As the Covid-19 pandemic rages on in the U.S., the financial futures of hospitals and physician practices remain in flux. Though hospitals saw some operating margin gains in September, patient volumes continued to decline, and losses related to operating physician practices grew according to two new reports.

Without incorporating funding received from the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act, median hospital operating margins saw a 6.5-percentage point decline from January to September 2020 as compared to the same period last year, according to a report from healthcare consultancy Kaufman Hall. With CARES Act funding, median operating margins dropped 1.4 percentage points. [Click chart to enlarge.]

The report — which used data from over 900 hospitals gathered monthly over the last three years — shows that in September, hospital margins increased by 8.1% year-over-year compared withSeptember 2019 without CARES Act funding. Margins increased by 15% year-over-year with the funding.

But September also marked the seventh straight month of declines in volume, with discharges down 9.9% between January and September and 5.6% year-over-year. Emergency department visits also fell 19.1% year-over-year and 16.4% year-to-date. [Click chart to enlarge.]

Higher revenues were offset by a rise in total expenses, which increased 1.8% year-to-date and 3.5% from the same period a year ago.

The boost in hospital margins last month is likely due to several factors, including an increase of about 2.3% year-to-date and year-over-year in average length of stay. Healthcare organizations also benefitted from the Medicare add-on payment of 20% for hospitalized COVID-19 patients and a suspension of the 2% sequestration reduction.

In addition, margins increased in September in part because hospitals continued to work through the backlog of surgical cases that were previously put on hold. Operating room minutes rose 3.6% year-over-year but were down 12% year-to-date, “reflecting the impact of Covid-related delays or cancellations of care,” the report states.

The second report from Kaufman Hall drills down on data from nearly 100,000 physicians and advanced practice providers, a vast majority of whom are health system employees. The findings show that costs associated with operating employed physician practices continue to be a significant concern for health system executives.

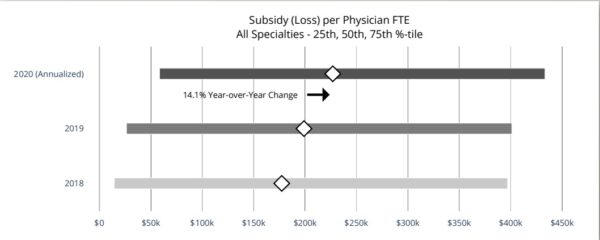

As of September, there was a 14.1% year-over-year increase in overall loss per physician for health systems, resulting in a median loss of about $227,000 per physician across all specialties. [Click chart to enlarge.]

The report compares data from 2019 to annualized data from January to August 2020. It shows shows hospital-employed physician practices experienced a 7.6% decrease in physician productivity as a result of declines in patient volume due to the pandemic.

There was a 1.7% increase in physician compensation per full-time employee to $319,346 in 2020. But net revenue earned per physician work relative value unit — a measure of productivity used in the Medicare reimbursement formula for physician services — also jumped by 2.5% from last year, likely due to expanded payer coverage of telehealth visits and services.

While there are some slightly encouraging figures in the report, Jim Blake, a managing director at Kaufman Hall, warned that there are challenges ahead, “as rising Covid-19 cases collide with the seasonal flu, and consumers continue to avoid hospitals.”

Photo Credit: Baris Ozer, Getty Images, and Kauffman Hall

Note: This article misspelled consultancy firm Kaufman Hall. The spelling has been updated. We regret the error.