Genmab, a company whose antibodies are part of drugs commercialized and in development in the hands of partners across the biopharmaceutical industry, is building up its own pipeline with the $1.8 billion acquisition of ProfoundBio. The deal announced Wednesday brings Genmab three clinical-stage antibody drug conjugates, or ADCs, the most advanced of which could compete against an AbbVie drug projected to become a blockbuster seller.

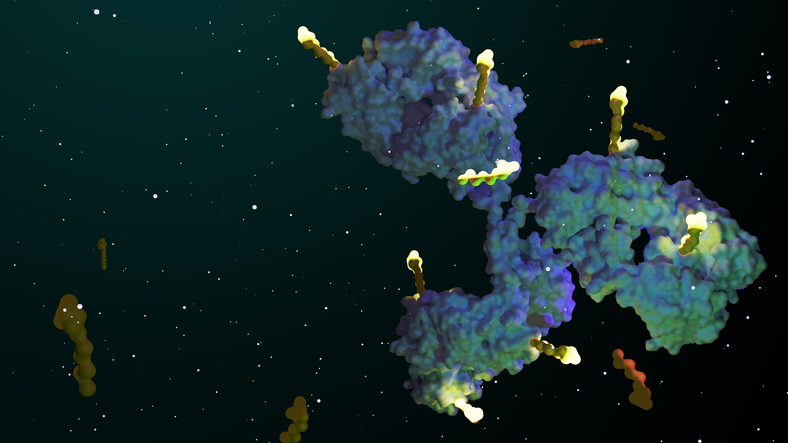

Privately held ProfoundBio is one of a growing number of companies developing ADCs, which chemically link a toxic drug payload to an antibody to offer targeted delivery of the therapy to tumors. The Seattle-based company develops its ADCs with a linker technology that enables a higher drug to antibody ratio, increasing the therapy’s potency while maintaining other properties, such as its safety profile.

Lead ProfoundBio program rinatabart sesutecan, or Rina-S, targets folate receptor alpha. This ADC is currently being evaluated in the Phase 2 portion of a pivotal Phase 1/2 study in ovarian cancer. Folate receptor alpha is also the target of Elahere, a drug developed by ImmunoGen that in 2022 became the first ADC approved for ovarian cancer. Elahere was the centerpiece of AbbVie’s $10.1 billion acquisition of ImmunoGen last year. The drug’s label carries a black box warning regarding the of risk visual impairment, corneal damage, and other eye problems. Rina-S has not shown any corneal toxicity, according to initial results from the dose-escalation portion of the study that were presented last fall during the annual meeting of the Society of Immunotherapy for Cancer (SITC).

With the Rise of AI, What IP Disputes in Healthcare Are Likely to Emerge?

Munck Wilson Mandala Partner Greg Howison shared his perspective on some of the legal ramifications around AI, IP, connected devices and the data they generate, in response to emailed questions.

In a note sent to investors, Leerink Partners analyst Jonathan Chang wrote that ProfoundBio’s Rina-S could be best-in-class among folate receptor alpha-targeting ADCs, offering the potential to expand the addressable patient population while also offering better safety than Elahere. Referencing the SITC data, Chang highlighted a 38% overall response rate across all doses in ovarian and endometrial cancer patients as well as a 67% overall response rate among patients with folate receptor alpha expression greater than 1%. Because Elahere’s FDA approval covers the treatment of patients who express high levels of the target protein, Rina-S may offer a treatment option for patients with low folate receptor alpha levels.

“The risk is that the acquisition is based on relatively limited clinical data to date although management indicated that they had access to non-publicly available data,” Chang said. “We view this transaction as adding a formidable competitor to this space given [Genmab’s] track record of timely and aggressive clinical development.”

[Paragraph updated to correct Epkinly’s indication.] Copenhagen-based Genmab already has a presence in ADCs through partners. Tivdak, a drug developed with an antibody from Genmab and ADC technology from Seagen (now part of Pfizer), won FDA approval in 2021 for treating advanced cervical cancer. The two companies share in the commercialization of this drug, which is Genmab’s first approved product. Genmab also records revenue from Epkinly, a bispecific antibody approved last year for diffuse large B-cell lymphma and commercialized under a partnership with AbbVie.

Genmab gets the majority of its revenue from royalties paid by companies that have commercialized drugs employing its antibodies. A single drug, the Johnson & Johnson multiple myeloma medication Darzalex, accounted for 68% of 2023 revenue, according to the company’s annual report. While that royalty revenue continues to grow, Genmab’s strategy includes developing drugs on its own and with partners. The Genmab pipeline spans nine programs in various stages of development for both solid tumors and blood cancers.

ProfoundBio, led by veterans of the ADC specialist Seagen, raised its initial funding in 2021. Its most recent financing was a $112 million Series B financing in February. ADCs continue to be a hot drug class for dealmaking. Gilead Sciences gained the ADC Trodelvy via an acquisition. AstraZeneca’s collaboration with Daiichi Sankyo led to several approvals for the ADC Enhertu. The Japanese drugmaker also has an alliance with Merck. Ipsen joined the ADC mix this week, licensing a Sutro Biopharma drug candidate. Startups that recently raised money for ADC R&D include Tubulis and Firefly Bio.

Genmab’s acquisition of ProfoundBio is a cash deal. The boards of both companies have approved the transaction, which is expected to close by the end of June.

“We believe that ProfoundBio’s ADC candidates, proprietary technology platforms and talented team will be a great addition to Genmab and that, together, we will be able to accelerate the development of innovative, differentiated antibody therapies for cancer patients,” Genmab President and CEO Jan van de Winkel said in a prepared statement.

Image: Getty Images