Cell therapy developer Autolus has a lead program under FDA review for a type of blood cancer and in clinical development for other indications. As the company looks ahead to a potential product launch later this year, it has filled its coffers with $600 million from a pair of deals, one of them a collaboration with BioNTech.

BioNTech is purchasing $200 million worth of Autolus shares and making a $50 million cash payment to the London-based biotech, the companies announced Thursday. In exchange, BioNTech is eligible for a royalty on sales of the Autolus cell therapy, obe-cel. While Autolus retains full rights to this therapy, BioNTech gets the option to access the biotech’s clinical site network and its manufacturing and commercial supply infrastructure, which may be used to advance the development of therapies in its own pipeline.

With the Rise of AI, What IP Disputes in Healthcare Are Likely to Emerge?

Munck Wilson Mandala Partner Greg Howison shared his perspective on some of the legal ramifications around AI, IP, connected devices and the data they generate, in response to emailed questions.

Soon after the BioNTech agreement was announced, Autolus raised more cash with a $350 million stock offering. The company said proceeds from both transactions will support activities such as manufacturing of obe-cel and ongoing clinical development of the cell therapy.

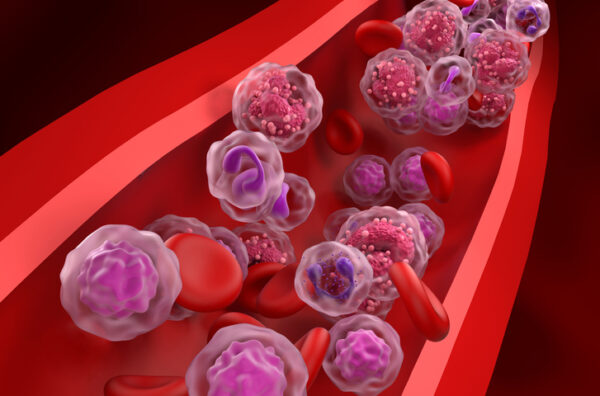

Obecabtagene autoleucel, or obe-cel, is a CAR T-cell therapy. Like the first generation of CAR T-drugs, Autolus’s therapy targets the CD19 protein on cancer cells. But Autolus engineers its therapy to offer lower toxicity and a longer duration of effect. Autolus initially developed this therapy as a treatment for adults whose acute lymphoblastic leukemia (ALL), a cancer of the blood and bone marrow, has relapsed or has not responded to earlier lines of treatment. The FDA’s target date for a regulatory decision is Nov. 16. Autolus expects to submit an application in Europe in the first half of this year.

The Autolus cell therapy is also in Phase 1 development for pediatric ALL patients and B-cell non-Hodgkin lymphoma. Autoimmune diseases offer additional opportunity. Autolus has said it expects a Phase 1 test of obe-cel in lupus will yield preliminary data in late 2024.

Meanwhile, BioNTech’s pipeline includes BNT211, a CAR T-cell therapy for solid tumors. This program is currently in Phase 1 development, but the company has said it plans to have 10 or more potentially registrational clinical trials in its pipeline by the end of this year. BioNTech co-founder and CEO Ugur Sahin said in a prepared statement that the Autolus collaboration enables his company to expand development of BNT211 to multiple cancer indications in a cost-efficient way. He added that the option to access Autolus’s precise cell-targeting tools will support BioNTech’s development of in vivo cell therapies and antibody drug conjugates. If BioNTech exercises that option, Autolus is in line to receive exercise fees and milestone payments, plus royalties from sales of any commercialized products developed with the biotech’s technologies.

In a note sent to investors Thursday, William Blair analyst Matt Phipps wrote that capital from the BioNTech pact and the stock offering will help Autolus as it progresses the development of obe-cel beyond cancer and into autoimmune indications. Autolus management told Phipps that the lupus study has begun enrollment, and the additional capital allows the company to more broadly deploy its resources toward autoimmune disease research. Plans include a “basket study,” a strategy more commonly used in cancer. Such studies test a single targeted cancer drug against many types of cancers to identify which ones it could treat. This basket approach could be used to find additional autoimmune indications for obe-cel.

“We believe the deal highlights the value of Autolus’s wholly owned manufacturing facility, which we toured toward the end of last year and the company’s extensive cell programming technologies,” Phipps said. “Management believes the capital on hand will allow the company to reach profitability on obe-cel in adult ALL and to expand development of the entire pipeline.”

Image: Getty Images