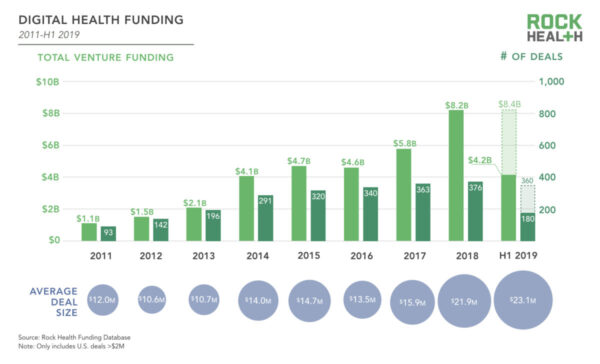

Concern about slowing investment in the digital health earlier this year has largely abated as the industry looks likely to meet or exceed 2018’s record-breaking funding haul, according to a report from Rock Health.

Digital health companies raised a total of $4.2 billion through the first half of 2019, which projected out for the rest of the year would reach $8.4 billion, $200 million more than 2018’s $8.2 billion figure.

The volume of deals has dropped slightly – with $100 million-plus investment deals making up around 30 percent of the deals in 2019 – and largely driving the investment trend. Average deal size is also up to $23.1 million, compared to $21.9 million in 2018 and $15.9 million in 2017.

Rock Health calculated there was $29.4 billion in capital invested in digital health startups since 2011 that were still waiting on returns and examined the two routes companies have to return liquidity to investors: IPOs and M&A.

Much attention has been on the companies testing the public markets this year after a digital health IPO drought that has lasted since 2016. According to Rock Health, IPO companies in digital health raised an average of $199 million and went public at an average age of 9.4 years.

Mountain View, California-based Livongo Health was the latest digital health company filing to go public, with a planned listing on the Nasdaq later this year. The chronic disease management company joins Phreesia and Health Catalyst as part of the raft of healthcare technology companies planning to go public in 2019.

Nashville-based Change Healthcare had their initial public offering last week, trading at $13 a share, below the $16 to $19 range that the company had targeted.

The success of these companies’ efforts will likely signal the near-term viability of IPOs as an exit route for the industry. A few of the IPO potential companies identified by Rock Health are telemedicine company American Well, genetic testing company 23andMe and cardiac imaging company Heartflow.

During the IPO drought, the exit opportunity that would offer liquidity to investors was M&A, with 120 and 110 exits respectively for 2017 and 2018.

This year’s M&A activity has slowed somewhat. There have only been 43 acquisitions in the first half of 2019, if that number is projected out, deal flow would be 25 percent lower than in the past couple of years.

While other digital health companies still remain the most active acquirers in the space, Rock Health spotlights other categories like consumer technology companies and non-healthcare companies looking to enter the industry through M&A like Amazon, J.P. Morgan and Best Buy.

Picture: Warchi, Getty Images