Repare Therapeutics’ drugs leverage a genetic vulnerability of tumors to kill them and the biotech has early clinical data indicating that its lead drug works in ovarian cancer and other tumor types. Roche sees promise in this DNA damage approach, and it’s forking over $125 million for global rights to the small molecule.

In addition to that upfront payment, the deal makes Quebec, Canada-based Repare eligible for up to $1.2 billion in milestone payments—$55 million of those payments are “near-term” milestones tied to clinical progress the drug, camonsertib, makes in Roche’s hands. Repare is also in line for royalties if Roche commercializes the molecule. The upfront cash, plus the milestone payments, will finance development of a pipeline whose progress also posed a problem, given the challenges facing any biotech company looking to raise money under current market conditions.

“As paradoxical as this might sound, we were a bit concerned with how nice the rest of the pipeline was looking and the investment that it would take,” CEO Lloyd Segal said, speaking during a conference call held after the deal was announced Wednesday evening. “We’re more excited about the pipeline, including [early clinical drug candidate RP-6306] than we ever have been. This [deal] enables us to have our cake and eat it too.”

Segal said Repare’s balance sheet is strong, but the cash from the Roche deal gives the company enough money to last into 2026. Roche says it plans to explore camonsertib across a range of tumor types. Repare retains an option to share in the development of that drug in the U.S. But in the nearer term, Repare’s focus will turn to RP-6306, which is currently in Phase 1 testing, as well as other programs that are advancing toward the clinic.

Repare’s drugs leverage a concept called synthetic lethality, in which a deficiency in a gene pair leads to cell death. While a deficiency in just one gene is not enough to kill the cell, a drug that targets the other gene in the pair can be the lethal trigger. The drug class known as PARP inhibitors pioneered the use of synthetic lethality as a way to target the DNA repair pathways of cancer cells. FDA-approved PARP inhibitors include Lynparza from AstraZeneca, Zejula from GSK, and Clovis Oncology’s Rubraca. But Repare aims to go beyond PARP by addressing other DNA repair enzymes.

A Deep-dive Into Specialty Pharma

A specialty drug is a class of prescription medications used to treat complex, chronic or rare medical conditions. Although this classification was originally intended to define the treatment of rare, also termed “orphan” diseases, affecting fewer than 200,000 people in the US, more recently, specialty drugs have emerged as the cornerstone of treatment for chronic and complex diseases such as cancer, autoimmune conditions, diabetes, hepatitis C, and HIV/AIDS.

Repare’s SNIPRx platform technology identifies these synthetically lethal pairings and matches them to the molecules that can target them. Camonsertib, which was previously known as RP-3500, is an oral small molecule drug designed to block ATR, a DNA damage response protein. It’s intended to address tumors with mutations in the ATM gene, which pairs with the ATR protein. In addition to identifying molecules that can leverage synthetic lethality, Repare says its technology also identifies patients that would benefit from this precision oncology approach.

Beyond the relationship between ATR and ATM, Repare said that its screening identified 19 additional genes that also have a synthetically lethal relationship with ATR, which means that the drug has the potential to address other groups of patients.

An open-label Phase 1/2 clinical trial testing camonsertib began in 2020. During the annual meeting of the American Association for Cancer Research in April, Repare reported that its drug led to durable clinical benefit across tumor types and genomic alterations. The company noted promising results in patients with ovarian cancer, breast cancer, head and neck squamous cell carcinoma, and melanoma.

The next program in the Repare pipeline, RP-6306, is a small molecule that blocks PKMYT1. In an investor presentation, Repare said RP-6306’s approach has the potential to address a range of tumor types including uterine, ovarian, stomach, colorectal, and bladder cancers. Phase 1 clinical trials are underway, including one study that is evaluating a RP-6306 alone or in combination with camonsertib in patients with advanced solid tumors. Kim Seth, head of business and corporate development, said the deal with Roche allows Repare to retain full rights to RP-6306 including the combination with camonsertib. Another Repare drug candidate that blocks polymerase theta has synthetically lethal relationships with multiple gene deficiencies found in tumors. The biotech is readying that drug for the preclinical research that could support an investigational new drug application.

Roche is not the first big company to take interest in Repare’s research. In 2020, Bristol Myers Squibb paid $65 million cash up front and made a $15 million equity investment to begin a partnership discovering targets for potential cancer drugs. Segal said that unlike the Roche partnership, which centers on a single asset that has reached clinical proof of concept, the BMS alliance is focused on delivering validated targets that that pharma giant will develop.

