Individual Coverage Health Reimbursement Arrangements, colloquially known as ICHRAs, have entered the zeitgeist. ICHRAs allow employers to provide employees a fixed amount of pre-tax money to purchase individual healthcare coverage and pay for health expenses. Recent articles have called out the VC interest in the space with some healthcare players even likening ICHRAs to Bitcoin given the level of buzz. The buzz is well earned as the number of US employees offered ICHRAs continues to grow. Yet, headwinds – including competition, individual coverage market uncertainty, and complexity – may hamper the ICHRA opportunity.

ICHRA overview

Before ICHRAs, the Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) created under the Obama administration allowed employers with fewer than 50 full-time employees to provide pre-tax money to employees for healthcare expenses. The first Trump administration created the ICHRA with ICHRAs becoming available to the public in 2020. The ICHRA is a defined contribution or fixed payment to employees, limiting employer exposure to increasing medical costs. Employers have faced rising costs as the Kaiser Family Foundation states that the average premium for single and family coverage for employer health insurance has grown 22% since 2018.

Estimates suggest that approximately 500k employees are participating in an ICHRA at the end of 2024. ICHRA adoption among employers grew almost 30% from 2023 to 2024 with the largest growth occurring among employers with 50+ full-time employees. Overall, the number of US employers offering ICHRA / QSEHRA has almost tripled since 2020. Oscar Health projects that the total size of the small and medium business (SMB) segment is 75 million lives which means that only 0.66% of the SMB population is offered an ICHRA today. As such, there is potential for ICHRA to expand into a large population.

Interestingly, the growth of ICHRA diverges from the growth of another defined employer contribution: the 401(k). By the end of 1982, nearly half of large US employers offered a 401(k). The 401(k) expanded from large employers down to small employers. In contrast, the ICHRA is a small business growth story that is trying to move up market. The majority of employers participating in an ICHRA are small employers with fewer than 50 employees. It is an open question if ICHRA adoption will continue to expand to employers with over 50 employees, but ICHRA adoption among these employers did grow by 84% between 2023 and 2024.

