Vera Therapeutics, a company that began as a gene-editing startup before pivoting to immunology with a drug that a big pharmaceutical company no longer wanted, found a lukewarm reception from Wall Street as its IPO raised just shy of $48 million.

The South San Francisco-based biotech priced its offering of 4.35 million shares at $11 each—well below the $14 to $16 price range it had targeted. On Friday, Vera’s shares began trading on the Nasdaq under the stock symbol “VERA.” The stock didn’t budge much from the IPO price, finishing its first trading day at $11.50 per share.

Before Vera Therapeutics was Vera, it was Trucode Therapeutics. The company was aiming to make gene editing more targeted and safer, initially focusing on developing therapies that correct the mutations that cause sickle cell disease and cystic fibrosis. Trucode, whose science was licensed from Carnegie Mellon University and Yale University, was able to raise $34 million in financing from Kleiner Perkins and GV.

The collaboration agreement with Yale expired in 2019, the IPO filing shows. The company and the university agreed to terminate the licensing deal last year. According to the IPO filing, the company’s efforts to develop gene-editing therapies ended last September.

In late January, Vera announced its new identity and its immunology focus, along with $80 million in Series C financing led by Abingworth. One week after that announcement, Vera reached a deal to dispose of the part of the Trucode technology licensed from Carnegie Mellon, selling it to NeuBase Therapeutics for $796,000 and 308,635 NeuBase shares valued at more than $1.7 million, according to the prospectus.

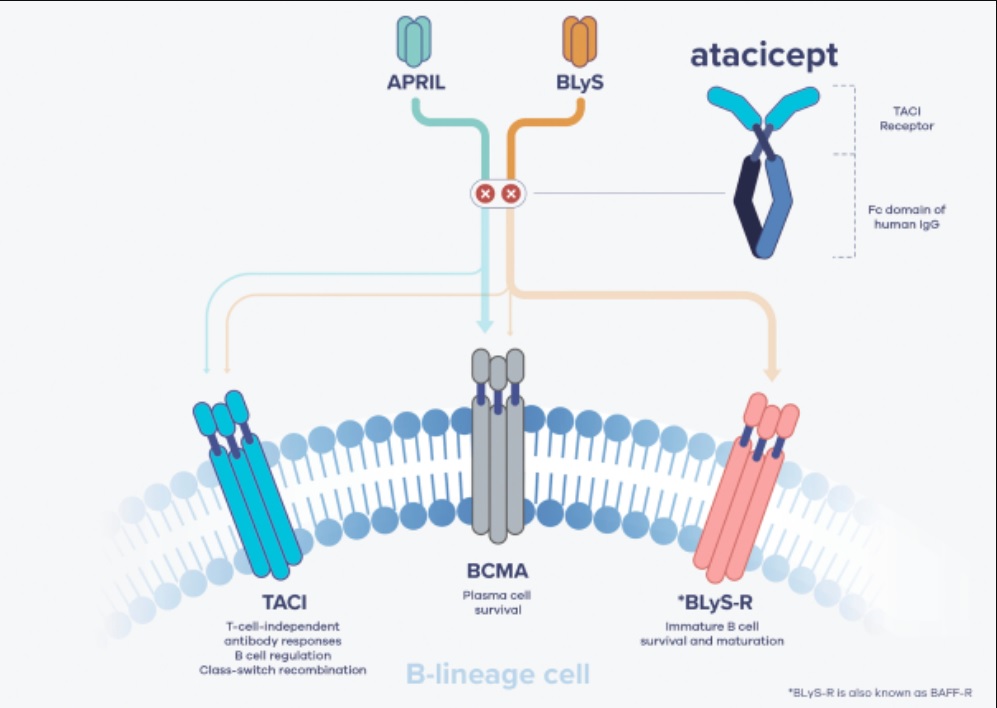

In the Series C funding announcement, Vera also announced its new lead program, a drug candidate called atacicept. The compound is a fusion protein that blocks two targets: B lymphocyte stimulator (BLyS) and a proliferation-inducing ligand (APRIL). The company is developing the drug as a treatment for a kidney disease called IgA nephropathy (IgAN). Also known as Berger’s disease, the disorder is characterized by a buildup of an antibody called immunoglobulin A (IgA), which leads to inflammation and kidney damage. There are no FDA-approved treatments for IgAN.

Atacicept is not the product of Vera research. The drug was initially discovered by Seattle biotech Zymogenetics, which developed it in autoimmune diseases and cancer under a collaboration with a subsidiary of Merck Serono. Merck Serono acquired exclusive rights to the compound in 2008 and went on to test the drug in more than 1,500 patients as a potential treatment for several autoimmune diseases. One of those diseases was IgAN.

In a small Phase 2a study (16 patients) described in the Vera IPO filing, the once-weekly subcutaneous injection reduced immunogenic galactose-deficient IgA1 (Gd-IgA-1), a protein that is associated with a higher risk of kidney damage when levels are elevated. Vera aims to pick up where Merck Serono left off. The company licensed atacicept’s rights last October, according to the filing. Vera now aims to advance the drug to a Phase 2b clinical trial. The company plans to start that study later this quarter, with preliminary results expected in the fourth quarter of next year.

“We believe atacicept has the potential to be the first disease modifying therapy for IgAN,” Vera said in the filing. “We believe the large and established clinical data set for atacicept provides a competitive advantage for us versus other emerging therapies in development, many of which are either earlier in development and have clinical profiles that are not as well characterized or are characterized by the well-known acute and chronic side effects of corticosteroids that limit their medical use.”

Vera is hardly alone in the chase to develop an IgAN drug. Chinook Therapeutics has two IgAN candidates that each take a different approach to the disease. The Seattle biotech’s most advanced IgAN drug candidate is in Phase 3 testing. Sweden-based Calliditas Therapeutics is evaluating Nefecon, its oral formulation of the anti-inflammatory drug budesonide, as a treatment for the rare disease. The Calliditas drug is in Phase 3 testing.

Novartis IgAN drug candidate iptacopan has met the goals of a Phase 2 test and the pharma giant is preparing to advance it to Phase 3. Bardoxalone, the lead drug candidate for Reata Pharmaceuticals, is currently under FDA review for chronic kidney disease caused by Alport syndrome. The company is also testing that drug in a Phase 2 study in IgAN. Vera notes in its prospectus that AstraZeneca and Boehringer Ingelheim each have drugs in late-stage testing that could be approved for chronic kidney disease and used as treatments for IgAN.

Since Vera formed, the company has raised $141.6 million, the company said in the IPO filing. The company’s largest shareholders are Abingworth, Fidelity, Longitude Venture Partners, and Sofinnova Venture partners, each holding 10.6% of the biotech after the IPO, according to the prospectus. GV and Kleiner Perkins, which invested in the company when it was Trucode, continue to hold stakes, owning 6.5% and 4.6% following the IPO, the filing shows.

With the IPO cash, Vera plans to spend between $30 million and $35 million to complete Phase 2b tests of atacicept in IgAN. That study will test three doses of the drug. In addition to measuring for reduction of Gd-IgA-1, the main goals will be to measure for elevated protein levels in the urine as well as estimated glomerular filtration rate, which is a measure of kidney function. Another $15 million to $20 million is planned for starting a Phase 2b or Phase 3 study for atacicept in patients with lupus nephritis. The rest of the IPO proceeds will be used for R&D, including development of atacicept in other indications.

Image from Vera Therapeutics prospectus