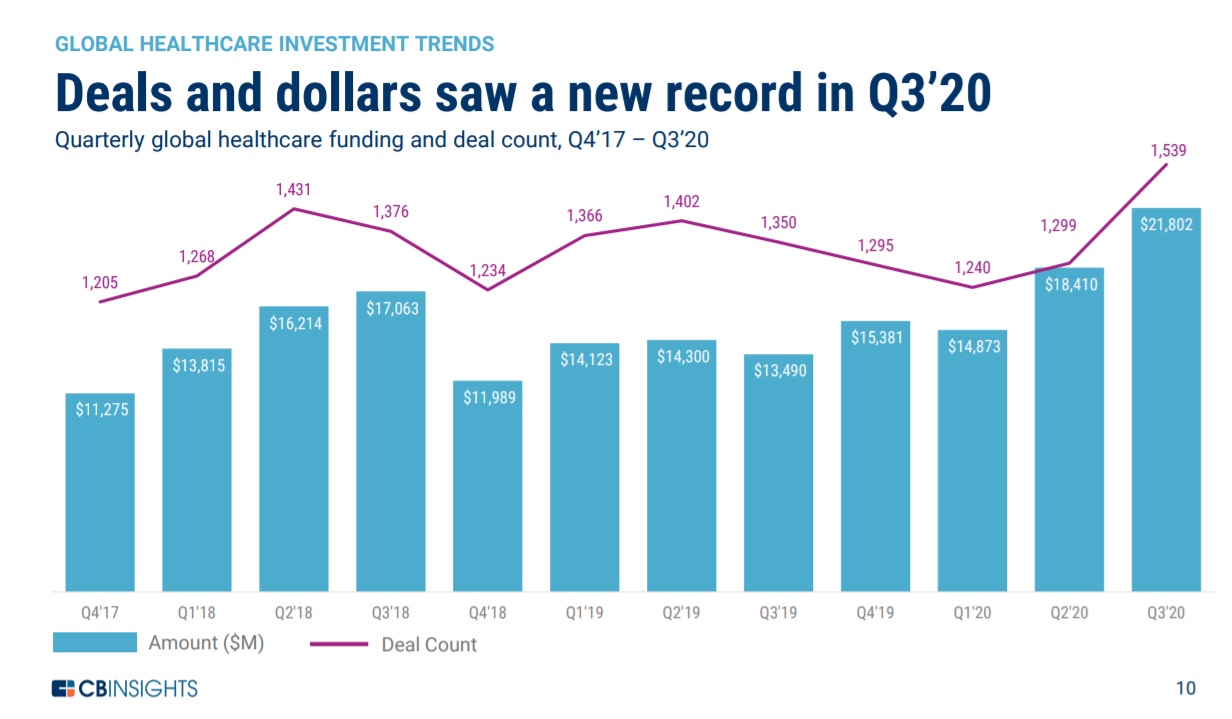

Healthcare funding reached record levels in the third quarter of 2020, according to CBInsights.

Healthcare funding hit a new record in the third quarter of 2020, according to new data from CBInsights. Healthcare companies around the world raised a total of $21.8 billion, compared to last quarter’s record of $18.4 billion. The total number of deals also increased 18% quarter-over-quarter, from 1,299 deals to 1,539.

It may be no surprise that telehealth, in particular, broke records when it came to the number of deals and dollars. Telehealth startups raised $2.83 million in the third quarter across 163 deals, according to the report. A significant portion of that was chalked up to large rounds, including ones raised by primary care startup VillageMD, direct-to-consumer health company Ro and healthcare navigation startup Grand Rounds.

The Covid-19 pandemic also shifted new attention to digital health companies, and this was reflected in the data. Global digital health funding set a new record of $8.4 billion in the third quarter, up 73% from the prior quarter, according to CBInsights.

Interest in mental health and women’s health companies also surged. The amount of funding poured into women’s health companies and the number of deals increased sharply quarter-over-quarter, for a total of $544 million raised in the third quarter of 2020. For example, Kindbody, which offers virtual and in-person fertility services, raised $32 million in July.

Though funding for mental health companies decreased quarter-over-quarter, the number of deals increased. For example, mental health employee benefits startup Lyra raised a $110 million funding round in August, months after striking a partnership with Starbucks.

Integrating GLP-1s: How Berry Street is Redefining Nutrition Care

Richard Fu details the company's approach to nutrition therapy and strategy for patients using GLP-1s.

Here were the top 10 deals for the quarter:

- JD Health, an online pharmacy and telemedicine company based in China, raised a whopping $830 million in August led by Hillhouse Capital Management.

- Insurance startup Bright Health raised $500 million to expand into the employer-based insurance market. It primarily focuses on individual market and Medicare Advantage plans.

- AI drug discovery platform XtalPi raised $319 million. SoftBank’s second Vision Fund co-led the funding round with PICC Capital and Morningside.

- Tizona Therapeutics, which develops cancer immunotherapies, raised $300 million from Gilead Sciences. The minority investment includes the option for Gilead to acquire Tizona in the future.

- CureVac, which develops mRNA-based cancer immunotherapies, raised $297 million. The German biotech firm is also developing a vaccine for the novel coronavirus.

- Walgreens invested $275 million in primary care company VillageMD. The initial investment is part of a bigger, $1 billion partnership between the two companies that involves opening hundreds of primary care clinics at Walgreens stores in the next three years.

- Freenome, which develops liquid biopsy tests for early cancer detection, raised $270 million. Its first product will be focused on colorectal cancer.

- Thrive, which is also developing liquid biopsy tests, raised $257 million. It’s launching a study of its first product, intended to detect multiple cancers.

- AI drug-discovery startup Recursion struck a partnership with Bayer after the latter led a $239 million funding round. It planned to pair Recursion’s platform with Bayer’s library of small molecules to discover and develop new drugs.

- Waterdrop, based in China, is taking a crowdfunding approach to insurance coverage. The startup, which raised $230 million, built a mutual aid system where its users make small contributions and can access a capped amount of money for medical costs.