Turning a patient’s cells into targeted cancer fighters presents manufacturing challenges that big pharmaceutical companies and upstart biotechs are trying to address. The cell therapy field is also expanding to autoimmune diseases. AstraZeneca believes it can check off both boxes with the acquisition of Gracell Biotechnologies.

AstraZeneca has agreed to a $1 billion deal for Gracell. According to financial terms announced Tuesday, the Cambridge, U.K.-based pharmaceutical giant is paying $2 for each Gracell share, which is a 62% premium to Gracell’s closing price last Friday and a 154% premium to the stock’s average price in the 60 days prior to the announcement of the deal. AstraZeneca could pay out more if China-based Gracell achieves a key regulatory milestone.

With the Rise of AI, What IP Disputes in Healthcare Are Likely to Emerge?

Munck Wilson Mandala Partner Greg Howison shared his perspective on some of the legal ramifications around AI, IP, connected devices and the data they generate, in response to emailed questions.

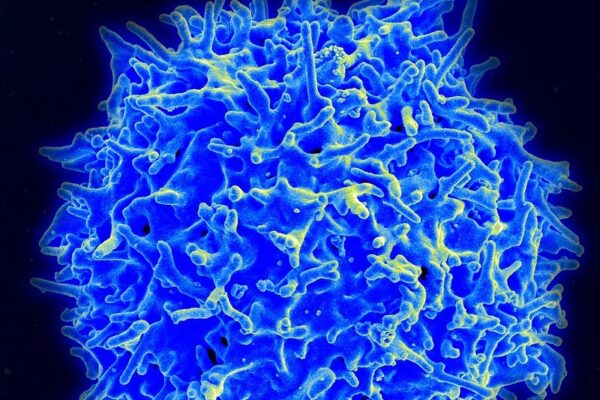

The commercially available cell therapies are cancer treatments made by harvesting a patient’s immune cells and engineering them in a lab to recognize and go after tumors. After those cells are multiplied in the lab, they must be transported back to the clinical site for infusion into the patient. This expensive multi-step manufacturing process can take weeks.

Gracell has two manufacturing technologies intended to dramatically shorten cell therapy manufacturing timelines and improve the fitness of cells to perform their therapeutic tasks. The FasTCAR technology is designed to offer next-day manufacturing of autologous cell therapies. Gracell is also developing allogeneic, or off-the-shelf cell therapies, made from cells from healthy donors. Gracell manufactures these therapies with a proprietary technology called TruUCAR.

Gracell’s lead program is a potential multiple myeloma treatment code-named GC012F. This FasTCAR-produced autologous cell therapy simultaneously targets BCMA, a protein abundant on multiple myeloma cells, as well as CD19, a cancer protein addressed by several blood cancer cell therapies. GC012F has reached early clinical development in the U.S. as a treatment for relapsed or refractory multiple myeloma.

During the annual meeting of the American Society of Hematology in San Diego earlier this month, Gracell presented updated Phase 1 data from an investigator-initiated trial testing GC012F in patients with newly diagnosed multiple myeloma. Of the 22 evaluable patients, all of them achieved an overall response to the therapy; 95%, or 21 of 22 patients, achieved a stringent complete response. The median follow-up time was 18.8 months.

The Gracell acquisition comes with a contingent value right, an additional payment tied to a milestone that will trigger the payout of an additional 30 cents for each Gracell share, bringing the total deal value to $1.2 billion. According to the merger agreement, the key milestone is accelerated regulatory approval or full approval. The indication for this milestone was not specified, but Gracell has multiple shots at this goal. In addition to multiple myeloma, Gracell’s lead program is also in development in China for B-cell non-Hodgkin lymphoma. The company has additional plans for GC012F in autoimmune diseases. The cell therapy is cleared to begin a U.S. Phase 1/2 study in systemic lupus erythematosus, the most common type of lupus.

In the announcement of the Gracell acquisition, Susan Galbraith, AstraZeneca’s executive vice president, oncology R&D, said the deal complements the pharma giant’s existing capabilities and previous cell therapy investments.

“GC012F will accelerate our cell therapy strategy in hematology, with the opportunity to bring a potential best-in-class treatment to patients living with blood cancers using a differentiated manufacturing process, as well as exploring the potential for cell therapy to reset the immune response in autoimmune diseases,” she said.

AstraZeneca last year struck a deal to buy Neogene Therapeutics, a startup developing T cell receptor therapies intended to address solid tumors, which have eluded cell therapies so far. The efforts to bring cell therapy to immunology include a partnership with Quell Therapeutics in type 1 diabetes and inflammatory bowel disease. Last month, AstraZeneca committed to pay $105 million up front to begin working with Cellectis in a cell therapy partnership spanning oncology, immunology, and rare diseases. AstraZeneca expects the Gracell acquisition will close in the first quarter of 2024.