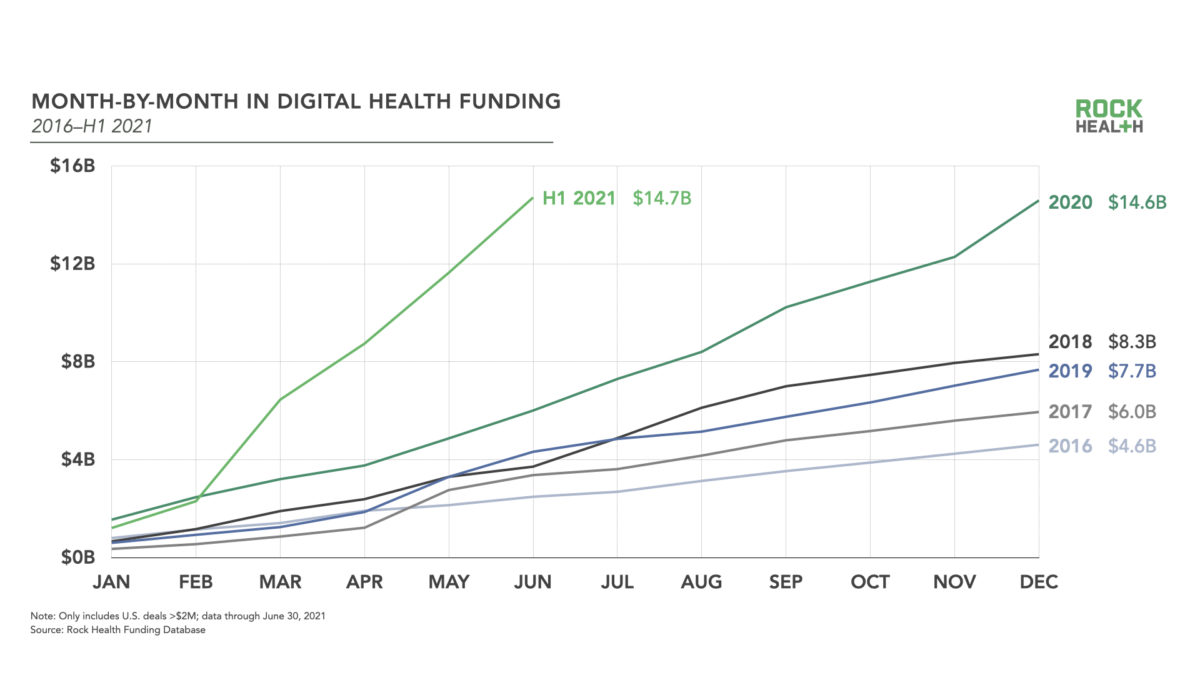

In a familiar refrain, digital health companies continue to break funding records, raising a total of $14.7 billion in the first half of 2021.

Since the start of the Covid-19 pandemic, more investors have turned their attention to digital health companies. So far, the trend doesn’t seem to be letting up.

In the first half of the year, companies raised a total of $14.7 billion across 372 deals, according to a report released today by Rock Health. By comparison, they raised $14.6 billion in 2020 — a record for the time — and just $7.7 billion in 2019.

Digital health companies broke funding records again in the first half of 2021, according to a report by Rock Health.

Large funding rounds, led by private equity firms and growth funds, fueled the record-breaking numbers, accounting for more than half of the total. Tiger Global Capital has not been shy about its plans to invest in digital heath, and led 14 funding rounds so far this year, including big investments in billing platform Cedar and digital physical therapy startup Hinge Health.

Some of the biggest funding rounds so far this year include:

A Deep-dive Into Specialty Pharma

A specialty drug is a class of prescription medications used to treat complex, chronic or rare medical conditions. Although this classification was originally intended to define the treatment of rare, also termed “orphan” diseases, affecting fewer than 200,000 people in the US, more recently, specialty drugs have emerged as the cornerstone of treatment for chronic and complex diseases such as cancer, autoimmune conditions, diabetes, hepatitis C, and HIV/AIDS.

