USA and China flag, conflict concept

China has been in the news a lot of late. Beyond the tariff and trade dynamics, China’s advances in and receptivity to digital health have started to hit US news feeds. Chinese health tech companies may look to export their AI and digital/mobile capabilities to the US.

A Tale of Two Industries

The U.S. was recognized as a global leader, innovator and pioneer for decades. Then, leading U.S. companies turned attention to competition, profits, mergers and acquisitions. They woefully underserved their consumers and lagged in adopting innovation. Furthermore, federal regulatory changes left U.S. companies scrambling in reactive mode.

This vignette describes the U.S. auto industry in the late 1960s, when the Big Three (GM, Ford, Chrysler) owned 90 percent of the U.S. market.

But doesn’t it sound a LOT like the U.S. healthcare industry of the past decade or more? Both the U.S. auto industry pre-disruption and the U.S. healthcare industry of today suffer from high defect (error) rates while simultaneously providing their products and services at a high cost.

By the mid-1960s American-made cars were not only road cruising gas guzzlers, but they had an average of 24 defects per unit, many of them safety-related. Meanwhile, Japan had been working to produce higher-quality cars at lower prices.

The New Blueprint: How Clever Care Health Plan is Scaling Its Member Experience [Video]

MedCity News was at the Vive conference and spoke with executives who shared their insights for the healthcare industry.

Most of us know the punchline: within just 15 years, Japan became the world’s leading auto producer in 1980, a position it held until China became no.1 in 2008.

Could the Chinese digital healthcare sector upend U.S. healthcare?

Chinese expertise in healthcare artificial intelligence (“AI”) and mobile/digital health continues to rapidly expand, driven by numerous challenges and advantages.

As in the U.S., increased rates of chronic illness and the aging population are putting pressure on the Chinese health system, though China differs from the U.S. with higher rate of death and illness due to chronic respiratory diseases. In the midst of this, China suffers a shortage of physicians with only 1.49 doctors per 1,000 people, much lower than 2.55 in the U.S.

Healthcare providers are not as well paid nor well respected in China as in the U.S., and China faces real difficulties of mistrust and suspicion of health providers. Beyond these healthcare dynamics, China has a highly rural population, a lack of existing infrastructure, and near universal consumer mobile adoption. Chinese innovators also have access to low cost labor, a large population, and more relaxed privacy regulations.

But will Chinese innovators look to export?

“Healthcare is local” is an axiom in much of our industry. Countless studies and initiatives have found that U.S. patients choose a closer-to-home doctor or hospital… even when faced with material differences in quality (including death rate!). Yet the bio-pharmaceutical industry has long been global. The current industrialization of care delivery sets the stage for globalization in other healthcare sectors as well.

While China’s population of 1.4 billion is 4x the US at 330 million, Chinese entities would be remiss not to focus on commercialization in the US. Because unit pricing is so much higher in the U.S., the total addressable market is quite compelling. For example, the average cost of heart bypass surgery is $20,490 in China compared to $93,000-$144,500 in the U.S. Per capita healthcare expenditures differ by more than an order of magnitude: $731 in China (2014) vs. $10,348 in the U.S. (2016).

Here again auto industry disruption may have lessons. Due to the protectionist mood of the 1980s in the US and the taunts of a Ford Chairman, Harold “Red” Poling, that the Japanese should “build cars where they sell them,” the only way Japan’s car companies could avoid import restrictions was to invest directly in America. The Japanese thus opened auto plants in the U.S.

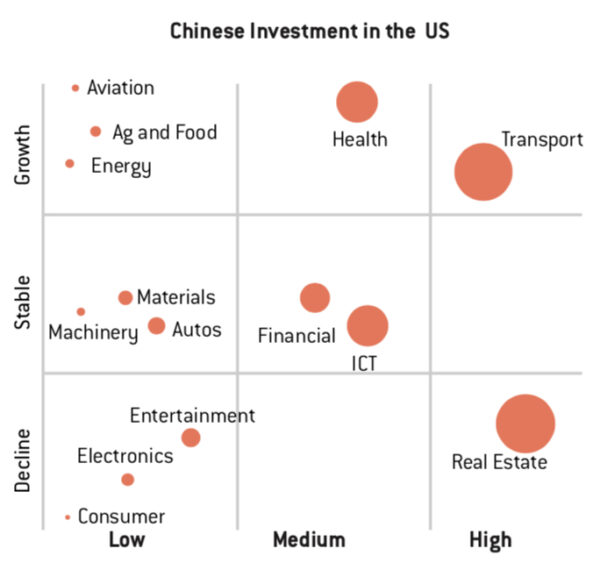

Similarly, the recent spate of Chinese operational and venture investments in the U.S. provides those entities early insights into commercializing healthcare innovation in the U.S. – not to mention relationships on the ground.