The Roche deal is expected to close in the third quarter of this year. The agreement grants Repare an option to share equally in camonsertib’s U.S. development as well as its commercialization, if it’s approved. If Repare exercises this co-development and profit-share option, it will still remain eligible for milestone payments as well as royalties from sale of the drug outside of the U.S.

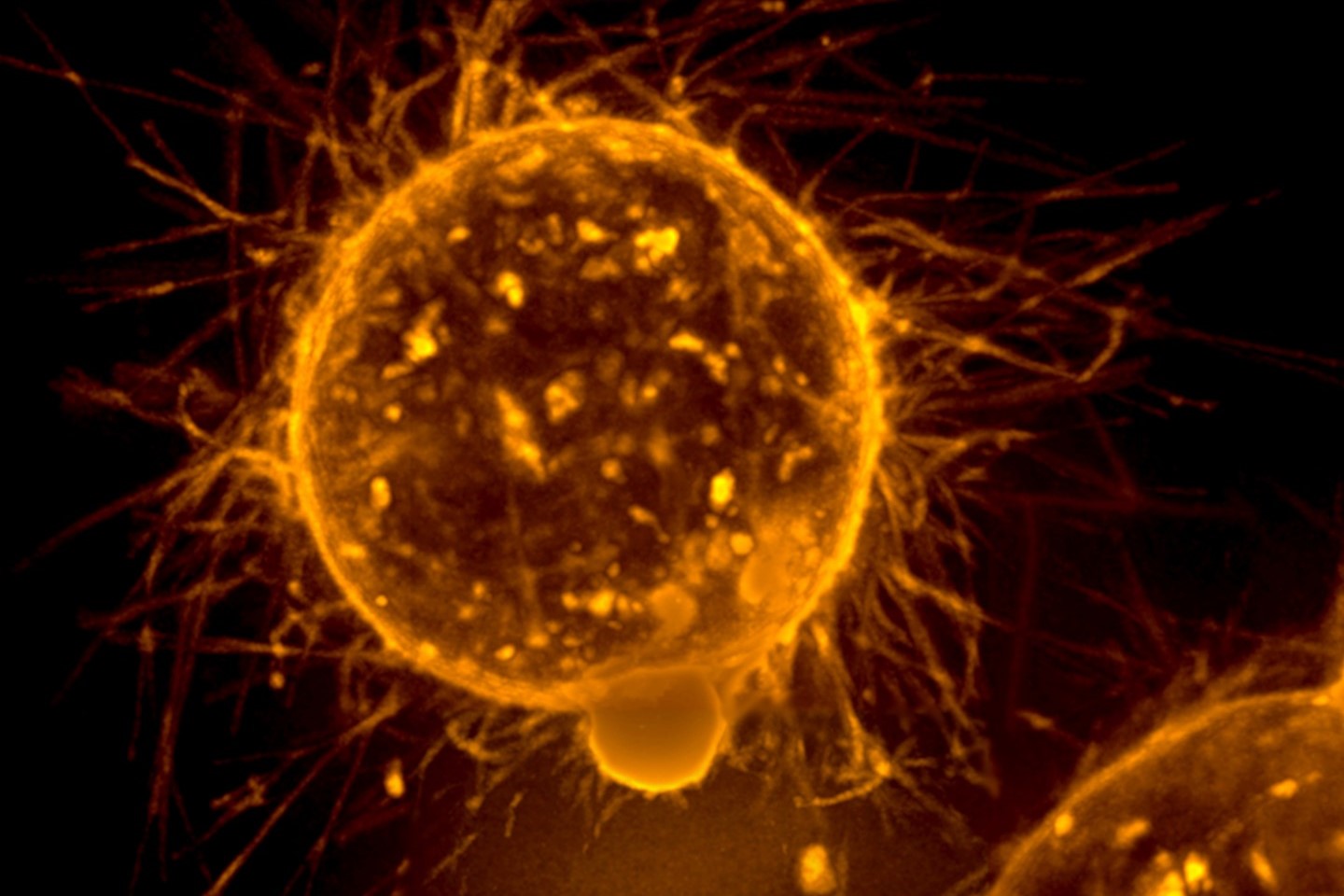

Public domain image by Stuart S. Martin via the National Cancer Institute