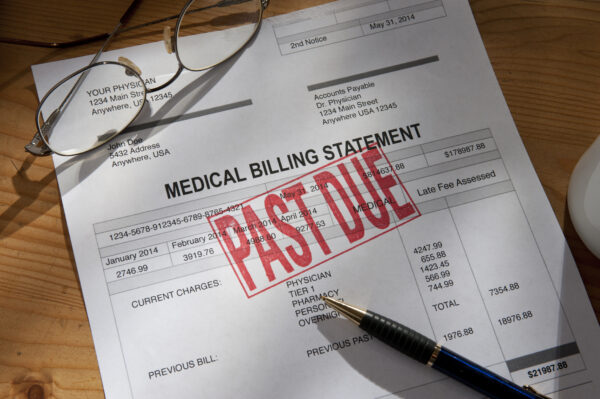

As high-deductible health plans and rising out-of-pocket costs shift more financial responsibility to patients, healthcare providers are facing a growing challenge: getting paid. Payment delays strain cash flow, disrupt operations, and can ultimately affect the quality of care. At the same time, confusing billing processes and limited payment options leave patients feeling frustrated and overwhelmed.

Improving patient payment collections isn’t just about recovering revenue. It’s about building trust, reducing administrative burdens, and ensuring patients can access care without added financial stress. When patients are informed about expected costs and have a basic understanding of their financial responsibilities, they are more likely to plan for and meet those obligations. Enhancing financial literacy through clear, upfront communication empowers patients to take control of their healthcare expenses. By reimagining the payment experience through transparency, flexibility, and technology, providers can drive better outcomes for both their bottom line and the patients they serve.

The growing burden on patients and providers

NEMT Partner Guide: Why Payers and Providers Should Choose MediDrive’s TMS

Alan Murray on improving access for medical transportation.

As healthcare costs continue to rise, patients are taking on a larger share of financial responsibility through higher deductibles and out-of-pocket expenses. While insurers still cover the bulk of medical costs, the portion patients must pay directly has increased significantly, creating new challenges for providers. Many healthcare systems still rely on outdated billing practices that make it difficult for patients to understand, manage, and pay their bills in a timely manner.

Common barriers to collections

Patients often face significant barriers when it comes to paying their bills. A lack of price transparency, confusing statements, and limited payment options all contribute to payment delays. While the No Surprises Act has improved cost clarity for uninsured patients, those with high-deductible health plans are often still left in the dark about their financial responsibility. This lack of clarity creates frustration and uncertainty. Surveys show that 65% of patients find medical bills confusing, which diminishes satisfaction. In fact, a 2024 Newsweek survey revealed that over 40% of patients left negative reviews due to billing issues, and 38% switched providers because of them.

The consequences of poor collections

Rising bad debt is a critical concern for healthcare providers. When patient balances remain unpaid, revenue is delayed, and financial sustainability is compromised. This not only affects the patient experience, driving some to avoid future care, but also creates significant challenges for CFOs. Mounting bad debt directly impacts their ability to make strategic investment decisions in areas like clinical care, facility improvements, and staff compensation. To mitigate these risks, providers must embrace a more innovative, patient-centered approach to billing and collections. Supporting patients with financial guidance improves their ability to pay.

Strategies for improving collections

1. Enhance patient engagement and financial counseling

- Provide financial counseling services.

- Train front-line staff on empathetic, proactive financial discussions.

- Offer discounts or incentives for early or prompt payments.

2. Improve price transparency and upfront communication

- Offer accurate, upfront cost estimates.

- Ensure that pricing is competitive compared to other hospitals and independent providers such as imaging or surgical centers.

- Train staff to initiate clear, compassionate conversations about costs.

- Use digital tools to verify eligibility and benefits in real time.

- Offer accurate, upfront cost estimates.

- Train staff to initiate clear, compassionate conversations about costs.

- Use digital tools to verify eligibility and benefits in real time.

