As healthcare spending continues to balloon with little end in sight, employers have been taking over the reins of their own healthcare destiny with growing frequency. One increasingly popular strategy to control those costs is an old-fashioned solution with new-fangled tech sheen: worksite clinics.

The concept has been in the news recently because of companies like Amazon and Apple establishing their own internal clinic models, but the history of worksite clinics dates back to the industrial boom ushered in by World War II. The manufacturing jobs created during the 1930s and 1940s necessitated the creation of healthcare support for workers to ensure that they remained on the factory floor and productive.

While this kind of occupational health support still makes up a large portion of the employer-sponsored clinic market, a growing cadre of clinic providers are targeting chronic conditions as the big drivers of healthcare spend. They position their brick-and-mortar primary care locations as a way to control costs through preventive care, thereby steering employers away from higher-cost providers.

“There’s a frustration with the variability of cost and quality in the local healthcare systems,” said Larry Boress, the executive director of the National Association of Worksite Health Centers.

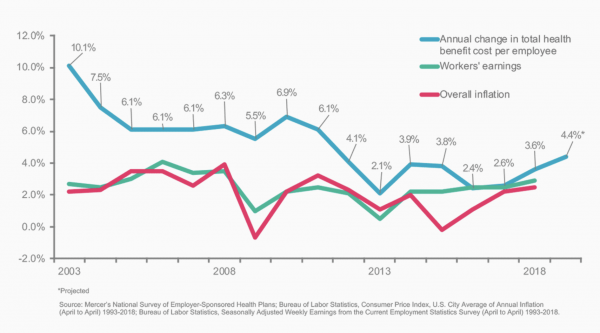

See below how employer healthcare costs have increased faster than inflation.

Credit: Mercer

Additionally, in highly competitive labor markets like the San Francisco Bay Area, convenient access to a clinic is part of talent retention strategies that include fitness centers, ping-pong tables and catered lunches. The Bay Area also has notoriously bad traffic and that means time away from work every instance an employee has to take care of a health matter.

“We’re also finding that employers recognize as people leave the worksite to pick up a drug, go to physical therapy or take their kids to an appointment, there’s a big impact on productivity,” Boress said.

Attend MedCity INVEST on April 23-24 to hear from employee benefits leaders like Livongo Health Chief Commercial Officer Jim Pursley, Midwest Business Group on Health CEO Cheryl Larson and The Zero Card CEO Jim Millaway. Use promo code MCN50 to save $50 Register now.

Not surprisingly, interest in the space is growing. According to a 2018 survey conducted by Mercer and National Association of Worksite Health Centers, a-third of U.S. employers with 5,000 or more employees offer general medical worksite clinics, up from 24 percent in 2012. The majority of those contract out with a third-party clinic operator. Two-thirds of survey respondents said they allow members to choose their worksite clinic as their primary care provider. This underscores the changing nature of these facilities within the overall employer benefits strategy.

A new form of managed care

Kaiser Permanente, the country’s largest managed care organization, grew out of the worksite employer-sponsored clinics at Henry Kaiser’s manufacturing facilities. Today, some employer-sponsored clinic providers view their services as an evolution of that trend especially given the renewed focus on primary care as a way to prevent downstream costs and referrals.

“I think the mantra that consultants have been helping to cheerlead with employers is that we’ve got to go back to the kind of primary care we’ve lost out on in this country,” said OMERS Ventures Managing Partner Michael Yang. “They’ve said ‘If you want to stop paying and you’re pissed at your bill, it’s all the downstream stuff you have to catch early.’”

Primary care has traditionally been a loss-leader for health systems and hospitals, which lose an average of $150,000 to $250,000 annually per PCP. For the most part, primary care has functioned as a funnel to refer care up to more expensive (and profitable) specialty care. Combine that with existing fee-for-service payment models and you have physicians struggling under the weight of seeing 20 patients a day and who are responsible for an average of 2,500 patients.

As employer-sponsored worksites are instead paid through a PMPM (per member per service) model, clinicians are given more time to holistically treat patients and prevent more serious illness, instead of just dealing with an acute medical need.

That, by itself, is likely to improve patient satisfaction, a key metric employers will look at when it’s time to renew worksite clinic contracts. Clinic companies also aim to boost satisfaction rates by making it easy to book appointments, for instance.

The interior of one of Vera Whole Health’s locations. (Vera Whole Health)

As Ryan Schmid, co-founder and CEO of Seattle-based clinic provider Vera Whole Health, puts it, “care coordination is the new managed care.”