- Diet app Noom, which raised $540 million in May

- Direct-to-consumer startup Ro, which raised $500 million in March

- Drug discovery startup Insitro, which raised $400 million in March

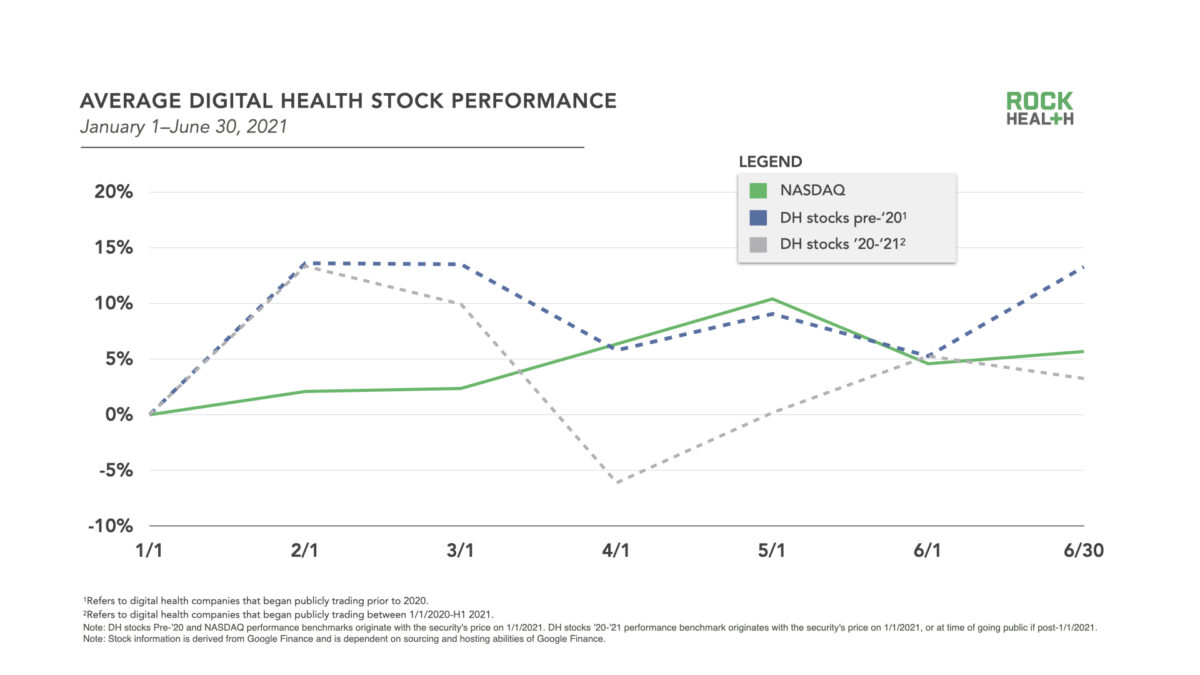

More companies plan big exits, but returns decline

While more companies continued to line up for big exits, the picture looks a little bit different than it did earlier this year. A total of 11 companies have gone public so far this year, and another 11 are lined up to go public through mergers with special-purpose acquisition companies (SPACs). But digital health companies that recently went public haven’t performed as well recently as their predecessors.

Of the 18 digital health companies that went public on the New York Stock Exchange and the Nasdaq since the beginning of 2020, their average stock returns fell below Nasdaq levels in the second quarter, according to the report. Meanwhile, those that went public before the pandemic generally performed on-par or better than the Nasdaq average.

Digital health companies that went public in 2020 or 2021 performed worse than the Nasdaq average in recent months, according to Rock Health.

It’s also possible that the enthusiasm for SPACs will wane, given a more scrutiny from regulators, and a waning number of targets to take public. By Rock Health’s count, there are 39 SPACs actively searching for healthcare targets and 47 highly capitalized digital health startups, meaning “sharp elbows are likely to emerge” as they compete for companies’ attention.

Photo credit: aurielaki, Getty Images