Sanofi is shelling out $1.15 billion to acquire Vicebio, a startup with a pipeline of respiratory vaccine candidates and a platform technology that will support the pharmaceutical giant’s ambitions to expand its portfolio with vaccines capable of addressing two or more pathogens with a single shot.

Beyond the upfront payment, the deal announced Tuesday puts Vicebio in line to receive up to $450 million more tied to the achievement of development and regulatory milestones that weren’t specified. The most advanced Vicebio program, VXB-241, is a bivalent vaccine for respiratory syncytial virus (RSV) and human metapneumovirus (hMPV) in Phase 1 development.

The current approach to vaccination against respiratory diseases is a single shot for each pathogen. As more vaccines become available for more pathogens, the growing number of shots becomes daunting to patients. London-based Vicebio is developing multivalent vaccines that could pose less of a burden. Besides VXB-241, which is being tested in in older adults, the Vicebio pipeline also includes VXB-251, which is in preclinical development for addressing RSV, hMPV, and parainfluenza virus type 3 (PIV3).

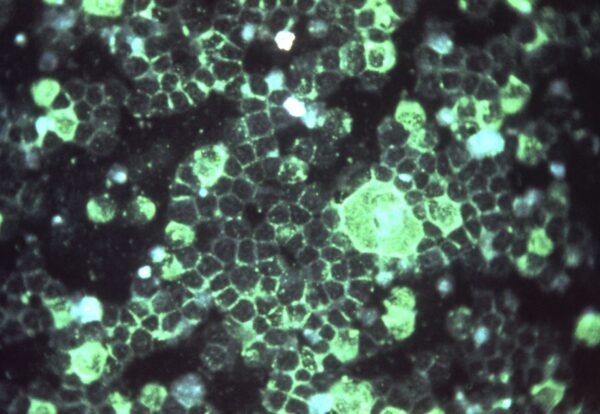

Like other proteins, viral antigens do not have a fixed shape. This instability makes it difficult to elicit a strong immune response. Vicebio’s technology, called Molecular Clamp, stabilizes viral proteins in the optimal shape for the immune system to recognize them. Sanofi said it sees the technology as a way to enable quicker development of fully liquid combination vaccines that can be stored at standard refrigeration temperatures. This capability eliminates the need for freezing or freeze-drying vaccines, which simplifies vaccine manufacturing and distribution. Also, vaccines made with this technology can also be supplied in prefilled syringes.

“This acquisition furthers Sanofi’s dedication to vaccine innovation with the potential to develop next-generation combination vaccines that could provide protection to older adults against multiple respiratory viruses with a single immunization,” Jean-François Toussaint, global head of research and development vaccines at Sanofi, said in a prepared statement.

Molecular Clamp is based on research from The University of Queensland in Australia. Medicxi licensed rights to the technology and provided the founding investment for Vicebio. The startup last raised money in 2024, a $100 million Series B financing to support Phase 1 testing of VXB-241 for RSV and hMPV. At the time, Vicebio said preliminary data were expected in mid-2025. So far, no results have been released.

Sanofi is already well established in in influenza vaccines. It’s trying to build on that with next-generation flu shots based on messenger RNA technology from its $3.2 billion Translate Bio acquisition in 2021. In RSV, Sanofi is represented by Beyfortus, an FDA-approved antibody drug that works like a vaccine, providing infants and young children protection from the respiratory pathogen.

The Power of One: Redefining Healthcare with an AI-Driven Unified Platform

In a landscape where complexity has long been the norm, the power of one lies not just in unification, but in intelligence and automation.

The pharma giant is pursuing other respiratory pathogens with vaccines based on its mRNA platform. For RSV, SP0125, is currently in Phase 2 testing in older adults. SP0256, a bivalent vaccine for RSV and hMPV, is currently in Phase 1/2 testing. Also in early clinical development is SP0291, an mRNA vaccine for RSV, hMPV, and PIV3. Sanofi said Vicebio’s vaccines complement its pipeline, potentially enabling the company to offer physicians and patients a non-mRNA vaccine option.

In a research note, Leerink Partners said the Vicebio acquisition is evidence of Sanofi’s enthusiasm for developing protein-based flu vaccines, following its 2024 alliance with Novavax enabling the companies to develop Covid-19/flu vaccine combinations. The firm also sees the deal as a sign of accelerating M&A activity sector-wide.

The Vicebio acquisition is expected to close in the fourth quarter of this year, pending customer closing conditions, including the sign-off from regulators. Sanofi’s other business deals this year include the $9.5 billion acquisition of immunology drugs developer Blueprint Medicines, which closed last week. Earlier this year, Sanofi paid $470 million to buy Vigil Neurosciences as well as $600 million for an early-stage autoimmune disease drug from Dren Bio.

Public domain image by the CDC