Rare disease offers plenty of drug research opportunities simply because there are so many diseases yet so few medicines. For the more than 7,000 rare diseases that have been identified, there are only about 650 FDA-approved therapies. Star Therapeutics aims to treat as many of these disorders as possible, conditions that have, for one reason or another, been overlooked. The company’s approach might enable it to tackle several at a time.

Many drug discovery efforts start by homing in on a specific biological target for a particular disease. Star takes a broader view, identifying multiple rare diseases that share common biological drivers, said CEO Adam Rosenthal. The goal is to develop a single drug targeting that shared biology—one drug for many diseases. The South San Francisco-based company has been working quietly for the past few years, and it’s now revealing details about its first disease target as well as the company’s approach and business model, which is backed by $100 million in financing.

Star is a biotech company, but it’s also a startup creator, Rosenthal said. The company’s research may uncover new biology, or it may make connections that others didn’t realize. Star builds a team around that biology, and then probes it deeply for the relationships among multiple diseases. To understand Star’s approach, it might help to look at a recently approved rare disease drug. Earlier this month, the FDA approved Enjaymo, making it the first treatment for cold agglutinin disease, a blood disorder. The regulatory nod went to Sanofi, which had acquired the monoclonal antibody. But the drug’s roots are in True North Therapeutics, where Rosenthal was chief business officer.

Cold agglutinin disease is an autoimmune condition that leads to the destruction of red blood cells. When True North began about a decade ago, Rosenthal recalled there was little in the scientific literature about the rare disease, which was regarded by many as a mild form of anemia. Discussions with physicians and patients revealed more serious outcomes, some of them fatal. True North identified a biological target associated with several immunological disorders, and the first clinical test of the biotech’s antibody was a basket trial in four different diseases. While cold agglutinin disease ended up as the lead disease target, Rosenthal said the plan was to develop the drug for multiple conditions. Star aims to replicate True North’s approach, but across multiple companies, each one focused on a specific area of biology.

“That was the motivation for doing this, because it was through that [True North] experience that we could really work with a disease that was overlooked,” Rosenthal said.

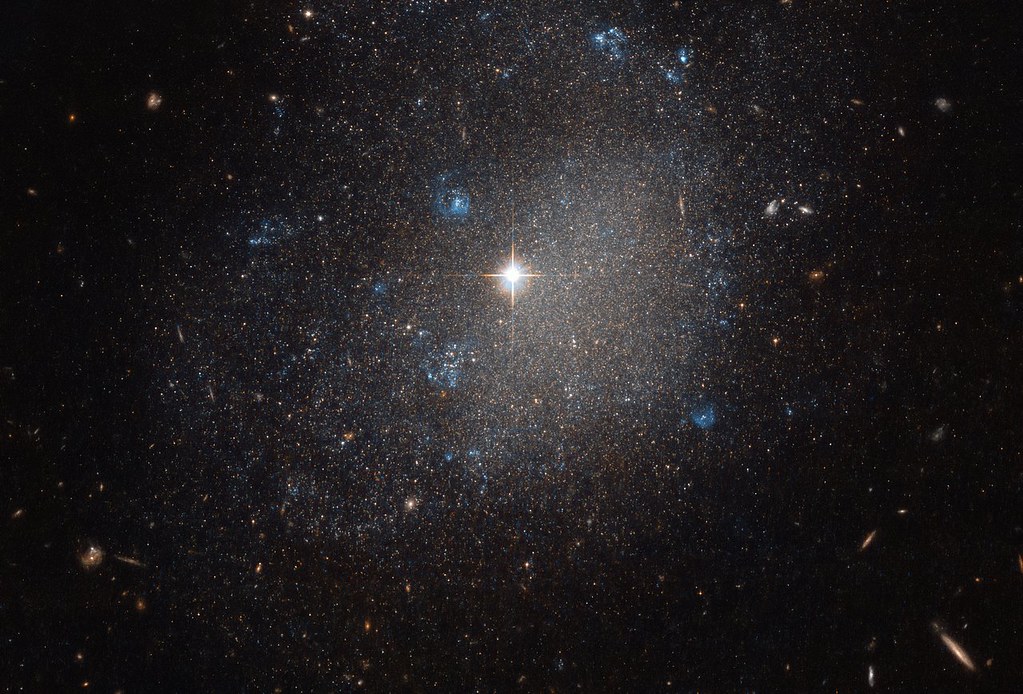

Star began its work by going through the list of 7,000 rare diseases to look for opportunities, prioritizing based on factors that include the science, the clinical development path, and the market opportunity. In a blog post, Rosenthal wrote that the search for shared disease biology is comparable to efforts of early astronomers to make connections among the constellations of stars. The company’s first focus turned out to be hematology and immunology because it fits with the experience of the Star team, which includes several True North veterans, Rosenthal said.

The first Star disease target is secondary hemophagocytic lymphohistiocytosis (sHLH), an autoimmune disorder characterized by an overactive inflammatory response. The disease can arise from triggers that include cancer, immunotherapy, and infection. It has no FDA-approved treatment, and it can rapidly lead to multi-organ failure and death.

Star’s first company, Electra Therapeutics, aims to treat sHLH by targeting signal regulatory proteins (SIRP), a family of cell surface receptors on various types of immune cells. While these receptors have been targeted by cancer drugs, they also play a role in several autoimmune conditions, said Rosenthal, who is also CEO of Electra. The biotech’s lead program, ELA026, is an antibody that targets SIRP and depletes immune cells of myeloid and T cells, which is intended to have the effect of putting the brakes on the overactive immune system.

Electra has already reached Phase 1 testing with its lead asset. Research is ongoing with the experimental drug in other diseases; Rosenthal declined to identify them, but he did say that the company’s approach to SIRP biology has potential applications in immuno-oncology.

Star is backed by a mountain of cash from a broad syndicate of investors. The $100 million behind Star is that company’s total financing raised since its 2018 inception. The money came from Westlake Village BioPartners, OrbiMed, Redmile Group, Cormorant Asset Management, RA Capital, Cowen Healthcare Investments, and New Leaf Venture Partners.

Electra’s initial financial support came from Star. On Wednesday, Electra unveiled an $84 million Series B round of funding co-led by Westlake Village BioPartners and OrbiMed. The new financing is part of the Star model. Rosenthal said the reason for placing the company’s science into different companies is to give each one the ability to focus and the flexibility to seek its own financing. But while the research and development efforts may be separate, the spinout companies will still share in many of Star’s resources, and these startups are being housed under the same roof, an arrangement that offers efficiencies. It also has precedent.

BridgeBio Pharma is among the companies that developed a “hub and spoke model,” forming subsidiaries focused on rare disease assets it acquires or in-licenses. Those subsidiaries share in the resources of the parent company. Others that operate similar models include Roivant Sciences and Cullinan Oncology. One difference between these companies and Star is that Star’s research is home grown. However, Roivant Sciences’ approach in recent years has expanded to include internal drug discovery powered by artificial intelligence and computational techniques. Other new companies to the hub and spoke model include Centessa Pharmaceuticals and Anji Pharma.

More startups from Star are coming soon. Rosenthal said that the next one is focused on rare hematological disorders. That company has a drug candidate currently in the preclinical research that could support the filing of an investigational new drug application. The disease targets are also undisclosed for now, but Rosenthal said that just like Electra, this newco already has a list of diseases that its drug can target.

“It’s a menu of options and it’s up to us to figure out what’s going to be the lead indication,” Rosenthal said.

Photo by Flickr user NASA Goddard Space Flight Center via a Creative Commons license