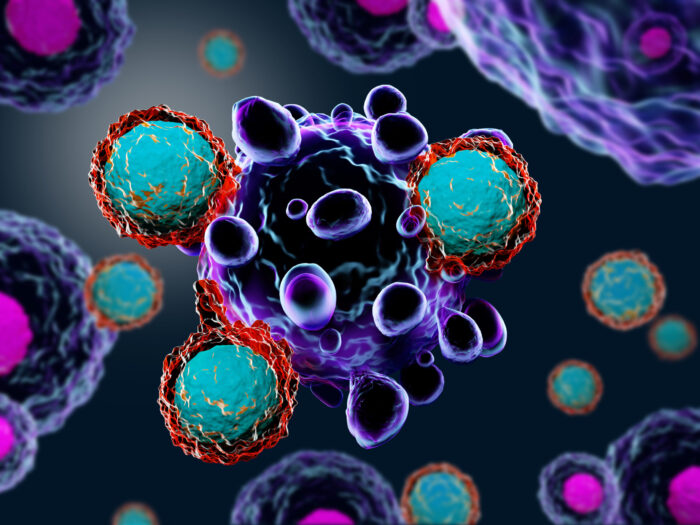

Cancer immunotherapies currently available include a type of drug that direct a patient’s T cells to tumors. But so far, this approach treats only blood cancers and not solid tumors. Another problem is that these drugs can spark side effects throughout the body—some of them potentially fatal. Janux Therapeutics is developing T cell engaging drugs that are more targeted, limiting their cell-killing effect to tumors. Still preclinical but with a Merck R&D partnership already in place, Janux now has $125 million to advance its own cancer drugs.

The fresh capital, a Series B round of financing, comes four months after Janux revealed its Merck partnership and just seven weeks after closing a $56 million Series A round of funding. The speedy series of events sets the company up to look ahead to clinical trials, and potentially raise more capital through an IPO.

San Diego-based Janux declined to answer questions about its technology or its plans. In a prepared statement, David Campbell, president and CEO of the startup, said that the new capital would enable the company to bring its immunotherapies into clinical testing while also supporting the development of additional drug candidates.

The class of drugs that direct T cells to tumors are called T cell engagers. Several drugs of this type are in clinical development in the hands of several biotechs. The only T cell engager that’s commercially available is Amgen’s blinatumomab, which is approved for certain types of leukemia and is marketed under the name Blincyto. The fusion protein is a bispecific T cell engager, which means it binds to two targets, one on a cancer cell the other on a T cell.

Blinatumomab’s label carries a boxed warning stating that the therapy can cause cytokine release syndrome and brain toxicity. Other cancer immunotherapies have the same warnings, as these drugs that prompt the immune system to fight cancer can also spark dangerous immune responses throughout the body.

A Deep-dive Into Specialty Pharma

A specialty drug is a class of prescription medications used to treat complex, chronic or rare medical conditions. Although this classification was originally intended to define the treatment of rare, also termed “orphan” diseases, affecting fewer than 200,000 people in the US, more recently, specialty drugs have emerged as the cornerstone of treatment for chronic and complex diseases such as cancer, autoimmune conditions, diabetes, hepatitis C, and HIV/AIDS.

Janux is developing what it calls the next generation of T cell engager therapies. Like blinatumomab, Janux’s drugs also bind to both a tumor cell and a T cell. But Janux is developing bispecific T cell engagers intended to provide a more targeted strike. The company’s proprietary Tumor Activated T Cell Engager ( TRACTr) technology produces drugs that circulate throughout the body but only convert into a T cell engager (TCE) at the site of a tumor, according to Janux’s website. The company adds that any activated T cell engager that escapes from the tumor microenvironment is rapidly cleared by the body, and therefore cannot accumulate in healthy tissue to cause toxicity.

“This key design feature ensures that there are high levels of TRACTr and activated TCE in the tumor and minimal activated TCE in healthy tissues,” the company says on its website.

In mouse research described in general terms on the website, Janux’s TRACTr showed anti-tumor activity comparable to T cell engager drugs, while showing a better safety profile by inhibiting the release of cytokines, the cell signaling proteins that spark cytokine release syndrome. In monkey studies, the company said dosing of its TRACTr sustained drug levels for longer than two weeks while T cell engagers were cleared from the blood in hours. Janux plans to develop its drugs for once-a-week dosing.

Late last year, Janux announced a partnership with Merck that grants the pharmaceutical giant exclusive rights to drugs developed under the pact. The companies disclosed no financial terms, other than to state that Janux could earn up to $500.5 million in upfront and milestone payments for each of the two targets selected by Merck, plus royalties from sales of any commercialized product. Merck will fund its partner’s R&D. The cancer targets for that partnership were not disclosed. But Janux has disclosed the cancer targets for its first wave of T cell engagers. They’ll aim for the cancer proteins PSMA, EGFR, and TROP2.

Janux is joining several companies in the chase to bring bispecific T cell engagers to solid tumors. Like Janux, Maverick Therapeutics has technology that activates its drugs only at the site of a tumor, sparing healthy tissue from the treatment’s toxic effects. The Brisbane, California-based biotech had been collaborating with Takeda Pharmaceutical and last month the Japanese pharma giant exercised its option to acquire its partner. Maverick’s lead program, MVC-101 (which Takeda will rename TAK-186), targets EGFR. The drug began a Phase 1/2 study in February.

Amunix is developing T cell engagers with proprietary technology that masks the drug and keeps it from affecting health tissue. That mask only comes off at the tumor site. The South San Francisco-based biotech’s technology also extends the half-life of its drugs. In March, Amunix raised $117 million in Series B financing to develop its pipeline of T cell engagers. Lead program AMX-818 targets solid tumors that express the cancer protein HER2.

The Amunix financing included crossover investors, firms that back both private and public companies. Large crossover investment rounds are one sign a biotech company is preparing for an IPO. Janux’s new round of funding also included crossover investors, led by RA Capital Management. Other new investors included BVF Partners, EcoR1 Capital, Hartford HealthCare Endowment, Janus Henderson Investors, Logos Capital, Samsara BioCapital and Surveyor Capital. Earlier Janux investors OrbiMed, Avalon Ventures, and Bregua also participated in the latest round of funding.

RA Capital’s investment in Janux marks the fourth nine-figure biotech financing that the investment firm has led in the past two weeks. Icosavax raised $100 million in Series B funding on April 7, followed a day later by a $100 million Series B round from Ventus Therapeutics. Both companies are preclinical but are ramping up plans to bring multiple programs into human testing in the coming year. Earlier this week, RA Capital led the $336 million Series C financing raised by Adagio Therapeutics.

Image: Meletios Verras, Getty Images