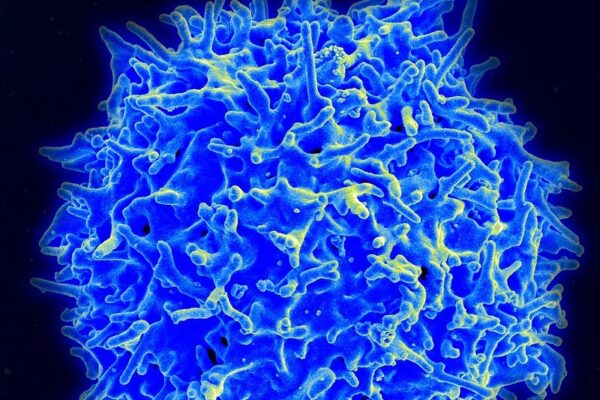

Cell therapy brings a new dimension to the personalization of cancer care. These treatments are currently made by engineering a patient’s own immune cells into better and more targeted cancer fighters.

Since these CAR T-therapies were first approved in 2017, the biopharmaceutical industry has been working to improve how these living medicines are manufactured. Six CAR T-therapies have reached the market so far, all of them for various types of blood cancers. Two of those therapies are from Bristol Myers Squibb. Clinical trials are ongoing to support use of currently available therapies in earlier lines of cancer care, said Lynelle Hoch, senior vice president, cell therapy franchise lead for BMS. Work is also underway to bring cell therapy to solid tumors. All of these efforts could enable cell therapy to reach many more people and treat many more types of cancer.

“A lot’s happened in the last two decades, but we’re certainly excited about what we can see in the future as well,” Hoch said, speaking Tuesday during a panel at the MedCity News INVEST conference in Chicago. The panel was moderated by Alice Valder Curran, partner at Hogan Lovells.

Cell therapies are tested in clinical trials at academic centers. But for an approved cell therapy to reach the masses, it must become available at community hospitals. The NorthShore Kellogg Cancer Center, which serves the Chicago-area, has been working for the past 15 months to put in place the various components to provide cell therapy, said panelist Dr. Bruce Brockstein, medical director of the cancer center.

Cell therapies started as later lines of treatment for cancers that have not responded to earlier lines of therapy. But physicians are interested in using these living drugs as earlier treatments. NorthShore has physicians with training and experience treating blood cancers, and they’ve seen data supporting the use of cell therapies, Brockstein said. But these therapies don’t yet have approvals as earlier treatments. The data do not always support moving a treatment into earlier lines, he added. In some solid tumors, such as sarcomas, a therapy that does well as a-fourth line treatment does not do well as a second-line therapy. However, some drugs may make more sense for use earlier in the cycle of a cancer, Brockstein said.

In addition to being among the newest types of medicine, cell and gene therapies are also among the most expensive. When gene therapies first reached the market, some insurance companies did not cover them and instead classified them as experimental, said panelist David McLean, CEO of Emerging Therapy Solutions (ETS), a firm that helps payers, reinsurers, and stop-loss carriers manage high-cost therapies for rare and complex disorders. McLean pointed to Novartis’s Zolgensma, a gene therapy for the rare disorder spinal muscular atrophy. Though some insurers tried to deny coverage following the therapy’s 2019 FDA approval, the insurance sector as a whole came around to covering that therapy and others.

There are financial consequences for not covering new treatments. BMS’s cell therapy Abecma was initially approved as a fifth-line treatment for the blood cancer multiple myeloma. But by the time patients reach a fifth line of therapy, their quality of life is bad and an insurer has already spent millions for their care, McLean said. Experts told ETS said that this therapy needs to become an earlier line of treatment.

“It’s going to benefit both, the payer and frankly the patient as well,” McLean said.

Clearing regulatory hurdles and securing payer reimbursement loomed as big questions for BMS’s cell therapies, Hoch said. But BMS did not encounter resistance, which surprised the company. U.S. payers quickly realized the value of these therapies, she said. Referencing the prospect of using Abecma as earlier line of therapy, Hoch said BMS will release data next month during the annual meeting of the American Society of Clinical Oncology supporting such a move.

McLean said insurance companies want to know the underlying clinical details about what’s happening with these patients—information that not only helps them understand how to cover cell and gene therapies, but also how to measure risk. Reinsurance companies will bear the brunt of this risk, which means that they’re going to take a much larger role in how plans are written. Consequently, deductibles and coinsurance will be going up, McLean said.

Right now, much of reinsurance deals with transplants, burns, accidents, and high-cost cancers, McLean said. Those categories are stable. Cell and gene therapies currently account for less than 5% of what reinsurance companies handle, he added. But in the next five to 10 years, he predicts that percentage will be closer to 50%.

“That’s why they need to understand how to underwrite the risk for this,” McLean said.