As healthcare spending continues to rise, a greater proportion of employers are turning to self-funding as a mechanism to gain more control over their costs and benefit offerings.

The same trend line holds true for the dental industry, which has more than 500 million annual visits that cost more than $100 billion. However, for the most part, self-funding dental benefits have only been possible for large Fortune 500 corporations.

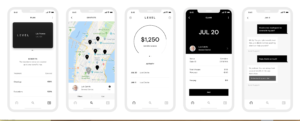

A new startup called Level launched this month to help small and medium sized businesses take more control over their dental benefits spending by transitioning to a self-funded model supported by a platform offering a more consumer-friendly experience through technology.

The 20-person startup is based in New York and is backed by investors like First Round Capital and Homebrew VC. Level – which currently works with companies like San Francisco-based Intercom – focuses on employers with between 50 and a few thousand employees.

Level largely functions as a third-party administrator for employers it helps transition to a self-funded model. Where Level differs from most TPAs is that the company operates and manages its own network of providers, in addition to providing claims processing and other administrative functions.

“You can think of Level as an insurance company in how we operate the network and deal with plan design, except we don’t hold financial risk,” Level CEO and co-founder Paul Aaron said said.

Aaron is a veteran of both Square and Oscar Health and said he saw the potential in bringing in a streamlined interface and payment system to the outdated dental market. The company’s provider directory lists all licensed dentists in the area and makes it easy to identify which are in network with Level.

Level’s platform also allows for cost estimates for procedures that take into account the member’s current benefits spend creating a more shoppable experience for consumers with greater price transparency.

Instead of a weeks long process that involves waiting for an invoice and a bill to come in through snail mail, Level handles the claims and billing process digitally making it easy for patients to pay their expenses online. The company designed their benefits and billing documents in a simplified format that makes their benefits and costs easier to understand.

“What we’re trying to do is create an experience that feels real time from a claims perspective and keeps everybody in the loop as quickly as possible,” Aaron said.

Aaron said from a moving to a self-insured model automatically leads to cost savings because of the simple fact that a-third of working adults don’t go to the dentist every year and most employees don’t reach their annual benefits limits, leading to cost savings that go directly to the employer.

Additionally, the platform also allows for easy mobile reminders for regular teeth cleanings and check-ups as preventive care to hopefully head off more serious (or expensive) issues. Level also pitches self-funding as a way to better customize benefit offerings based on a company’s employee makeup or specific needs.

“We want to make employer’s utilization data much more accessible and help them get a better understanding of how their benefits are being used and how to optimize plan design going forward,” Aaron said.

From the dentist’s perspective being a part of Level’s network means faster claims processing and a reduction in the kind of administrative overhead and paperwork that can be a serious burden on smaller practices.

Aaron said the company currently has clients in New York and California and will scale up to being fully national within the year.

“I think we’d like the market to come around to this idea that self insurance is a super power and made it easy for smaller companies to have the resources that only larger companies have traditionally had access to,” Aaron said.

Picture: AndreyPopov, Getty Images