Almost every patient can recount a bad billing experience. But for Florian Otto, his wife’s negative experience tied to a hospital visit spurred him to create Cedar. It’s a New York medical billing startup he founded with former AppNexus Vice President Arel Lidow in 2016.

On Monday, the startup that aims to make medical billing easily understood by patients announced that it had raised $102 million in a Series C funding round. The funding includes $77 million in venture capital, led by Andreessen Horowitz, and $25 million in venture debt from JP Morgan.

With the Rise of AI, What IP Disputes in Healthcare Are Likely to Emerge?

Munck Wilson Mandala Partner Greg Howison shared his perspective on some of the legal ramifications around AI, IP, connected devices and the data they generate, in response to emailed questions.

As part of the investment, Andreessen Horowitz Managing Partner Scott Kupor will join Cedar’s board of directors. The New York-based company plans to use the additional funds to further develop its technology and expand to more health systems.

“We’ve been extremely impressed by the patient payment solutions they’ve built and look forward to partnering to help them deliver on their mission to allow healthcare providers to understand and engage with patients more effectively,” Kupor said in a news release.

For Otto’s wife, the billing experience began at the hospital where she swiped her credit card for a copayment. A month later, she got a stack of paper and had to call to pay her bill. Weeks after that, she received a bill for an MRI where she had to fax in the payment. She later got a collections call for a bill she never received.

“The big problem is on the interaction side between the hospital and the patient,” said Otto, a former physician and a former executive with Zocdoc. “The problem is not the willingness or ability to pay. Hospitals make it extremely difficult for patients to pay their bill.”

This is obviously bad for patients. But it’s also a big problem for healthcare providers given that more than half of hospital bills go unpaid.

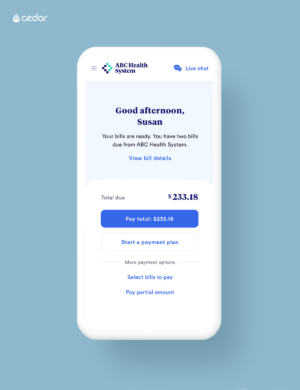

Cedar’s billing software helps patients manage and view the details of their bills.

Otto’s hypothesis was that if it were easier for patients to access and understand their bills, more people would pay them. The company’s solution does three things: First, it explains each line item of the bill in understandable language, instead of CPT codes. It also personalizes the billing experience to understand why a patient might not be paying a bill, such as problems paying the bill or a concern with it. Finally, it gives providers analytics and helps connect them with patients to answer billing questions.

The startup currently has 25 enterprise clients, including ChristianaCare and American Oncology Network. It has reported a 30% increase in collections and 95% patient satisfaction rates. The startup also recently struck a partnership with North Carolina-based Novant Health to build out its platform.

Otto said he looked forward to working with Kupor as a mentor, and that the $102 million in funding should put the company on a “total new trajectory.” Including the recent funding round, Cedar has raised a total of $157 million to date.

Cedar has also developed some specific responses to billing problems it has encountered since it started. For example, it developed messaging to help patients if they saw a claim denied because they didn’t get prior authorization, because their insurance card had expired, or because they didn’t include their auto insurance information when seeking care after a car accident.

The company also found that many patients who received bills were eligible for Medicaid, but were not enrolled in it, so Cedar developed a tool to help walk them through that process.

“We of course knew in the beginning that billing was messed up. You don’t need to be a rocket scientist to know that. But we didn’t know about all of this denials messaging. We didn’t know Medicaid enrollment was such a problem,” Otto said. “Balance billing a patient because their insurance information was expired — that, in my opinion, is a billing mistake. Sending a patient a bill for $10,000 because they were not enrolled in Medicaid is, in my opinion, a billing mistake.”

The next step for Cedar is to develop more pre-visit billing information. The company has already developed a contactless check-in solution. It will do an insurance eligibility check, tell patients how much their copay will be and provide cost estimates for planned procedures. It can also help patients set up a payment plan in advance, if needed.

Photo credit: atibodyphoto, Getty Images