China’s 1.4 billion population and more relaxed privacy regulations allow a vast amount of medical images and data to feed AI applications.

Chinese tech giant Baidu first started “AI” rebranding in 2010, followed by Google in 2015, Alibaba in 2016 and Tencent in 2017. China’s government announced its ambition to be the global leader in AI by 2030.

But what about healthcare-specific applications of AI?

While US tech giants including Alphabet/ Google, Apple, Microsoft and Amazon are actively pursuing healthcare of late, Chinese tech giants Alibaba, Tencent and Baidu already operate in the Chinese healthcare industry.

In 2017, the Chinese government designated Tencent to advance intelligent healthcare. Tencent Trusted Doctor, a leading non-public online-to-offline healthcare company in China, revealed four sets of new AI-powered products to facilitate medical visits and health checkup in Q1 2019.

And what about the potential impact of AI on U.S. healthcare costs?

A report by Frost & Sullivan points out that AI has the potential to improve outcomes by 30 percent to 40 percent while cutting treatment costs by as much as 50%.

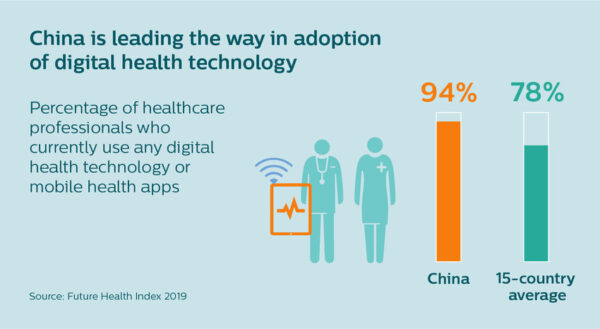

China’s healthcare professionals lead adoption of digital health technology and mobile health apps with a whopping 94 percent usage penetration compared to 76 percent for U.S.

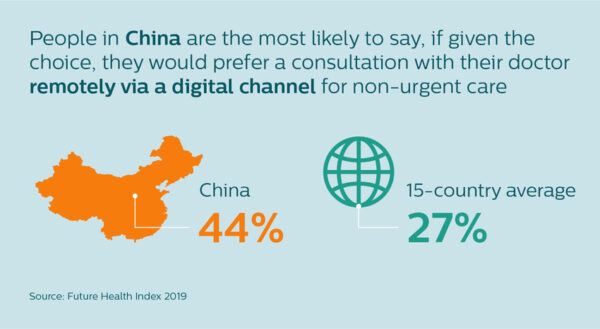

Almost half (43 percent) of China’s population lives in rural areas, facing severe health provider shortages and monetary constraints. And according to the China Internet Network Information Center, 97.5 percent of internet users in the country used a mobile device to access the internet in 2017. Not surprisingly, a key piece of the Chinese Work Plan for the Prevention of Chronic Disease 2012-2015 included mobile devices to monitor patients.

The CEO of Philips Greater China, Andy Ho’s June 2019 article for World Economic Forum provides insights from Philips’ 2019 Future Health Index:

How are Chinese consumers currently using mobile for healthcare?

Tencent is leveraging existing mobile payment channels to push healthcare technology offerings to end users at scale. Their Tenpay offering (WeChat Pay and QQ Wallet) is the second largest mobile payment offering after Alibaba, with 38.9 percent market share in China.

Tencent has been partnering with networks of Chinese hospitals and doctors facilitating payments and appointments through its popular WeChat messaging app for several years now. In April 2019, it also added a medical health module to WeChat Wallet, which has over 1 billion daily active users. This module links to online medical services powered by the Tencent Health platform. Tencent Trusted Doctor has 440,000 certified doctors in its network. Additionally, Tencent backed WeDoctor, a web-based service for appointment booking, medical education, online diagnosis, and virtual consultations with doctors. WeDoctor was founded in 2010, launched mobile app in 2014 and has 220,000 doctors in its network and 160 million users.