3. Offer flexible and digital payment options

- Provide multiple payment channels, including mobile payments and online portals.

- Establish flexible payment plans with clear, transparent terms.

- Develop settlement offers that align with patients’ financial situations, such as providing timely options during tax season.

- Leverage third-party financing options to help patients manage expenses without delaying care.

4. Simplify and streamline billing processes

- Implement clear, patient-friendly billing statements with easy-to-understand charges.

- Consolidate bills to avoid overwhelming patients with multiple statements.

- Use automated text, email, and phone reminders to prompt timely payments.

5. Leverage technology and automation

- Employ AI tools to predict payment behavior and personalize outreach.

- Enable self-service through payment kiosks and online bill pay.

- Integrate electronic health records with billing systems to streamline the payment experience.

- Incorporate two-way text messaging that allows patients to connect with customer service representatives in real time, offering immediate support and enhancing satisfaction.

- Employ AI tools to predict payment behavior and personalize outreach.

- Enable self-service through payment kiosks and online bill pay.

- Integrate electronic health records with billing systems to streamline the payment experience.

6. Partner with experienced industry experts

- Leverage the expertise of partners who have a proven track record across diverse healthcare markets.

- Utilize their insights and best practices to optimize billing, collections, and patient communication.

- Benefit from scalable solutions that have been tested and refined nationwide to improve financial outcomes and patient satisfaction.

Measuring success and continuous improvement

Improving patient payment collections requires ongoing monitoring and refinement. Tracking key performance indicators lets organizations see progress and identify areas for further investigation or optimization. Metrics to monitor include:

- Repeat caller reduction – Ensure that patients do not have to make multiple calls to resolve billing issues, improving efficiency and patient satisfaction.

- Collection rate improvement – Measure the percentage of patient payments collected versus billed amounts.

- Reduction in bad debt write-offs – Track how much uncollected revenue is being written off due to non-payment.

- Patient satisfaction scores related to billing – Use surveys and feedback to gauge whether billing improvements are reducing frustration.

Continuous training and process refinement

Even the best strategies fail if staff aren’t equipped to implement them. Regular training helps teams understand policies, to confidently discuss costs, and effectively utilize technology. Process reviews help identify bottlenecks and inefficiencies, allowing for continuous improvement.

Leveraging patient feedback

Patients are the best source of insight into what works. Actively seek feedback to refine billing statements, payment options, and communication strategies. A patient-centric, technology-driven approach is necessary for long-term financial health, and partnering with the right experts can fast-track that success.

Improving patient payment collections is not just a financial necessity; it’s an opportunity to build stronger relationships with patients. By focusing on transparency, flexibility, and technology, providers enhance the payment experience. It’s about fostering trust, simplifying processes, and helping patients confidently navigate their financial responsibilities. Adopting these strategies makes a difference in both operational success and patient satisfaction. A proactive, patient-centric approach to payment collections lays the foundation for a healthier, more financially secure future.

Photo: KLH49, Getty Images

Daniel Thomas is Conifer’s Vice President of Patient Services, overseeing strategy and operations for Patient Access, Pre-Service, Customer Service, Early Out, Bad Debt, and revenue-cycle integration functions. He focuses on helping hospitals and health systems develop and execute strategies that elevate their patient experience and drive RCM operational improvements.

Previously, as Vice President of Conifer’s Patient Services Center, Daniel led all pre-service functions and marketing across all Conifer customers. Daniel also led Transformation Operations, managing large-scale offshore transitions including recruiting, training, legal, IT, and workflow management. With over a decade of experience at firms like CIOX Health, McKinnis Consulting, and R1 RCM, Daniel is a results-driven leader recognized for enhancing operational efficiency and reducing costs. His problem-solving, relationship-building, and analytics skills drive strategic initiatives that boost client performance.

This post appears through the MedCity Influencers program. Anyone can publish their perspective on business and innovation in healthcare on MedCity News through MedCity Influencers. Click here to find out how.