“Having an employer-sponsored clinic is a great opportunity to establish rapport and trust with the patients in the way that’s unique from the 1990s HMO, especially if the rest of the care plan works around it,” Schmid said. “It can function as the anchor for their healthcare, in addition to their health plan which gives them a much broader network and much broader choice than a typical HMO.”

It’s not just the newer entrants making this pitch. More established companies in the space are taking a similar tack and touting their robust networks of clinics and services.

Jami Doucette, the president of Brentwood, Tennessee-based Premise Health, which was founded in 1964 and operates hundreds of clinics across the country, said his company’s clinicians act as the “quarterback” of a member’s experience as they move through the healthcare system, a sentiment echoed by other providers.

Clinic operators generally target around 15 to 25 percent reduction in healthcare costs. While initial savings can come from reduction in unnecessary specialty care and ER diversions, the true downstream value happens with the prevention of chronic disease, which can take years to actually come to fruition.

That is not to say all providers follow through on the promise. A few signs of whether a clinic is actually meant to function as a medical home are if they are physician-led, how primary care is actually used to handle referrals and whether dependents are given access to the site.

Reaching past the clinic

Especially amongst larger employers, it’s unlikely that a company’s entire workforce will have the ability to physically access a worksite clinic. In response, clinic operators are looking at ways to use technology or develop new models to extend the reach of their service offerings.

Methods of delivering care like mobile clinic services or setting up local clinic hours can help reach remote or satellite workforces, as well as near-site clinic models that are open to a variety of nearby companies for a lower cost.

San Clemente, California-based Crossover Health has made delivering virtual care a key part of its model through the recent acquisition of telehealth startup Sherpaa Health. Crossover was founded in 2010 and counts major companies like Facebook, Microsoft and Visa among its customers.

Its CEO, Scott Shreeve, sees the company’s move into virtual care as key to making the company’s platform an employee’s initial healthcare touchpoint and guard against over-utilization of its brick-and-mortar locations through technology-enabled triage.

“The deal provides our customers access and more capacity,” Shreeve said. “For many of our in-person clients, there’s simply no more room in the inn.”

To that end the company has developed dedicated teams of “virtualists” — clinicians who work out of the same physical office, but are dedicated solely to deliver care virtually. That system, which has parallels in the financial services and retail industries, allows for care coordination of patients with a team specializing in the nuances of practicing medicine virtually.

Part of clinic operators’ promise is to boost utilization of the myriad digital health point solutions purchased by employers.

While many worksite clinics have aspirations to be the leader and director of that pack, the truth is that employer clinics are often just one in a score of benefits solutions. In order to be successful in that strategy, clinic operators are trying to move horizontally and capture other products and companies under their larger care coordination umbrella.

Shreeve chose a somewhat surprising company as an inspiration behind Crossover’s own movement towards a blended model: eyeglass company Warby Parker.

“When they launched they were 100 percent online, but what they found was that customers needed a physical place to go as well,” Shreeve said. “What we’re trying to do is create one simple place to go that blends both the in-person and the online experiences.”

Driving then steering

While the idea of using a worksite clinic operation as the front door for employee health sounds great in theory, the concept only works if employees walk through that door in the first place. This is where benefits design has a major role.

John Hohman, president of New York-based insurance broker NFP’s West Coast operations, said setting co-pay and deductible levels low or at zero is one way to drive to employees to use a clinic for the first time. From that point, he said it’s up to the operator to develop a positive experience and relationship to keep patients coming back.

Crossover Health’s San Francisco location (Crossover Health)

In the heyday of the HMO, workers often bristled at their primary care doctor serving as a gatekeeper to specialty care or ancillary services. It’s not clear how employees today will react to what might be construed as employers similarly cutting off other options to receive care. Hohman said it’s a difficult question to answer.

“If I say ‘you work for me and you can only go there,’ I don’t think people are quite ready for that yet,” he said. “Not everything is in alignment yet for that to happen. But do I think it’s going that way? Yes I do.”

Paladina Health CEO Chris Miller said in one model the Denver-based company offers, Paladina charges for every employee of the company and makes the worksite clinic the assigned PCP for that workforce. The clinic is often paired with high-deductible plans — to save costs while driving employees towards utilizing the location.

In this case, visits to the clinic are offered at little to no cost and optional annual wellness exams are often sweetened with employee premium reductions. Miller said those who may overuse this system are balanced out by employees who only visit the clinic once or twice a year for their incentivized wellness exam.

As part of the sales pitch to employers, clinic operators tout the ability for them to have a better handle on healthcare referrals by diverting unnecessary speciality care and giving doctors the means to more effectively control referral spending through technology tools.

