Startups come out of stealth for a variety of reasons but what’s common to the unveiling is that they always follow a predetermined calendar.

A pandemic, of course, can wreak havoc on the best-laid plans. But for New York-based Tomorrow Health Covid-19 is a crisis that equals a great opportunity. As the greatest public health emergency in modern history took hold in the world, the home health company — built around an e-commerce platform where patients can buy needed medical supplies and equipment — saw a “400 percent increase in inbound” interactions, said it’s CEO Vijay Kedar. That only meant one thing: speed up the formal public relations blitz scheduled for August to this week. Founded in 2018, Tomorrow Health formally launched on Tuesday.

“It’s been a substantial uptick as it relates to individuals and families [reaching out to us] and also pretty substantial in terms of our dialogue and partnerships with payers who have an increased focus on home-based care now,” Kedar, who is also a co-founder, said in a phone interview.

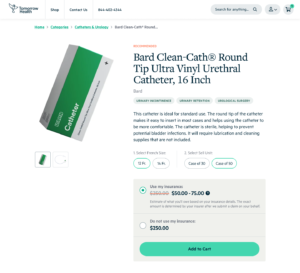

There are tons of online medical equipment sites, many local, brick and mortar retailers as well as large medical equipment providers promising to deliver everything from CPAP masks and walkers to catheters and bandages, so what does Tomorrow Health bring to this decidedly not-so-sexy segment of healthcare?

Only the Holy Trinity – cost savings, efficiency and an unparalleled customer experience rarely delivered in the industry — if Kedar is to be believed.

This is how it works. A patient in need of medical supplies and equipment creates an account on Tomorrow Health and enters relevant insurance details. The insurance information is confirmed and in real time a search for medical equipment can be conducted.

Solving Healthcare’s Provider Data Problem Starts with Interoperability

Break down the silos. Take control of your provider data.

Results show prices of products that are covered by insurance, as well as what the price would be without insurance coverage. Thus, consumers who were going to buy online from other sites that do not take insurance can immediately see the price difference.

Results show prices of products that are covered by insurance, as well as what the price would be without insurance coverage. Thus, consumers who were going to buy online from other sites that do not take insurance can immediately see the price difference.

But the larger cost savings benefit can be felt by payers, Kedar said, and that goes into the efficiency argument that Tomorrow Health is making. Kedar’s personal experience while coordinating his mother’s care led him to realize that the medical equipment supplies segment is hopelessly antiquated, deeply fragmented and operationally near-broken. In many cases, patients that are ready to be discharged from the hospital cannot be released because needed medical supplies wouldn’t be delivered to the home in time. This adds up to the indirect charges that payers have to shoulder. If a startup can coordinate this piece more efficiently and have strong distribution networks whereby the products are delivered home in a timely manner, surely payers would beat a path to Tomorrow Healths door. At least that’s what Kedar is hoping to prove.

There is also a direct cost that payers bear in terms of medical supplies and equipment spend. The segment has its share of fraud, waste and abuse, Kedar said. (I noticed the waste part of it in caring for my own brother who died from Stage 4 cancer in 2017. Boxes and boxes of wound care supplies would arrive in the wrong size and there would be no possible way to return them.)

“Medical equipment and supplies is a top 3 category for Medicare in terms of fraud, waste and abuse,” Kedar said. “Medicare’s improper payment rate for medical supplies and equipment is 45% relative to 8% for every other category. From a payer lens, that’s a demonstration of what has been a resulting problem from the lack of visibility into the space and the excess utilization that has resulted from that.”

Kedar contends that Tomorrow Health, powered by strong technology and robust partnerships with distributors can tackle this nagging and expensive problem.

“We believe that the solution to all these problems is really to combine technology-enabled operations with a deep personalized touch and focus,” he said. “All of the individuals and families that we work with will have clear visibility through our platform of the products and supplies they have ordered, ones that are recurring or are under re-supply, the prescriptions and authorizations they have on file.”

