Last year, when I met the CEO of Butterfly Network — a point-of-care ultrasound device maker — during the annual J.P. Morgan Healthcare Conference, the Massachusetts company was in the middle of a turnaround. After being in business for 12 years, revenue had slid and the public company’s stock was trading at around $1. 2024 would be the year the company would get its “mojo back” promised Joseph DeVivo, declaring that Butterfly Network would have to demonstrate revenue growth once again.

Last week when I met DeVivo, he was smiling ear to ear.

“We launched our third product — iQ3 in February [2024]. We grew 14% in the first quarter. We grew 16% in the second quarter. We grew 33% in the third quarter and we just ended off the year at 35% [in the fourth quarter],” he declared. “I call that mojo. It’s 25 percent growth for the year. And the best part about it is it came in from everywhere. There was no one big deal.”

Tackling Rising Drug Costs and Growing Popularity of GLP-1’s

See how Quantum Health is providing the steps to help their members tackle the cost of specialty medications and other drugs.

The fourth-quarter end and year-end percentage growth are based on preliminary unaudited earnings the company released during JPM. In the third quarter ended Sep 30, the GAAP results indicate that Butterfly Network had revenue of $20.6 million, up from $15.4 million in the same quarter in 2023. It narrowed its third-quarter loss to $16.9, or 8 cents a share, compared with $27.4 million or 13 cents per share from the same period in 2023. The company’s stock is now trading at nearly $4, up from $1 just a year ago.

Much of the revenue growth in 2024 came from market adoption of iQ3 — 80% of sales in the U.S. in the third quarter was the iQ3 product, DeVivo said, adding that the company sells around 20,000 to 25,000 devices a year. He described the third-generation device as much more powerful with higher processing power and improved image clarity.

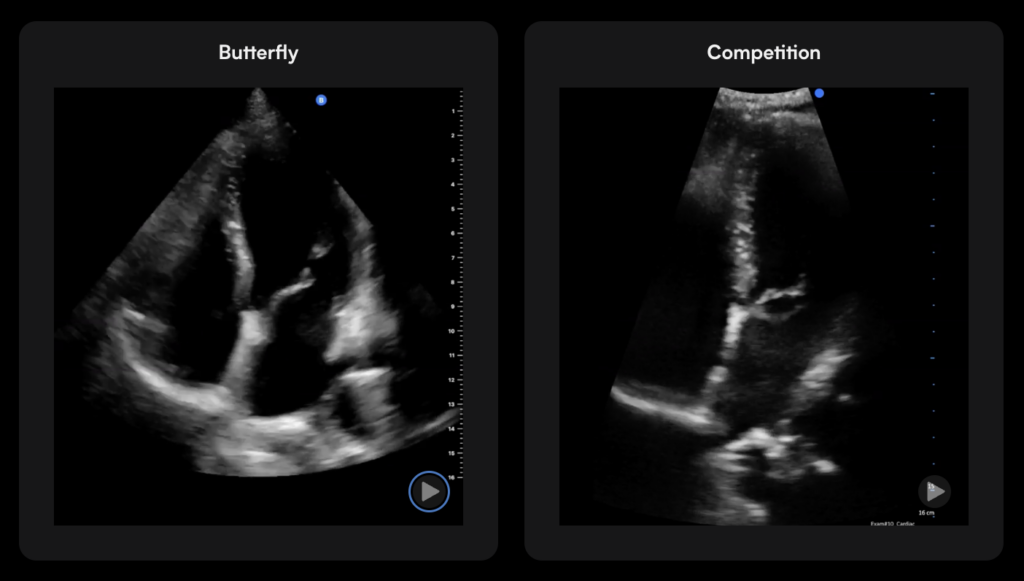

“The image quality is the difference between a three and a seven-megapixel image on the camera,” he said.

That allows the device to be used in hospital procedures, as opposed to Butterfly Network’s first and second-generation devices, DeVivo said. For example, it can aid in needle placement in anesthesiology and cardiac scans in the ER. And it’s not just a matter of being powerful enough to be considered for hospital applications. With this device, Butterfly Network may be able to compete with better known device makers — including GE Healthcare, which makes portable ultrasound devices, such as the latest VScan Air CL and the VScan Air SL.

