Customization is something that people are pursuing and adopting in every aspect of their life. One startup is betting this will extend to their consumption of health insurance as well.

Customization is something that people are pursuing and adopting in every aspect of their life. One startup is betting this will extend to their consumption of health insurance as well.

Bind Benefits, a personalized health plan provider that recently entered the fully insured market in Florida, has raised $105 million in a new funding round. The same syndicate that ran its Series A funding round in 2018 ran the latest round. The investors were Ascension Health Ventures, Lemhi Ventures and UnitedHealth Group.

The funds are meant to turbocharge this fully insured product that will now be rolled out to more than 30 states by the end of 2021. After announcing it’s entry to the fully-insured market in Florida in September, Bind has filed for approval in Ohio, Texas, Virginia and Wisconsin, and has plans to expand to 30 states by the end of next year.

The Power of One: Redefining Healthcare with an AI-Driven Unified Platform

In a landscape where complexity has long been the norm, the power of one lies not just in unification, but in intelligence and automation.

Founded in 2016, the Minneapolis-based company began by offering personalized health plans for large, self-insured employers. Bind has provided its self-funded administrative services only platform to companies like Best Buy, Lumen and Medtronic.

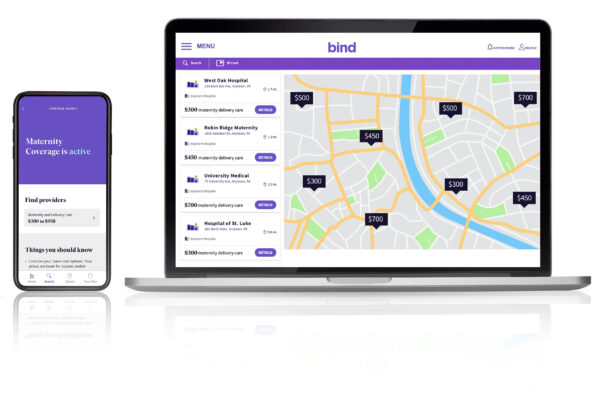

The plans include core coverage for certain services, such as primary and specialty care, emergency and hospital care, preventive care as well as the option of adding on coverage for services outside of the core coverage at any time. Think of buying coverage for a planned knee-replacement surgery for a few months in the same way a consumer might opt to get HBO for a time to watch Game of Thrones.

While this on-demand aspect of buying health insurance might appeal to people, Bind is also hoping that its emphasis on price transparency — the plan allows members to compare treatment options along with price points — will resonate with consumers. Further, there are no deductibles or coinsurance fees — terms that are inextricably linked to health insurance and represent a universally-felt cause of frustration and worry for consumers.

In a wide-ranging phone interview, Bind CEO Tony Miller expanded on this new vision of health insurance and discussed the future of the employer-based insurance market, among other things.

Note: Responses have been edited for length and clarity.

MedCity News: Let’s talk a little bit about the future of the employer-based insurance market. In a recent interview with MedCity News, Mark Bertolini, the former CEO and chairman of Aetna, said the future of employer-based insurance is defined contribution. Do you agree or disagree? Can your model adjust to that future?

Tony Miller: This concept of defined contribution is nothing new. It’s been around for almost 30 years. The challenge really is the execution of making that off-ramp happen. That’s where I think it gets a little sticky.

Employers are [already] putting and funding the forward cost of their benefit liability on their balance sheets. So, employers have been basically, the way I call it, the ‘parent’ in health insurance. They’ve actually built a budget for us. And so, what’s really hard about this move to defined contribution is — would people still allocate that money so they could have coverage in a health insurance product? And that to me is one of the tricky parts of how you would make this work.

I had the opportunity to speak at a big health benefit event right after the ACA passed in New York City. It was 50 of the Fortune 100 benefit leaders and CFOs and I was asked to come speak about defined contribution. I kept asking people in that meeting, the ACA gives you the off-ramp, why are none of you taking it? The ACA allows you to stand up vouchers and allow people to go into the individual exchanges and as we’ve seen, almost zero employers have done it. And what was so interesting at that point was that there was no interest in even thinking about it. That just shows you how important [insurance] benefits are as an attraction/retention/compensation tool for these big employers.

