Tango Therapeutics hasn’t yet reached the clinic, but the company is on track bring its lead program there soon, and when it does it will be supported by $353 million from a merger deal that takes the company public.

Cambridge, Massachusetts-based Tango announced Wednesday that it has agreed to combine with BCTG Acquisition, a special purpose acquisition company (SPAC). Such publicly traded companies serve as vehicles for other private companies looking for a way to join the public markets other than a conventional IPO.

BCTG is sponsored by Boxer Capital, a firm that also happens to be one of Tango’s investors. The combined company is keeping the Tango name and will be led by its CEO, Barbara Weber. When the deal closes, Tango’s stock is expected to list on the Nasdaq under the stock symbol “TNGX.”

Tango develops drugs based on synthetic lethality, a concept that involves tapping into a genetic vulnerability in cancer. By targeting one gene, a drug can knock out another gene that is paired to the first one. That approach is intended to target cancer cells while sparing healthy ones. Tango’s focus is on developing drugs that counteract the loss of tumor suppressor genes and reverse the ability of cancer cells to evade the immune system.

With the announcement of the planned merger, Tango is disclosing some details about its pipeline. Lead program TNG908 is designed to block PRMT5, an enzyme that is expressed at high levels in tumors and whose synthetic lethal pair is a gene called MTAP. The company plans to file an investigational new drug application (IND) with the FDA in the fourth quarter of this year, proceeding to clinical testing in multiple cancer types.

A Deep-dive Into Specialty Pharma

A specialty drug is a class of prescription medications used to treat complex, chronic or rare medical conditions. Although this classification was originally intended to define the treatment of rare, also termed “orphan” diseases, affecting fewer than 200,000 people in the US, more recently, specialty drugs have emerged as the cornerstone of treatment for chronic and complex diseases such as cancer, autoimmune conditions, diabetes, hepatitis C, and HIV/AIDS.

A second IND filing is planned for next year for an inhibitor of a cancer protein called USP1, which Tango plans to develop for BRCA1-mutant breast, ovarian, and prostate cancers. A third program for an undisclosed target is expected to reach the clinic in 2023 for lung cancer characterized by a mutation to the STK11 gene. The company also plans to continue work on preclinical compounds in its pipeline with the goal of filing a new IND every 12 to 18 months.

Tango unveiled its approach to cancer drug research in 2017, springing from Third Rock Ventures, the venture capital firm that incubated the startup. In the years since, its work has attracted the attention of one large pharmaceutical partner. Gilead Sciences signed on as a collaborator in 2018. That deal had the partners working together on five drug targets. Last summer, the companies expanded the pact to encompass 15 targets. At that time, the Foster City, California-based pharmaceutical company paid its partner $125 million up front and made a $20 million equity investment.

The partnership with Gilead is focused on developing drugs that address how cancers evade the immune system. The cancer drug targets remain undisclosed but depending on the progress of the research, Tango could earn up to $410 million for each of the partnered programs. Tango’s three lead programs are not included among the 15 covered by the Gilead pact.

According to terms of the SPAC merger deal, current Tango shareholders will convert all of their equity in the biotech into common stock in the combined company. The $353 million in cash that will become available to Tango breaks down to $167 million from the accounts of BCTG and about $186 million in private funding from a group of investors.

Boxer Capital is part of the group of private investors, which includes Avoro Capital Advisors, Bain Capital Life Sciences, funds and accounts managed by Blackrock, EcoR1 Capital, Farallon Capital, Fidelity Management & Research Company LLC, Foresite Capital, Janus Henderson Investors, Logos Capital, RA Capital Management, Samsara BioCapital, Southpoint Capital, Surveyor Capital and Woodline Partners LP. Also joining the new financing are earlier Tango investors, including Casdin Capital, Cormorant Asset Management, and Gilead Sciences.

The deal, which is expected to close in the third quarter of this year, still needs approval from BCTG shareholders.

Tango and BCTG have scheduled a conference call to discuss the merger on Wednesday, 10 a.m. Eastern time.

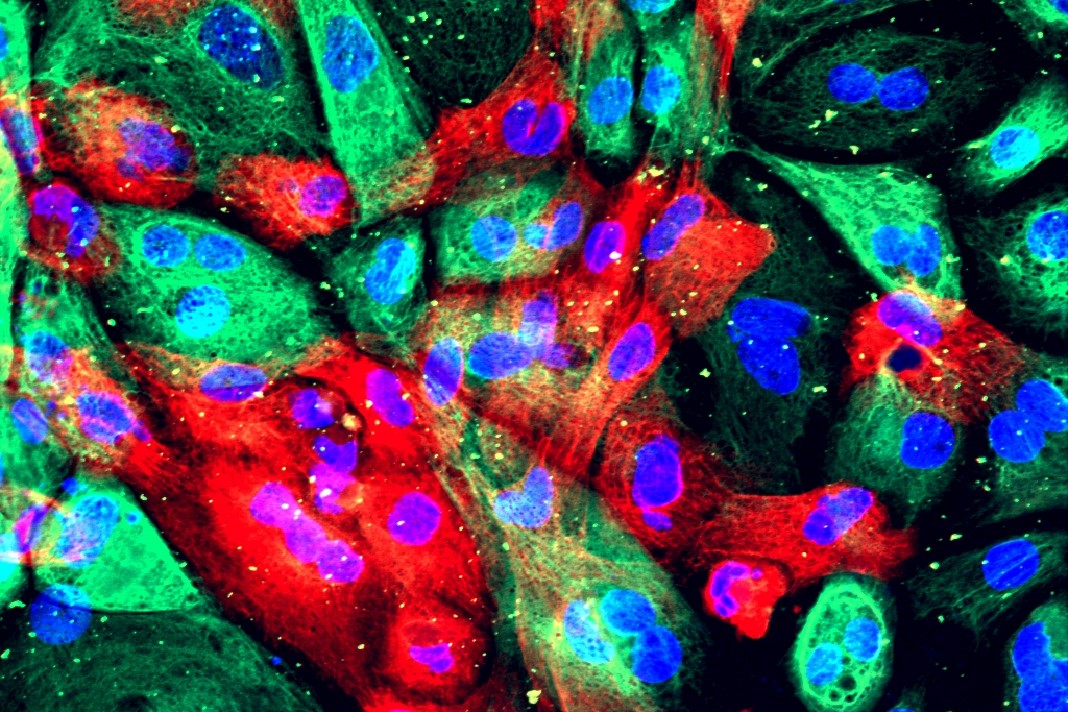

Public domain image by the National Cancer Institute