ICHRA market participants

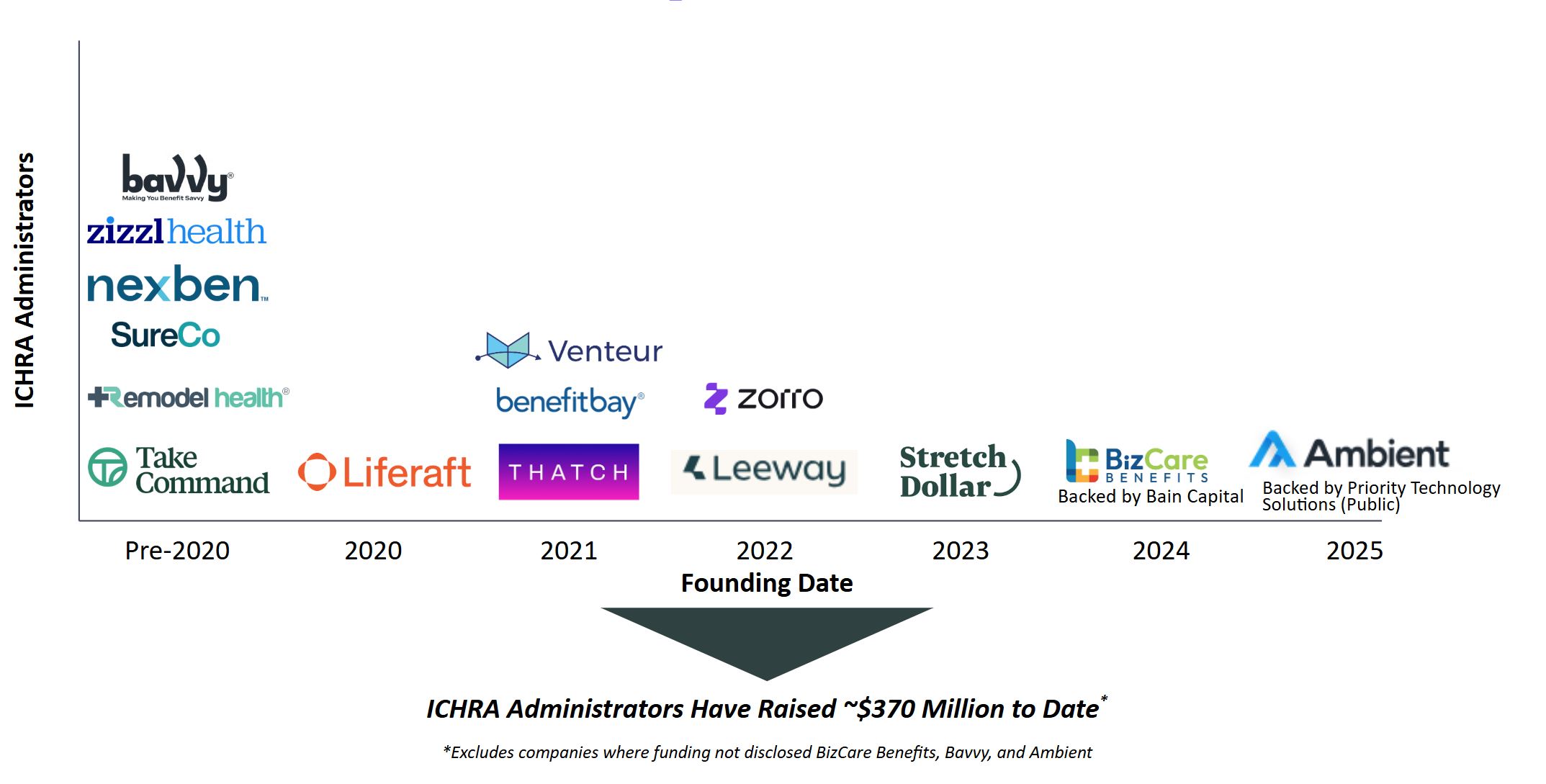

Propelling and capitalizing on the growth of the ICHRA market are ICHRA administrators. These companies like Take Command, Thatch, etc. support employers on designing the ICHRA program, enrolling employees, and ongoing management of the ICHRA. ICHRA administrators earn revenue through platform fees and commissions from insurance carriers. Administrator platform fees are charged to employers on a per employee per month (PEPM) basis and are typically in the range of $20 to $40 PEPM. Additionally, some administrators have in-house insurance agencies which can generate commissions from insurance carriers when an ICHRA employee selects insurance through their platform.

ICHRA administrators by founding year

Image created by the author, information source, Pitchbook

Beyond ICHRA administrators, healthcare fintech companies and payers are entering the ICHRA space. Fintech companies, like Echo and Lynx, build financial infrastructure for ICHRA administrators to deliver premium and healthcare expense payments on behalf of employees. Payers like Ambetter Health (a Centene company) and Oscar have both recently looked to ICHRA as a driver of growth. Ambetter Health hired a President to oversee their ICHRA operations, and Ambetter Health has struck channel partnerships with ICHRA administrators (here, here). Oscar has called out their focus on ICHRA in a recent investor presentation, and Oscar has directly participated in ICHRA administrator fundraising (see StretchDollar’s seed fundraise).

Challenges to ICHRA going forward

ICHRAs depend on the stability of the individual coverage health insurance market. Currently, the individual coverage market is stable, but subsidies for ACA premiums are anticipated to expire at the end of 2025. If the expiration of subsidies causes the individuals receiving them to leave the ACA market, then there may be premium increases making ACA plans and thereby ICHRA (a gateway to ACA plans) less attractive.

Beyond ACA market dynamics, the ICHRA administrator market is competitive with a number of new entrants in recent years. Administrators differentiate on their go-to-market strategy, level of service provided, and fintech capabilities. Yet, ICHRA administrators are all performing similar functions for similar companies. Each administrator is trying to capture as many employer customers as possible in a land grab producing stiff competition among players.

In addition, ICHRA administrators face competition from PEOs and brokers. PEOs, like Justworks, handle benefit administration for small businesses, and the PEO can often connect small businesses directly with a group plan. Brokers compete against ICHRA administrators selling small business health coverage. Brokers may face lower commissions engaging a client in an ICHRA as opposed to a group plan stunting the growth of ICHRA through the broker channel. Anecdotally, brokers may only reach for an ICHRA if an account was going to “roll” or leave them as a customer. Despite these challenges, some ICHRA administrators are working closely with PEOs and brokers to act as sales channels for employers who might be interested in pursuing an ICHRA.

Where ICHRA is headed

Rising group plan premiums, stable individual markets, and a desire for individual choice, suggest that ICHRAs will continue to be an attractive option for employers. Yet, the players in the ICHRA market may look different going forward. We could foresee the large number of ICHRA administrators collapse into a handful of large dominant players given the limited amount of differentiation among administrators. This would follow a similar trend to what was seen in the PEO market where 5 PEOs out of a total of ~500 PEOs account for ~40% of employees participating in PEOs. We foresee smaller ICHRA administrators differentiating on their channel partnerships (e.g., broker, PEO relationships), capabilities (e.g., care navigation), payer relationships, and employer specialization (e.g., focusing on one / a few employer types).

Beyond ICHRA administrator consolidation, we hypothesize there may be consolidation between ICHRA administrators and PEOs. Under this scenario an ICHRA administrator gains access to a pool of existing customers to sell into, lowering acquisition costs and potentially expanding their reach. While payers are active in the ICHRA space, we don’t think an ICHRA administrator would welcome a payer acquisition because it would limit the number of insurance carriers an ICHRA administrator could offer employers. Yet, a company like Ambetter Health or Oscar may view an acquisition of an ICHRA administrator more favorably as a means of expanding their risk pool and enriching their risk pool with younger workers as 35% of ICHRA employees are under 34.

Overall, we anticipate continued growth in the number of employees offered an ICHRA. However, given strong competitive dynamics among ICHRA administrators and potential individual market risk with ACA subsidy expiration, we are moving cautiously when looking at companies. New entrants need to have strong competitive differentiation relative to existing competitors to be considered potential investment candidates.

Photo: rudall30, Getty Images

The author thanks the OCA Ventures Healthcare team members Michelle Cao, Bob Saunders, and Sarah Manasevit for their guidance and support on this article.

John Syme is currently an MBA Intern at OCA Ventures on the Healthcare Team. OCA Ventures is a Chicago-based VC investing in Seed and Series A technology and healthcare companies. The OCA Healthcare team invests in companies across the spectrum of diagnostics, digital health, and healthcare IT. Prior to OCA, John co-founded and led a VC-backed oncology digital health company named Primum. He is currently pursuing his MBA at Northwestern Kellogg School of Management and is based in Evanston, IL.

This post appears through the MedCity Influencers program. Anyone can publish their perspective on business and innovation in healthcare on MedCity News through MedCity Influencers. Click here to find out how.