Currently available chronic kidney disease therapies can slow the condition’s progression, but they can’t stop the decline in organ function. Regenerative medicine company ProKidney is offering the potential for a different outcome—tissue repair. The biotech is conducting a pivotal test of its cell therapy, and it has agreed to a merger deal that takes the company public and infuses it with $825 million to support its clinical trial plans.

Behavioral Health, Interoperability and eConsent: Meeting the Demands of CMS Final Rule Compliance

In a webinar on April 16 at 1pm ET, Aneesh Chopra will moderate a discussion with executives from DocuSign, Velatura, and behavioral health providers on eConsent, health information exchange and compliance with the CMS Final Rule on interoperability.

ProKidney, a biotech that maintains operations in Winston-Salem, North Carolina, and Palo Alto, California, announced Tuesday that it is merging with Social Capital Suvretta Holdings Corp. III, a special purpose acquisition company, or SPAC. The merger has been approved by the boards of directors of both companies. When the transaction closes, the combined company will operate under the ProKidney name and trade on the Nasdaq under the stock symbol “PROK.”

Chronic kidney disease (CKD) can result from a variety of conditions, including diabetes and hypertension. Regardless of the cause, the disorder leads to steadily worsening kidney function over time. When patients reach the point of kidney failure, they need either regular dialysis or a kidney transplant.

Most of the CKD therapies available are small molecules designed to address some aspect of kidney function. AstraZeneca drug Farxiga and Invokana from Johnson & Johnson both belong to a class of class of diabetes medicines known as SGLT2 inhibitors. These drugs prevent kidneys from reabsorbing glucose back into the blood. In CKD, these drugs reduce the risk of worsening renal function. A relatively new Bayer drug works in a different way, blocking a receptor whose overactivation is associated with the inflammation and scarring that develops from CKD. That Bayer drug, Kerendia, won its FDA approval last July.

