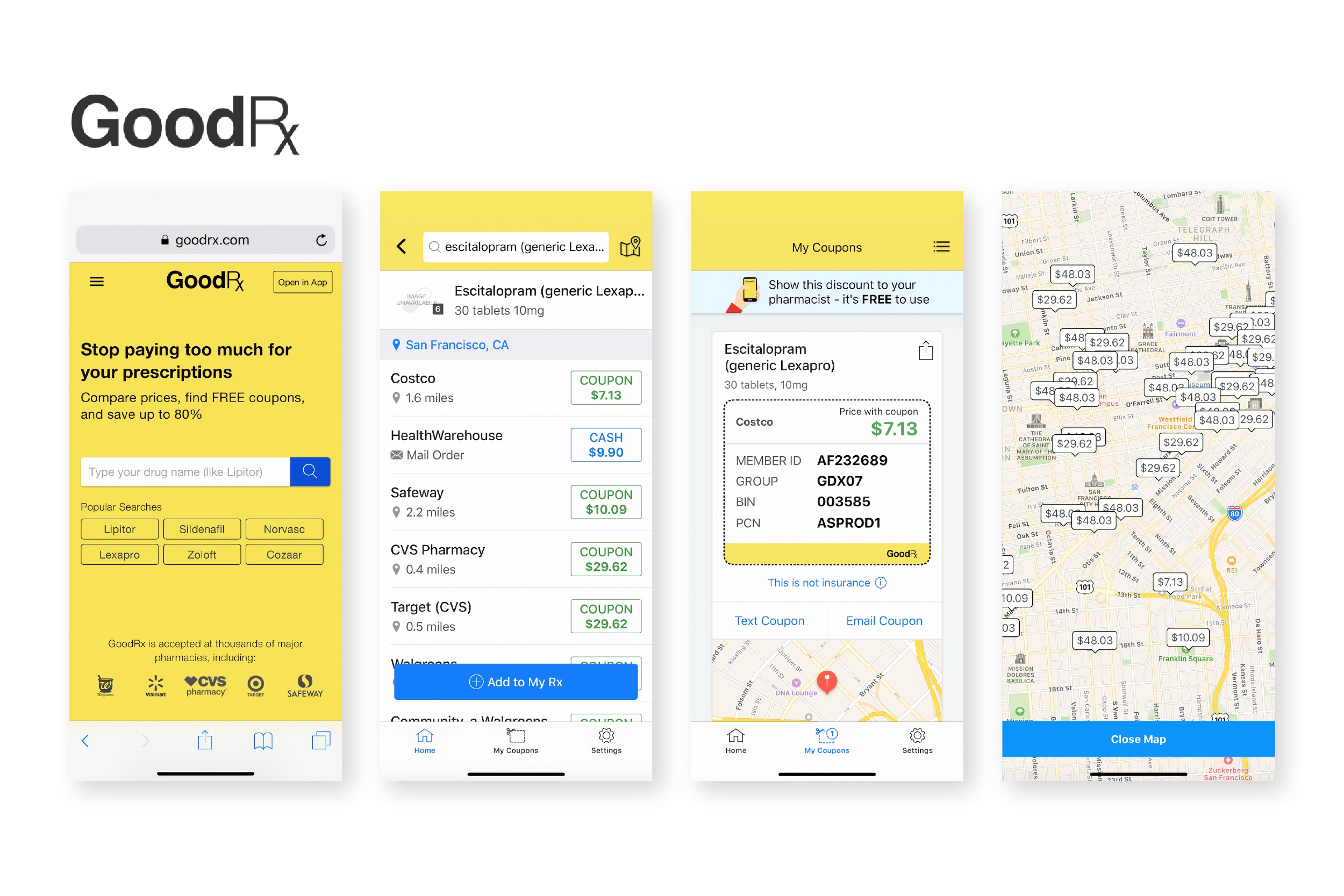

GoodRx’s app lets users search for self-pay discounts for prescriptions. Photo credit: GoodRx

Prescription discount startup GoodRx is reportedly preparing to go public. The company filed initial paperwork for a potential IPO with the Securities and Exchange Commission, according to anonymous sources cited by Reuters.

The listing could take place later this year or in early 2021.

GoodRx, which was founded in 2011, offers drug discounts to self-pay customers and has a prescription price comparison tool. The company brings in revenue through referral fees from pharmacy benefit managers such as CVS as well as advertising.

The company has quietly scaled up since. In 2018, technology private equity firm Silver Lake acquired a one-third stake in GoodRx for a valuation of $2.8 billion, according to CNBC.

As of June, the company said it has grown its revenue by 55% since 2018 and increased its headcount to 350 employees.

The Power of One: Redefining Healthcare with an AI-Driven Unified Platform

In a landscape where complexity has long been the norm, the power of one lies not just in unification, but in intelligence and automation.

Two recent hires also hint at GoodRx’s growth plans. Bansi Nagji, McKesson’s former chief strategy officer, joined the company as its new president. He had helped facilitate the combination of McKesson and Change Healthcare, and sat on Change Healthcare’s board during its IPO.

Karsten Voermann was brought in as CFO in June to help GoodRx scale its financial operations, according to a news release. He previously served as CFO for Mercer Advisors, where he closed roughly 10 acquisitions per year, and also led Mercury Payment Systems through its IPO in 2014.

GoodRx had not responded to requests for comment at the time of publication.