Johnson & Johnson’s first cancer cell therapy came via a licensing agreement. Dealmaking is bringing two more to its pipeline. The pharmaceutical giant has agreed to pay Cellular Biomedicines $245 million for two next-generation cell therapies in development for advanced blood cancers.

The sum announced Tuesday is an upfront payment giving J&J global rights, excluding China, to two autologous CAR T-therapies. J&J could pay more based on the achievement of development, regulatory, and sales milestones, but no further details of those payments were disclosed. If the cell therapies reach the market, Cellular Biomedicines will receive royalties from sales. The deal also calls for the companies to negotiate an option for J&J’s Janssen subsidiary to commercialize the therapies in China. The transaction is expected to close by the end of June.

The Funding Model for Cancer Innovation is Broken — We Can Fix It

Closing cancer health equity gaps require medical breakthroughs made possible by new funding approaches.

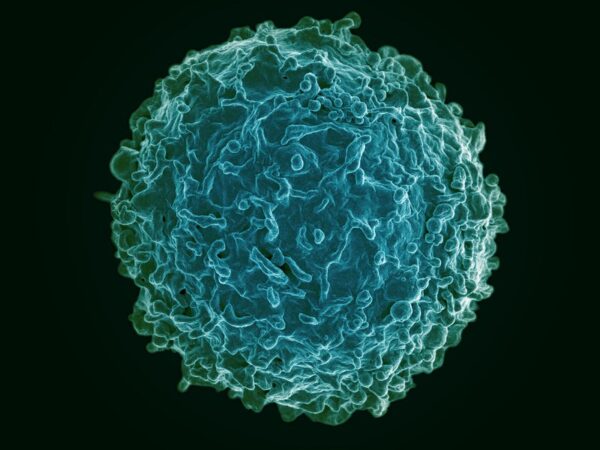

The drugs from Rockville, Maryland-based Cellular Biomedicines are potential treatments for a type of non-Hodgkin lymphoma called diffuse large B-cell lymphoma (DLBCL). This cancer is characterized by rapid and uncontrolled growth of immune cells called lymphocytes. The CAR T-therapies that have reached the market, including a Bristol Myers Squibb cell therapy approved for DLBCL, are each engineered to go after a single protein target on the surface of cancer cells.

The Cellular Biomedicines CAR T-candidate C-CAR039 is a bispecific CAR T-therapy engineered to go after two targets: CD19 and CD20. This approach could help patients whose cancer has relapsed or has not responded to earlier lines of treatment. An ongoing Phase 1b study in the U.S. is evaluating the cell therapy in such patients. There are other companies pursuing a bispecific approach to CAR T-therapy. In March, Cargo Therapeutics unveiled a $200 million Series A financing to advance a pipeline that includes a lead therapeutic candidate that targets CD19 and CD22. A pivotal Phase 2 study is on track to begin mid-year; preliminary data are expected in mid-2024.

The second Cellular Biomedicines therapy heading to J&J, C-CAR066, is engineered to target CD20. Compared to the first generation of CAR T-drugs, the company has described it as having superior anti-tumor activity. In early clinical trial results presented in 2020 during the annual meeting of the American Society of Hematology, data showed all seven patients who received experimental therapy had responses to the treatment. Tumor regression ranged from 45% to 100%. Furthermore, the expansion and proliferation of the cell therapy in the peripheral blood showed a positive correlation with the extent of tumor regression.

C-CAR066 was well tolerated by patients. Cases of cytokine release syndrome, a known adverse effect of CAR T-treatments, were reversible. There were no incidents of neurotoxicity, another known adverse effect of these therapies. This therapy has the FDA’s blessing to proceed to a Phase 1b study in patients with relapsed or refractory DLBCL. J&J expects this study will begin in the second half of this year.

Reducing Clinical and Staff Burnout with AI Automation

As technology advances, AI-powered tools will increasingly reduce the administrative burdens on healthcare providers.

“We are committed to advancing the science and treatment of B-cell malignancies, especially in DLBCL where deeper responses and long-term remissions represent a persistent unmet need,” Sen Zhuang, vice president, clinical research and development at Janssen Research & Development said in a prepared statement.

J&J’s first CAR T-therapy, Carvykti, won its FDA approval last year as a treatment for multiple myeloma, a cancer of plasma cells. This therapy, which was developed in partnership with China-based Legend Biotech, is made by engineering a patient’s T cells to target a protein called B-cell maturation antigen. Under the collaboration and licensing agreement, J&J and Legend share in the production and commercialization costs of Carvykti. They also share equally in profits from sales, except for China, where Legend will receive 70% and J&J will get 30%.