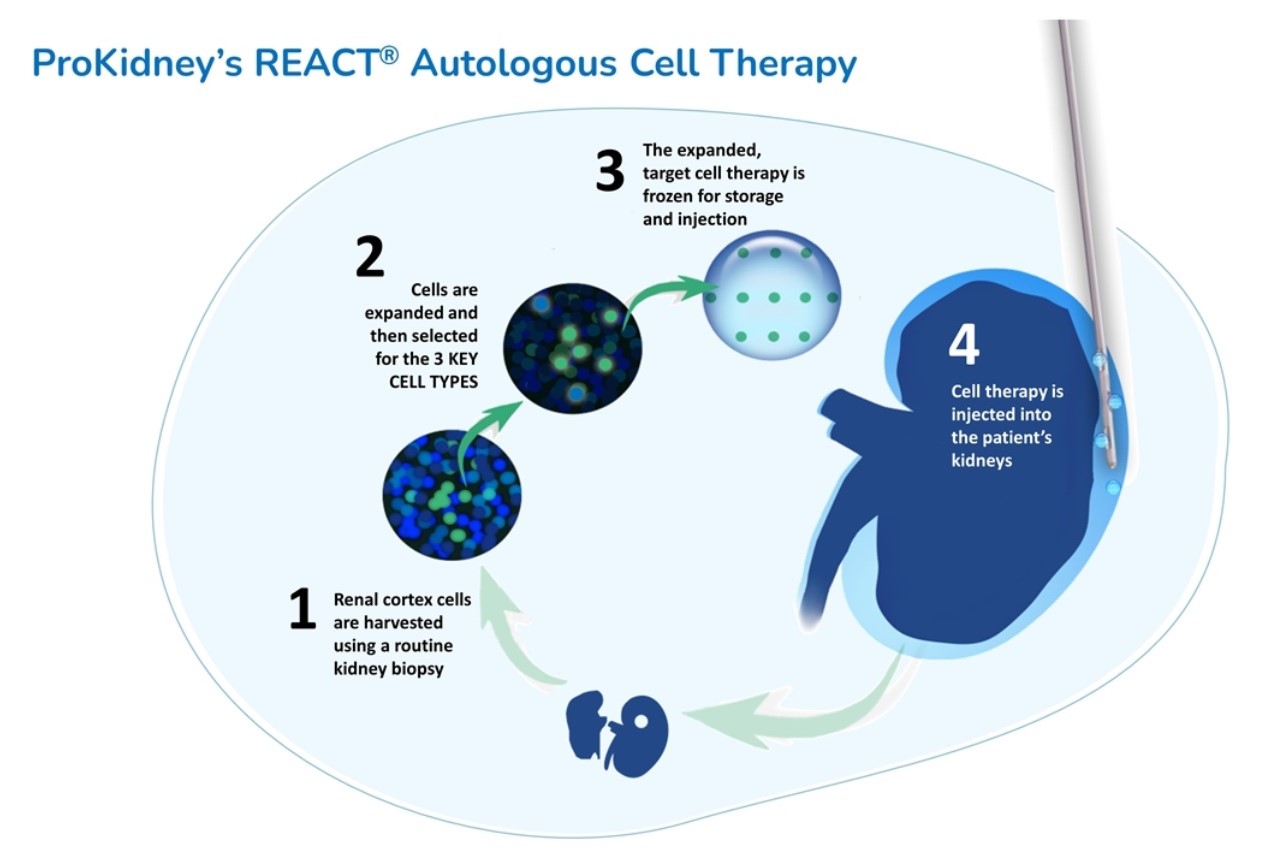

The experimental chronic kidney disease treatment of ProKidney is autologous, meaning it’s made from a patient’s own cells. The personalized therapy is made from a biopsy of a patient’s diseased kidney. From that small sample, ProKidney identifies and isolates three key types of progenitor cells, cells that have the capability to differentiate into other types of cells. These cells are multiplied in a lab and suspended on a hydrogel scaffold. This formulation is then injected into the patient’s kidney, where it migrates to the injured portions of the organ to promote the generation of new structures in nephrons, the urine-producing units of the kidneys. ProKidney calls its experimental treatment “renal autologous cell therapy,” or REACT.

A Deep-dive Into Specialty Pharma

A specialty drug is a class of prescription medications used to treat complex, chronic or rare medical conditions. Although this classification was originally intended to define the treatment of rare, also termed “orphan” diseases, affecting fewer than 200,000 people in the US, more recently, specialty drugs have emerged as the cornerstone of treatment for chronic and complex diseases such as cancer, autoimmune conditions, diabetes, hepatitis C, and HIV/AIDS.

So far, REACT has been tested in a Phase 2 study enrolling 81 diabetic patients with CKD. According to preliminary results outlined in a Social Capital Suvretta investor presentation, about half of the patients who received the ProKidney cell therapy showed improvement in kidney filtration rate; more than 80% of those responders are projected to never progress to end-stage renal disease or renal replacement therapy, which includes dialysis. By contrast, more than two-thirds of the study participants who received the standard of care are projected to progress to end-stage renal disease and dialysis. The ProKidney cell therapy has been safe so far, with no adverse effects reported from repeat injections of REACT.

Based on the positive mid-stage data, ProKidney this month began a Phase 3 clinical trial. The study is a randomized clinical trial that includes a control arm in which participants will be given sham injections. The 1,000 to 1,500 study participants will be between 30 and 80 years old with type 2 diabetes and moderate-to-severe CKD. The FDA has given REACT a Regenerative Medicine Advanced Therapy (RMAT) designation, which permits regular interaction with the FDA throughout the pivotal study. ProKidney expects a primary analysis of data will occur in 2025.

The SPAC merger is structured to infuse ProKidney with about $825 million. That sum breaks down to $250 million from Social Capital Suvretta, as well as $575 million from entities that have agreed to purchase shares of the combined company at $10 per share. This additional private investment will include contributions from Social Capital, ProKidney’s earlier investors, Suvretta Capital affiliate Averill, and other undisclosed institutional investors and family offices.

ProKidney’s existing shareholders will be eligible to receive up to 17.5 million additional shares, depending on the future stock performance of the company. Those shareholders and ProKidney’s management have also agreed to lock up 50% of their shares until five years or regulatory marketing authorization for REACT, whichever comes first.

In the merger announcement, ProKidney said that while the Phase 3 study is ongoing, the company will build manufacturing capabilities to support a potential commercial launch in late 2025 to mid-2026. At the outset, the company expects it would be able to supply REACT to 20,000 patients annually. Following the launch, the company will build additional manufacturing facilities that could serve an additional 40,000 to 45,000 patients per year.

ProKidney is led by founder and CEO Tim Bertram, whose career includes stints at Smithkline Beecham, Pfizer, and Tengion, a Winston-Salem-based biotech that was developing regenerative therapies for the bladder and kidneys. Tengion reached early clinical testing but was unable to find a partner to finance further development of those programs. In 2014, running low on cash, the company filed for bankruptcy protection and liquidated its assets.

Image from Social Capital Suvretta investor presentation