The “deep, personalized touch” is part of the customer experience that Kedar expects to deliver to everyone who creates an account on Tomorrow Health. While that customer experience has been described as an Amazon-like experience, it’s an imperfect analogy at best. There is not a lot of handholding and support required for consumer goods. Not so for a four-wheeled walker with a seat, catheters, CPAP masks, all of which need to be installed correctly. This is where Tomorrow Health’s customer service representatives (Kedar calls them care advocates) come in.

“For every member that we serve, our care advocates do a follow-up consultation to help and guide them through set up and support the ongoing management, and frequently communicate with them,” he explained. ”

In the course of such interactions, the care advocates can find out whether the equipment fits their needs, if it is still needed, and if not, what other products might be more appropriate. Gathering this information may help in attacking the problem of waste. But more importantly, the hands-on customer service may distinguish the startup from bigger names in the space like Apria Healthcare that have a host of negative reviews from irate customers complaining of a variety of issues, including delayed delivery. By contrast, Tomorrow Health promises order tracking and delivery within one to two days — in this respect, it does aim to provide an Amazon-like (or Amazon Prime-like) experience.

Yet not every startup with a vision for shaking up the status quo is able to draw venture capital. Tomorrow Health has raked in $7.5 million in a seed round led by Andreessen Horowitz and including Box Group and Rainfall Ventures, as well as wealthy angels including C-level executives from Flatiron Health, Quartet, Stripe, Massachusetts Medicaid, and the World Bank. Compare that to an analysis by Wing that showed that the average startup in 2019 raised $5.6 million in its seed round.

Investors were likely drawn by the team that Kedar thinks provides Tomorrow Health a leg up in its mission to transform the home health medical supplies segment. Kedar said he led the care innovations team at health insurance startup Oscar Health; the company’s CTO and co-founder Gabriel Flateman held the same title at Casper, the mattress company that sold directly to consumers. In addition to that, the team has a group of healthcare heavyweight advisers: Trevor Fetter (former CEO of Tenet Healthcare) and Trent Haywood (former chief medical officer of the Blue Cross Blue Shield Association) among others.

Tomorrow Health has already inked partnerships with more than 100 national and regional with payers and distributors. The company is licensed by Medicare. While the number one goal is to expand partnerships with payers, the company isn’t ignoring healthcare providers. The website encourages physicians to refer their patients to Tomorrow Health.

“We also provide the capability to caregivers and member’s physicians to order on their behalf,” he said. “That’s one of our big focuses — is really creating the authentication and capability for other stakeholders to order on behalf of patients and manage their supply needs.”

Since late last year, the company has had “engaged with thousands of members to date across a wide range of needs, Kedar said, declining to provide details on how many accounts have been created or how many transactions have occurred through the site. Tomorrow Health operates in 24 states and Washington D.C. including areas hit hard by Covid-19 such as New York, New Jersey, Michigan, Louisiana and Washington.

“We have served both the Covid-infected patients who are coming home and discharged after being two weeks on a ventilator and in need of respiratory mobility support in the home as well as Covid-affected folks who are home and managing chronic conditions and are trying to stay outside the hospital,” Kedar said.

Delivering care at home has been an ongoing trend as the healthcare industry has been trying to shift to value-based care in fits and starts. But Covid-19 has seemingly turbocharged that trend of at-home care. Health tech companies have already seen a boost as a result. It remains to be seen whether companies like Tomorrow Health can translate the trend into commercial success given that the market it is trying to claw its way into is massively fragmented, has numerous players and involves a tremendous amount of coordination with different stakeholders.

Photos: Tomorrow Health

CORRECTION: A previous version of the story mischaracterized a quote referring to the “improper payment rate” of Medicare as it relates to durable medical equipment. In essence, Medicare pays a much larger proportion of “improper” DME claims whether due to fraud or inefficient operations compared with improper payments in all other types of Medicare claims.