Employers recognize how valuable health benefits are, and if you want to be strategic about attracting and retaining, you probably want to be thinking about how you offer that product up. It won’t be one-size-fits-all — it won’t be defined contribution for everybody, and it won’t be defined benefits for everybody. I think there is going to be this blend, and what is awesome about Bind’s product is that we get that opportunity for you to design how far you want to go in letting consumers define their own benefit and how much you still control as a plan sponsor.

Question: How has the Covid-19 pandemic played into the growth of Bind this year?

Tony Miller: For us, right when the pandemic hit and everyone started recognizing we needed to shelter-in-place, we needed to shut down, then what people immediately realized is, ‘Oh my gosh, current insurance design does not support how to handle a pandemic.’ We had to pass legislation to say, you know what, testing for Covid, some treatments for Covid, diagnostics for Covid, all need to be pre-deductible and they are now a qualified health expense in the preventive sense in the context of an HSA/HDHP [Health Savings Account/High Deductible Health Plan] plan design.

It was such a highlight to how broken insurance design is. If you took a condition-first approach like Bind took, [and in this case] the condition is an infectious disease, you look at the intersection of the clinical reality and the actuarial reality of the infectious disease. And it’s very clear you should provide early and reliable testing for free as fast as possible. Bind’s plan did that. We did not need Congress to act to improve our insurance design.

[Also, employers] are not interested in shopping for a new benefit [right now]. The entire industry is basically in this, well I’m not going to do anything in ’20 because I’m just trying to survive the pandemic, I want to see what’s going to happen, is a vaccine going to arrive, does the economy open back up, and so there was this freeze of ‘Don’t change your benefits, I’ve got bigger problems to worry about.’ And besides, benefits are not a cost problem this year. I think what’s going to happen is as we open up, and as everyone thinks there’s going to be this new utilization surge, which I don’t know if I believe that yet, then you really want a plan that looks more like Bind where we navigate you into better healthcare journeys.

Question: As Bind expands into the fully insured market, what is the role UnitedHealthcare will play?

Tony Miller: The blueprint that we gave to investors all the way back in 2018 when we did the Series A round, what we wanted was to prove was three things — customers are going to buy it, consumers are going to like it and it actually makes healthcare more affordable for everyone — both plan sponsors and consumers. And we wanted to prove that out on the self-funded basis first because that is the most capital-efficient way. What people don’t realize is employers, especially big employers — big employers are the insurance company. So, instead of [Bind] having to raise venture capital with the risk-based capital reserves to offer a fully insured product, all we had to do is stand up the administrative services to deliver this new benefit design.

Now, we want to go into the fully insured market and actually offer this solution to the people who need it most, you know, where premiums are on the rise, deductibles are on the rise, coinsurance is on the rise and healthcare looks very unaffordable. And we wanted to do that again in a capital-efficient manner.

So we could go raise a bunch of venture money and put that into our own risk-based capital reserves and our paper, but instead we approached United and said, hey, we’d like to be capital-efficient here, you have some insurance shelves we could offer our product on, and as we gain membership, you have the scale to put in the risk-based capital reserves not using venture money, but using other sources of more efficient and cheaper capital, and would you be willing to do that with us. And the answer was yes, absolutely.

And so, we’re saving, relative to the other startups who are trying to do fully insured [products] themselves as venture startups, we’re saving hundreds of millions of dollars, relative to having to lock up that capital to allow regulators to believe you’ve got a solvent insurance company. The insurance company the regulator sees is the paper we are filing on, and that paper is a UnitedHealthcare license.

Question: What happens to Bind if the ACA goes away after the Supreme Court rules on it and what happens if in the future Medicare for All becomes a national reality?

Tony Miller: We are confident our solution works in any future scenario on how we structure and regulate health benefits and insurance.

Photo credit: Bind