens.

Biopharma companies should be at the forefront of understanding which drugs work best for which patients and under which circumstances; however, this will likely require large investments in data and analytics capabilities. Also, the shift toward increasingly customized treatments could have a significant impact on the biopharma supply chain: smaller-volume therapies could require new manufacturing capabilities for both branded products and generics.

- Curative therapies

Curative therapies—gene therapies, cell therapies and other time-limited treatments that remove disease symptoms through the permanent (or semi-permanent) correction of the underlying condition—have the potential to reduce the incidence and prevalence of many diseases, especially those driven by single genetic mutations (e.g., certain cancers, sickle cell anemia). As with prevention, treatments that cure disease could reduce or eliminate the demand for some prescription medicines.

While biopharma companies are leaders in the development of curative therapies, they may need to adopt new business models that address the shift from chronic treatment to a one-time treatment. In addition, data will be needed to demonstrate the long-term health economic value of these therapies before widespread adoption can occur. Companies will likely need to develop sophisticated methods for monitoring post-treatment patients to help shape the value story. Also, they may need to explore novel financing mechanisms to enable both access and affordability, given that the short-duration treatment has the potential for a lifetime of benefit.

- Digital therapeutics

Increasingly effective and scalable digital therapeutics, which use software programs to deliver evidence-based interventions to patients that help prevent, manage, or treat a medical disorder or disease, could replace traditional pharmacologic treatments. These digital interventions leverage cognitive behavioral therapy, a well-established and effective (but, thus far, not easily scalable) treatment approach, to enact behavioral change and deliver improved patient outcomes. Virtual coaches, for example, can help patients modify behavior in the moment to reduce the symptoms of anxiety, depression, and insomnia. Sleepio, a digital treatment for insomnia that does not involve drug therapy, is one example that is covered by a PBM in lieu of pharmaceutical sleep agents. Some digital therapeutics are empowering patients to take charge of their symptoms for complex chronic diseases including autoimmune diseases.

The future of digital therapeutics depends on user adoption, the ability to demonstrate results, and pricing and reimbursement optimization. While some patients might try the technology, they may lose interest after a few days or weeks. However, if the digital experience is user-friendly, includes a human touch when necessary, incorporates storytelling (rather than commands), and understands the motivation for each patient, adoption will likely continue to grow.

- Precision intervention

Advances in robotics, nanotechnology, tissue engineering, and other medical technologies could lead to dramatically improved outcomes in cancer, infectious disease, inflammatory conditions, and chronic pain. Robotic surgery integrated with augmented/virtual reality, artificial intelligence, and advanced analytics, for example, may make it possible to remove a tumor in a previously inoperable site and eliminate or reduce the need for chemotherapy. Microscopic nanotechnology particles have the potential to enter diseased tissues and deliver more targeted and precise medical interventions. Manufacturers and clinicians could use 3D printing (additive manufacturing) to create highly customized, low-cost medical technology products or restore damaged tissues.

Increasingly sophisticated medical technology could be highly disruptive to biopharma companies by reducing or eliminating the need for major classes of pharmaceuticals such as chemotherapy, insulin, and anti-inflammatories. Therefore, biopharma companies working in impacted disease areas should consider adopting some of these technologies, or risk operating in a much smaller market in the future.

Preparing for the new normal

The biopharma industry’s rapid pivot to prioritize development of effective Covid-19 vaccines highlights the impact new operating and business models can have in addressing a grave societal need, and an important tenant of the future of health, disease prevention. Current progress is being driven by unprecedented levels of collaboration among industry players, public-private partnerships, and accelerated at-risk R&D paradigms and large-scale investments. Learnings from these models could be applied to continue to advance the science and development of medications for areas that have been underserved by traditional market forces. The five forces of change described in this article should prompt company leaders to ask themselves:

- How will each of these five forces disrupt our current business model?

- Where do we see new business opportunities? What are the potential threats to our current business? How might these unfold over time?

- To what extent do we want to play in these emerging areas?

- How can we address these disruptive threats now? What capabilities are needed to enter emerging areas? What are some no-regret moves that we can make (e.g., potential partnerships, acquisitions?

- How can we continue to monitor the landscape for future disruption?

Armed with insights on where to play and how to win, biopharma leaders should then develop strategies to take advantage of the opportunities that emerge in a future built around prevention, early detection, and personalized therapies. Organizations that maintain the status quo could wind up shrinking along with the demand for drug interventions to manage symptomatic diseases.

Photo: nevarpp, Getty Images

The research referred to in the post - The future of biopharma: Reimagining business models in 2040 - can be accessed here.

Tom Yang is a principal at Deloitte Consulting and assists biopharma and biotech executives deliver growth strategies that adapt to the ever-evolving life sciences and health care landscape. He has worked extensively with clients to develop and commercialize breakthrough products in oncology, immunology, and liver disease.

Sonal Shah is a senior manager with the Deloitte Center for Health Solutions within Deloitte Services LP and leads the center’s life sciences research. Through her research, she helps inform Deloitte’s health care, life sciences, and government clients about emerging trends, challenges, and opportunities. Prior to Deloitte, Sonal worked in the biopharma industry.

Christine Chang, MPH, is a research manager with the Deloitte Center for Health Solutions, Deloitte Services LP. She conducts primary and secondary research and analysis on emerging trends, challenges, and opportunities within the health care system. She supports Deloitte’s Life Sciences and Health Care practice across all sectors and has written on topics including innovation, value-based care, and emerging technologies.