Novartis aims to overcome two hurdles facing current cancer cell therapies: the lengthy time it takes to manufacture these personalized treatments and their inability to address solid tumors. The pharmaceutical giant has developed technology that speeds up manufacturing. It’s now turning to Legend Biotech for cell therapies that can leverage the platform, one of those therapies an early-stage program that goes after a promising target for lung cancers.

Per deal terms announced Monday, Novartis is paying Legend $100 million up front for global rights to manufacture and commercialize the Legend cell therapies. For China-based Legend, which has U.S. operations in New Jersey, the deal adds a second big pharmaceutical partnership. Legend’s alliance with Johnson & Johnson led to the FDA approval and commercialization of Carvykti, a CAR T-therapy for multiple myeloma, a type of blood cancer.

Carvykti targets BCMA, a protein abundant on the surface of multiple myeloma cells. The central asset in the Novartis pact is LB2102, a Legend cell therapy designed to target delta-like ligand 3 (DLL3), a protein expressed on multiple types of cancer cells but rarely found on healthy cells. Legend is among the biotech companies developing ways to target DLL3 as a way to treat lung cancers.

Legend has begun a Phase 1 test of LB2102 in both extensive stage small cell lung cancer and large cell neuroendocrine carcinoma of the lung, a rare and aggressive type of cancer. While the deal calls for Legend to run the Phase 1 test of LB2102 in the U.S., Novartis will reimburse certain development costs and expenses for this study, according to a Legend regulatory filing. The pharma giant is responsible for further clinical development of LB2102 as well as the development of the other therapeutic candidates covered by the agreement. Novartis may manufacture them with its next-generation manufacturing technology, T-Charge.

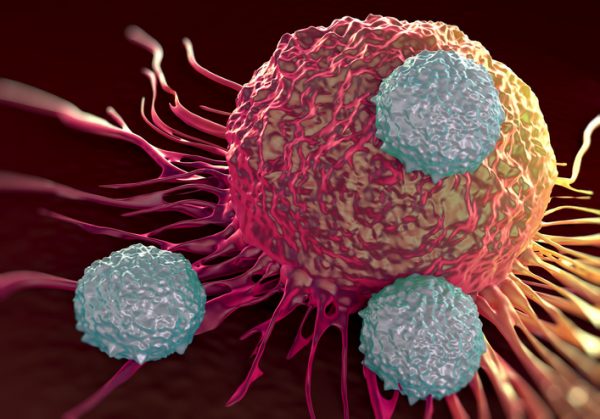

Autologous cell therapies are made by harvesting a patient’s T cells and engineering them to express a chimeric antigen receptor (CAR) that seeks out a particular cancer target. The cells are then expanded in a lab before they’re sent back to the hospital for infusion into a patient. This manufacturing process is the same for the first-generation of CAR T-therapies, including Novartis’s Kymriah, which in 2017 became the first FDA-approved CAR T-therapy.

With Novartis’s T-Charge platform, the expansion step happens inside the patient. The technology is also intended to preserve the stemness of a T cell, which is the cell’s ability to self-renew and mature. The intended result is T cells with greater potential to proliferate and fewer of these cells that become exhausted. LB2102 would become the first solid tumor-targeting cell therapy candidate made with T-Charge. Legend could earn up to $1.01 billion in milestone payments tied to the progress of the partnered programs. The biotech would also receive royalties from sales of if any of these cell therapies reach the market.

“We believe LB2102 has an innovative CAR design and armor mechanism that increases its anti-tumor activity,” Guowei Fang, Legend’s chief scientific officer and head of business development said in a prepared statement. “The preclinical evidence shows that an autologous CAR T could be a differentiated treatment option for patients with small cell lung cancer.”

In a note sent to investors Monday, William Blair analyst Sami Corwin wrote that the deal is an “incremental positive” for Legend, allowing the company to monetize its DLL3 program earlier in development and providing it with $100 million in non-dilutive cash. She added that Legend’s valuation is mainly tied to the J&J-partnered Carvykti. In the nine months ended Oct. 1, J&J reported more than $13 billion in Carvykti sales, an 8.2% increase over sales in the same period in 2022.

Image: royaltystockphoto, Getty Images