New Jersey legislators are calling for state officials to investigate Clover Health, a San Francisco-based insurance startup, as well as other entities created by the owners of CarePoint Health System. The for-profit health system had planned to sell two of its New Jersey hospitals, and was seeking a buyer for the third. But after the New Jersey State Commission of Investigation found CarePoint had funneled $150 million in management fees to companies created by its owners, lawmakers are calling for state authorities to call off the deal and further investigate their businesses.

CarePoint Health was created when Vivek Garipalli, James Lawler and Jeffrey Mandler bought its three hospitals out of bankruptcy between 2008 and 2012. Garipalli and Mandler also co-founded insurance startup Clover Health in 2014.

So far, bids to find a buyer for the hospitals haven’t been promising. A deal for Prime Healthcare to buy 254-bed Bayonne Medical Center fell through in January. RJWBarnabas Health, a nonprofit health system, signed a letter of intent to acquire 363-bed Christ Hospital and 333-bed Hoboken University Medical Center. But by early February, negotiations hit a standstill, according to the Hudson Reporter.

Concerned about the hospitals’ future, New Jersey legislators representing Hudson County called for state authorities to further investigate the owners’ finances and nullify any sale of land related to the hospitals, according to a Feb. 10 letter first published in the Hudson County View.

Navigating The Right Steps For Your Healthcare Startup

This webinar will explore how a banking platform approach could be the resource for your company.

They specifically called for the Department of Health, Department of Banking and Insurance, and Attorney General to investigate the operations of Clover Health and Alaris Health, a New Jersey-based nursing home company created by a minority owner of Christ Hospital. Alaris Health owner Avery Eisenreich is currently embroiled in a lawsuit with CarePoint.

“It now appears that Christ Hospital is on the verge of bankruptcy and petitioning for closure and that Bayonne Medical Center is only a few weeks behind. The impact of closing one or more of these facilities on the Hudson County community would result in a devastating loss of health care access for thousands of individuals and families,” the letter stated. “The near bankruptcy of the CarePoint hospitals is directly related to the decision by ownership to withdraw unreasonably large sums from their operations for personal profit at the detriment to services and the health care available to Hudson County residents.”

Clover Health denied any involvement with CarePoint, in an emailed statement.

“Clover Health and CarePoint are entirely separate and independent entities, with different management teams, investor structures, and boards of directors. Clover has no influence on CarePoint’s operations, finances, or strategy, and vice versa,” the company’s president and chief technology officer, Andrew Toy, stated.

A complex web

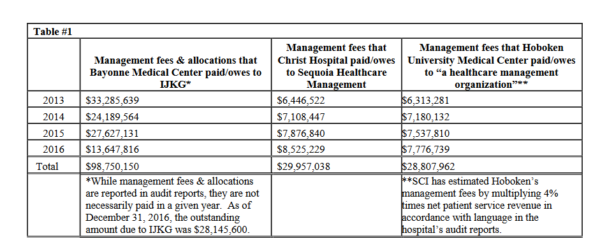

According to the New Jersey State Commission of Investigation’s report in March, CarePoint’s hospitals had paid more than $157 million in management fees to holding companies between 2013 and 2016. These entities, IJKG and Sequoia Healthcare Management LLC, were owned by Garipalli, Lawler and Mandler through a complex structure of business entities.

“These related-party management entities have no employees and only limited operating expenses which, in combination with other information, raises questions about the nature of their operations,” the report stated.

CarePoint hospitals paid millions in management fees to private entities, according to a report by the New Jersey State Commission of Investigation.

In past testimony to the State Commission of Investigation, Mandler had said that IJKG is a holding company but that its fee was for the “sweat equity” for work conducted by him, Garipalli and Lawler. Regarding the payments to Sequoia Healthcare Management, Garipalli said they were “incentive payments” that would only be made if the hospitals were successful.

In 2014, Sequoia Healthcare Management obtained a $60 million loan from a financial institution. Between 2013 and 2016, some of the proceeds of that loan were divvied out to LLCs linked to the three owners. According to the report, on July 17, 2014, more than $43.5 million was transferred to an LLC linked to Garipalli, more than $5.4 million to Lawler, and more than $5.4 million to Mandler. Clover Health was incorporated on the same day.

According to the report, “Garipalli confirmed that there is a connection between the loan closing and the incorporation of Clover Health Investments. He explained, ‘[W]e needed to raise outside capital. You cannot raise outside capital as long as the insurance company owed money, so we had to pay off that loan before anyone would want to invest capital into what became Clover.’”

Growing pains

Clover Health, which primarily offers Medicare Advantage plans in New Jersey, has faced its own struggles. Valued above $1 billion, the startup has prominent investors in Greenoaks Captial, Sequoia Capital, and Alphabet’s GV. The company has raised more than $900 million to date, including a $500 million round it closed in January of 2019.

Two months after that funding round, Clover Health announced it would cut a quarter of its workforce, calling it a restructuring. The company said the layoffs were not for financial reasons, but part of an effort to shift its expertise from tech to the Medicare Advantage market. In January, the company had 400 employees, down from roughly 500 last year.

The company also shuffled its top leadership, with co-founder and chief technology officer Chris Gale leaving in 2017. But the company said its membership base is growing. Clover said 54,000 members had enrolled in its Medicare Advantage plans for 2020, up from 39,400 in 2019.

Photo credit: YinYang, Getty Images