The VScan Air CL is appropriate for obstetrics, abdominal imaging, MSK applications, while the VScan SL is used for fast cardiac and vascular evaluations. Both are dual probes and their starting prices are $4,855 and $5,499 respectively.

DeVivo was quick to draw a contrast.

“So I believe with our most recent product, we have [become] — at a minimum — equivalent to GE and I do everything they do, but with one probe,” he said. “They have [two] 6,000-dollar probes. I have one 4,000-dollar probe.”

Large ultrasound machines made by the likes of GE and Philips use piezoelectric crystals whereas the Butterfly Network uses semiconductors. The handheld ultrasounds made by Philips (Lumify) and GE (VScan) were an advancement making ultrasound portable and accessible at the point of care, but using the same piezoelectric crystals used in the larger devices. But DeVivo declared that Butterfly’s iQ3 uses ultrasound-on a-chip technology and is able to scan anywhere in the body using a single device whereas Lumify and GE products still need different probes to scan different things.

“PZT-crystal devices, including carts and handhelds, require at least 3 different crystal transducer heads to allow for whole-body scanning,” an external spokeswoman further explained in an email. “Whereas Butterfly can do all 3 (and additional advanced modes) on just one probe that switches between the arrays digitally via our one chip transducer — and at a lower cost than a single PZT probe.”

DeVivo sees Butterfly Network leading the digital revolution in ultrasound in the same way that digital cameras ultimately unseated the likes of Kodak and any cameras requiring film. He also will tell you that he does not see a future where handheld devices make larger ultrasound machines redundant.

But, DeVivo is so sure of the capability of iQ3, the homepage on the company’s website shows a side by side video comparison of the image quality between that device and GE’s VScan CL product. Here’s a still photo from that video:

Butterfly Network is beginning to get traction among large health systems, DeVivo said. University of Rochester Medical Center is a customer. Without naming the institution, he shared the story of how a health system official called the company to express frustration that doctors who bought Butterfly Network’s portable ultrasound device were bringing it to their work and creating data residing outside the in-house EMR system.

“It was a compliance issue and the doctors knew this but they didn’t care,” DeVivo recalled. “We went into our database and we searched all the doctors with an email address in that institution. And in that one town, 140 doctors had personally purchased a Butterfly device.”

What Butterfly did thereafter was offer them middleware that would import all that data into the EMR and other pieces of Butterfly’s software, including education modules and reimbursement modules.

“And so they purchased our software,” he said. “We were able to give them the data they didn’t have because everything goes in the cloud. And today they have just about 600 devices.”

DeVivo said the large ultrasound devices in hospitals aren’t going to be replaced by portable handhelds but the semiconductor-based technology “adds a layer of early detection” — especially given that not many patients are sent to radiology given the high cost of imaging. Having this on hand means that primary care doctors and even specialists can rule out certain things almost immediately.

The other advantage with the Butterfly Network is just the sheer volume of data and images the company as has amassed over the years. DeVivo touted that the company has around 100,000 iQ devices around the world and 21 million images and that image number is growing daily. The company can train models on these data.

“If I wanted to have 10,000 heart scans and I wanted to train an AI model on those, you could do it,” he declared. “Go ask any one of these companies what they would do to get 10,000 heart scans, lung scans. So we are the only company that’s fully networked and has that database.

Another point of differentiation is the “Butterfly Garden” where AI companies are building apps off of the company’s data and device. For instance, ThinkSono, which is an ultrasound AI to detect deep vein thrombosis .

“You plug your Butterfly in while their app is open and the imaging from our device populates their app. So what that means is every day or every time a new app is available, my device gets more powerful, it has more capability,” DeVivo explained.

This helps the app developer sell its product to Butterfly’s customers while the latter’s devices get more functionality. In 2024, company signed 17 such partnerships, DeVivo said.

The overall goal, ultimately, is to get entrenched deeply within health systems.

“We have several very large customers and they produced some data around their experience and we’re starting to go back to some existing customers that maybe have our devices in one or two departments and talking to them about a broad based deployment,” DeVivo said. “I think that’s over the next one or three years, that’s the next big phase of growth.”

Photo: lvcandy, Getty Images and Butterfly Network