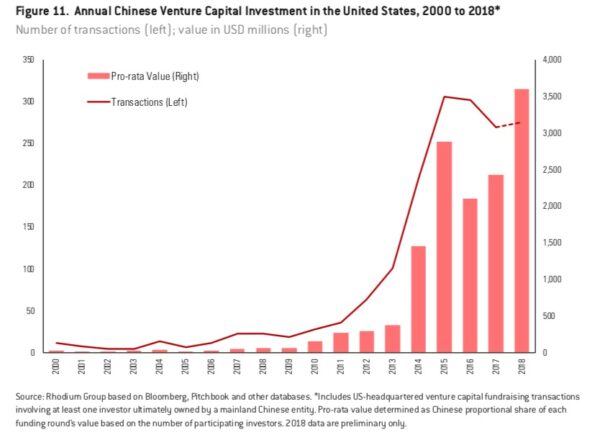

China’s increasing venture capital activity in U.S. healthcare innovation

Across a number of industry segments, Chinese VC investors participated in over 1,700 U.S. VC funding rounds since 2000, investing $14 billion with over 80 percent of China VC deals happening from 2014 to 2018. For a number of reasons, Chinese investment in US has been significantly lower in the past year.

And while not publicized much, several Chinese tech giants already have AI labs in the U.S. Alibaba, has had a secretive base in Seattle since 2014, and in 2017, announced it would open 2 research and development labs in Bellevue and San Mateo. In 2014, Baidu opened its Silicon Valley AI research lab and added Seattle AI research lab in 2017. In 2017, Tencent opened a Seattle AI hub focusing on speech recognition and natural language processing (NLP), led by Yu Dong, formerly of Microsoft Research.

And while not publicized much, several Chinese tech giants already have AI labs in the U.S. Alibaba, has had a secretive base in Seattle since 2014, and in 2017, announced it would open 2 research and development labs in Bellevue and San Mateo. In 2014, Baidu opened its Silicon Valley AI research lab and added Seattle AI research lab in 2017. In 2017, Tencent opened a Seattle AI hub focusing on speech recognition and natural language processing (NLP), led by Yu Dong, formerly of Microsoft Research.

A long shot?

The healthcare industry is more complex and multi-faceted than the automobile industry. Healthcare faces privacy and security considerations as well as market imperfections such as moral hazard and adverse selection.

Not to mention the monumental differences between the healthcare industries in the two countries along numerous dimensions. For example, while the Chinese market has a large direct purchase segment, for much of the U.S. healthcare industry, the purchaser and consumer are distinct and largely isolated from each other. And, of course, the US regulatory environment is quite complex.

But what if?

Ultimately, consumers benefited because reverse innovation from Japan disrupted the US auto industry: lower cost, higher quality cars.

Organizational culture change was a significant barrier, so much so that the U.S. auto industry even 40 years later still has not fully recovered.

Fasten your seat belts… we’re in for an interesting ride in U.S. healthcare!

Heather Jorna, Doug Williams and Isabella Mancini contributed to this article.

Picture: Veronaa, Getty Images

Jaime Moran is inspired by the team, clients and users of Yaro, where she is currently Interim CEO helping commercialize a platform that helps empower individuals to live healthier, happier, more productive lives – while reducing healthcare costs. She brings over a decade of operating company experience driving results across complex, multi-stakeholder ecosystems with an array of partners including health insurers, healthcare provider systems, health technology, analytics, retail and digital health companies.

Jaime founded Shift Health Advisory, which has advised health tech venture capital funds and tech-enabled services start-ups on strategy, product development, operations and commercialization. Prior to founding Shift Health Advisory, Jaime was a VP of Healthcare Innovation at Walgreens. She has worked in innovation, strategy and product development at the national Blue Cross Blue Shield Association and Aetna’s Innovation Labs.

Before working in healthcare, Jaime spent five years advising technology companies raising capital and completing mergers and acquisitions. Jaime earned her MBA as an Arjay Miller Scholar at Stanford Graduate School of Business. She received an MSc in Chemical Research as a Fulbright Scholar at University College London, where she published research on computer simulations of molecular interactions.

This post appears through the MedCity Influencers program. Anyone can publish their perspective on business and innovation in healthcare on MedCity News through MedCity Influencers. Click here to find out how.