The list of authorized Covid-19 medications includes a lot of drugs that are injected or infused, formulations that aren’t ideal for outpatient use. Pardes Biosciences is developing an antiviral drug in pill form. The company is still in the preclinical stage of development, but the startup’s approach and its veteran leadership have drawn the interest of a blank check company, which has reached a merger deal that takes Pardes public and infuses it with $276 million.

Pardes is merging with FS Development Corp. II, a special purpose acquisition company (SPAC) sponsored by Foresite Capital, the companies announced Tuesday. When the deal closes, the combined entity will keep the Pardes Biosciences name. The new company also expects to have a new Nasdaq stock symbol: “PRDS.”

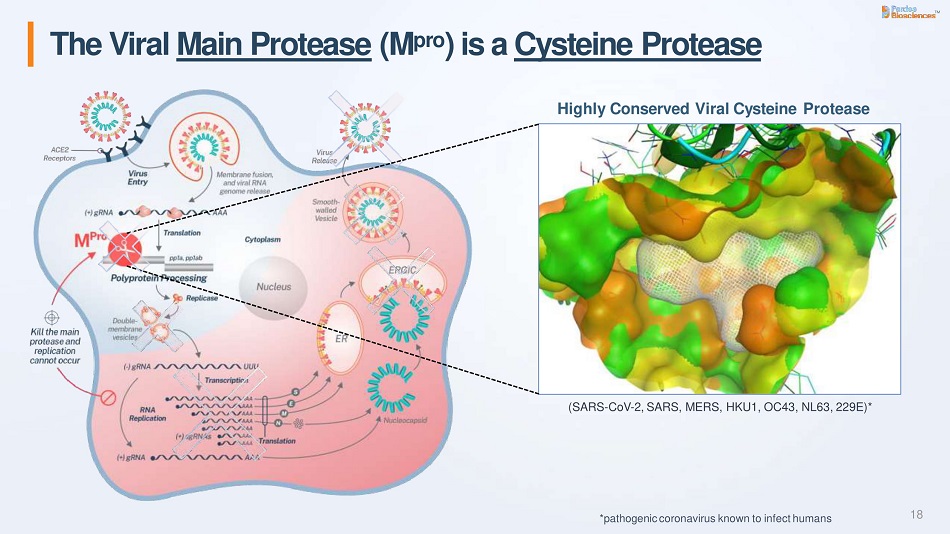

The lead drug candidate of Carlsbad, California-based Pardes is PBI-0451, a protease inhibitor. This class of drugs block proteases, enzymes that are key to viral replication. Protease inhibitors have already reached the market for treating HIV and hepatitis C. Pardes developed its drug to target SARS-CoV-2 main protease (Mpro), an enzyme that the novel coronavirus requires early in its life cycle. This enzyme is a good target because it isn’t found in humans, so blocking it is less likely to cause adverse effects.

This protease is also “highly conserved,” which means it doesn’t change much even as the novel coronavirus mutates. That means PBI0451’s targeting of Mpro should continue to be effective against current variants and new ones that emerge. Furthermore, Mpro is required for every known coronavirus, giving the Pardes drug the potential to treat coronavirus infections beyond Covid-19.

Pardes isn’t the only company developing a protease inhibitor for Covid-19. Pfizer has reached Phase 1 testing for its oral antiviral drug, PF-07321332. That drug targets a protease called SARS-CoV-2 3CL. In addition to Covid-19, Pfizer has said its drug candidate has shown activity against other coronaviruses in lab tests, suggesting that it too could become a tool to address future coronavirus threats.

A Deep-dive Into Specialty Pharma

A specialty drug is a class of prescription medications used to treat complex, chronic or rare medical conditions. Although this classification was originally intended to define the treatment of rare, also termed “orphan” diseases, affecting fewer than 200,000 people in the US, more recently, specialty drugs have emerged as the cornerstone of treatment for chronic and complex diseases such as cancer, autoimmune conditions, diabetes, hepatitis C, and HIV/AIDS.

Pardes is led by CEO Uri Lopatin, whose experience includes leading the hepatitis B virus programs at Gilead Sciences and Roche. He was also a founder and chief medical officer of Assembly Pharmaceuticals, which later became Assembly Biosciences. Lopatin was not available for comment. Chief Scientific Officer Lee Arnold is another Assembly Biosciences alum; Chief Development Officer Brian Kearney is a 21-year veteran of Gilead Sciences.

Until Tuesday, Pardes kept a fairly low profile. The startup launched in February 2020, according to an investor presentation. Ten months later, the company nominated PBI-0451 as its Covid-19 drug candidate. In February of this year, Pardes quietly raised a $52 million Series A round of financing. The company is currently doing the preclinical research to support the filing of an investigational new drug application. Pardes said in the presentation that clinical studies are expected to begin in the first quarter of next year evaluating PBI-0451 as a treatment for Covid-19. Concurrently, the company plans a separate Phase 3 study testing the drug in Covid-19 prevention.

Pardes isn’t a one-drug biotech. The company’s pipeline includes a second-generation coronavirus drug that is currently preclinical, the presentation shows. Pardes is developing drugs to treat other, non-coronavirus infections. The company also has undisclosed programs for inflammation and oncology in the discovery stage.

The SPAC merger will bring Pardes $201.2 million, the cash balance in FS Development Corp. II’s account. In conjunction with the merger, a group of investors have agreed to purchase shares in the company valued at $75 million. Those investors include Foresite Capital, RA Capital Management, Frazier Life Sciences, funds and accounts advised by T. Rowe Price Associates, GMF Capital LLC, EcoR1 Capital, Monashee Investment Management LLC, and Gilead Sciences.

Foresite Capital has been spreading its Covid-19 therapy bets. The firm is also an investor in Adagio Therapeutics, a Waltham, Massachusetts-based company developing antibody drugs for treating and preventing infection from SARS-CoV-2 and its variants, as well as other coronaviruses.

Pardes’s current cash balance is $42.2 million, so the deal will leave the company with $318.4 million total. The transaction is expected to close in the third quarter of this year.

Image from Pardes Biosciences investor presentation