Clinic operators have their own proprietary secret sauce made up of claims data and various other inputs that gives their physicians insight into cost and quality metrics for local specialists, as well as imaging and diagnostics services.

Dr. Kate Long, a physician who manages a clinic for Charlotte-based Healthgram, said the upfront information she’s received on cost has helped shape her referral patterns by providing insight into what patients actually pay.

She even used the tool to make a decision about her own care ahead of a recent ophthalmology appointment.

“I went and looked up the two major eye clinics in the area and the other clinic was hands down less expensive,” Long said. “I liked my doctor at the first location, but why wouldn’t I choose the other clinic I knew it was cheaper?”

A stepping stone to direct contracting

Some proponents of the employer clinic model have placed the trend of worksite clinics as a precursor to a larger movement towards direct contracting with providers and health systems.

As operations grow, clinics are also bringing imaging or diagnostic services under their roof, or contracting out in bundled payment arrangements with vision and dental providers.

“I would say that it is a step toward direct primary care and direct provider contracting. In fact, CMS and health systems are exploring the feasibility of these models with employers and patients,” said Christopher Lee, the clinical solutions marketing manager at Family Health Centers of San Diego.

Not everyone is so convinced.

“How to create a network, how to evaluate a network, how to manage a network and all that kind of stuff is really challenging, and that’s what carriers have been doing for decades. That’s their bread and butter,” said OMERS Ventures’ Yang.

Somewhat ironically, health systems and hospitals themselves are one of the leading customer categories for third-party clinic operators. Providers struggle with the same cost considerations as other employers and often have additional privacy concerns which outside clinic vendors are able to address.

Health systems like Johns Hopkins and Stanford Health have also taken a go at the onsite clinic model as a potential new business line.

Paladina Health’s Miller said his company is exploring collaborations with health systems who see Paladina as a way to expose commercial clients to their service offerings. But he pointed to the additional challenge of working to avoid the appearance of a conflict-of-interest with other clients.

“The crux of our business model is dependent on us to be agnostic with referrals, we can’t be obligated to send referrals to a specific health system if we’re promising to deliver the best value-based care,” Miller said.

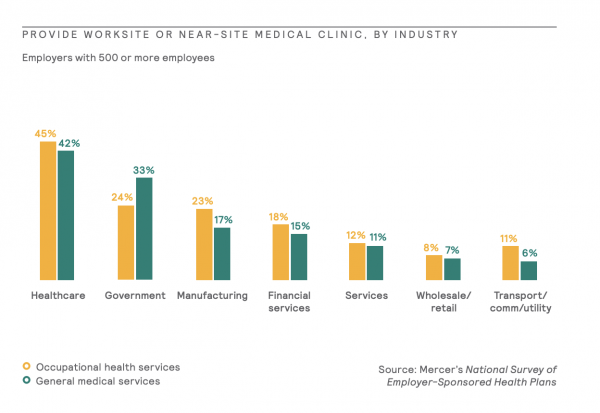

See below to see the industries that are most likely to provide worksite clinics.

Credit: Mercer

While once considered the realm of only mega-employers, direct contracting relationships are being considered by more companies because of the same cost crunch that have led to the expansion of the employer-sponsored clinic model.

One Willis Towers Watson survey conducted in 2018 found that while only 6 percent of employers were currently contracting directly with providers, the proportion of employers considering direct contracting jumped to 22 percent in 2019.

The approach has gained steam with employers like Walmart becoming more aggressive in the way that it run its Centers of Excellence programs. The company requires plan participants — employees — to travel to one of eight chosen providers around the country in order to have their spine surgeries covered.

All this may imply that payers are being left out in the cold. Not so.

In some cases, operators are launching locations in partnership with insurers which place these near-site clinics firmly in the center of plan design. For example, Vera Whole Health launched a partnership with Blue Cross and Blue Shield of Kansas City in 2018 to open three clinics available exclusively to specific BCBS KC members as part of a more effective strategy to manage care. Meanwhile, payers are becoming providers. UnitedHealth Group has quietly become one of the top employers of physicians through its OptumCare subsidiary.

Irrespective of payer-employer clinic partnerships and payer-provider consolidation, employers are not waiting for others to fix the problem as evidenced by the actions of Apple, Walmart and the Haven healthcare collaborative.

“There’s a realization out there that doing the same thing over and over is not going to get different results,” said Hohman, the benefits consultant.

It’s no small irony then, that a potential key part of that new solution is itself a throwback.

Picture: Hulton Collection, Getty Images