Eikon Therapeutics, a company headed by the former Merck executive who steered the cancer drug Keytruda to FDA approval, has raised $350.7 million to support a pipeline that includes a lead drug candidate now in a pivotal test that could support expanding melanoma treatment to a pair of new immunotherapy targets.

The lead Eikon drug, EIK1001, is a small molecule designed to hit toll-like receptors 7 and 8 (TLR7/8). Activating these receptors is intended to spark an immune response that fights cancer. According to clinical trial records, the Phase 3 test is evaluating EIK1001 alongside Merck’s checkpoint inhibitor Keytruda, comparing that combination against Keytruda and a placebo as a first-line treatment for advanced melanoma. The trial’s targeted enrollment is 740 patients. Separately, the Eikon pipeline lists EIK1001 in Phase 2 testing in non-small cell lung cancer.

EIK1001 was initially developed by Seven and Eight Biopharmaceuticals. Eikon licensed global rights to that immunotherapy and another TLR7/8 agonist in 2023; financial terms were not disclosed.

The Power of One: Redefining Healthcare with an AI-Driven Unified Platform

In a landscape where complexity has long been the norm, the power of one lies not just in unification, but in intelligence and automation.

Eikon is also in the clinic with EIK1003, an inhibitor of PARP1. This enzyme is key to DNA repair in cells, so blocking it leads to cell death. Though PARP inhibitors are already approved to treat certain cancers, they come with toxicity risks thought to be associated with the blocking of PARP2. Eikon’s EIK1003 selectively inhibits PARP1 with the goal of offering the same efficacy as currently available PARP inhibitors while avoiding the toxicity of those drugs.

EIK1003 is in Phase 1 testing in patients with breast, ovarian, prostate, or pancreatic cancers. Eikon is also taking a PARP1-selective approach with EIK1004, which is designed to penetrate the blood-brain barrier to treat brain cancers. The company’s website states that a Phase 1 test of this drug began in the first quarter of this year.

“With clinical studies now operating in 28 countries, across five continents, we are accelerating the development of much-needed therapies while continuing to expand our research and development capabilities,” CEO Roger Perlmutter said in a prepared statement.

Eikon’s PARP inhibitors came from Impact Therapeutics. The company’s pipeline also includes assets acquired from Cleave Therapeutics in preclinical development for cancer and neurodegenerative disease. Financial terms for these deals were not disclosed.

Hayward, California-based Eikon emerged in 2021, backed by $148 million in funding led by The Column Group. Perlmutter, formerly the president of Merck Research Laboratories, was named the startup’s CEO. Eikon discovers drugs with proprietary technology that visualizes proteins, enabling scientists to see how they move within a live cell in real time. This visualization technology is based on the research of company co-founder Eric Betzig, who was awarded the 2014 Nobel Prize in Chemistry.

The most advanced internally discovered Eikon drug candidate is EIK1005. This drug is an inhibitor of WRN, an enzyme that plays a role in DNA damage repair. WRN has emerged as a therapeutic target for tumors characterized by high microsatellite instability (MSI) and it’s a driver of certain gastrointestinal and endometrial cancers. According to Eikon’s website, the company is developing EIK1005 for MSI-high cancers and sensitive cancers that have defects in DNA repair. The company expects to begin a Phase 1 test of EIK1005 in the first half of this year.

Eikon’s last financing was in 2023, disclosed as $106 million raised in the first tranche of a Series C round. With the new financing announced Wednesday, the company said it has raised about $1.1 billion to date. The latest round was led by earlier investors in the company who were joined by some new investors. This investment syndicate includes Lux Capital, Alexandria Venture Investments, AME Cloud Ventures, The Column Group, E15 VC, Foresite Capital, General Catalyst, Soros Capital, StepStone Group, funds and accounts advised by T. Rowe Price Associates and UC Investments.

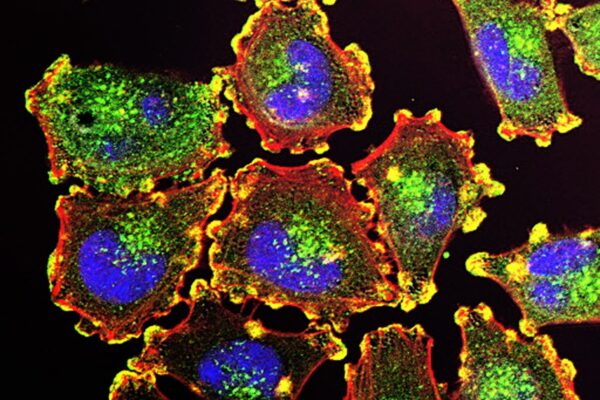

Public domain image by Julio C. Valencia via the National Cancer Institute