Healthcare providers develop scorecards and churn out voluminous reporting on accounts receivable (AR), but too often fail to provide actionable conclusions. Such omission produces strong headwinds against implementing performance improvement and can stall efforts to reduce aged balances.

To help revenue cycle leaders shortcut reporting efforts and ultimately collect more dollars, the following are five questions they should ask about their AR worklists to identify opportunities for performance improvement.

With the Rise of AI, What IP Disputes in Healthcare Are Likely to Emerge?

Munck Wilson Mandala Partner Greg Howison shared his perspective on some of the legal ramifications around AI, IP, connected devices and the data they generate, in response to emailed questions.

1. Do my worklists accurately reflect the risk on my accounts?

Worklists typically use age, balance, payer, and sometimes denial status to prioritize work. In the most simplistic approaches, the highest dollar claims are worked first, often resulting in multiple touches on newly billed claims and too little effort spent on other balances.

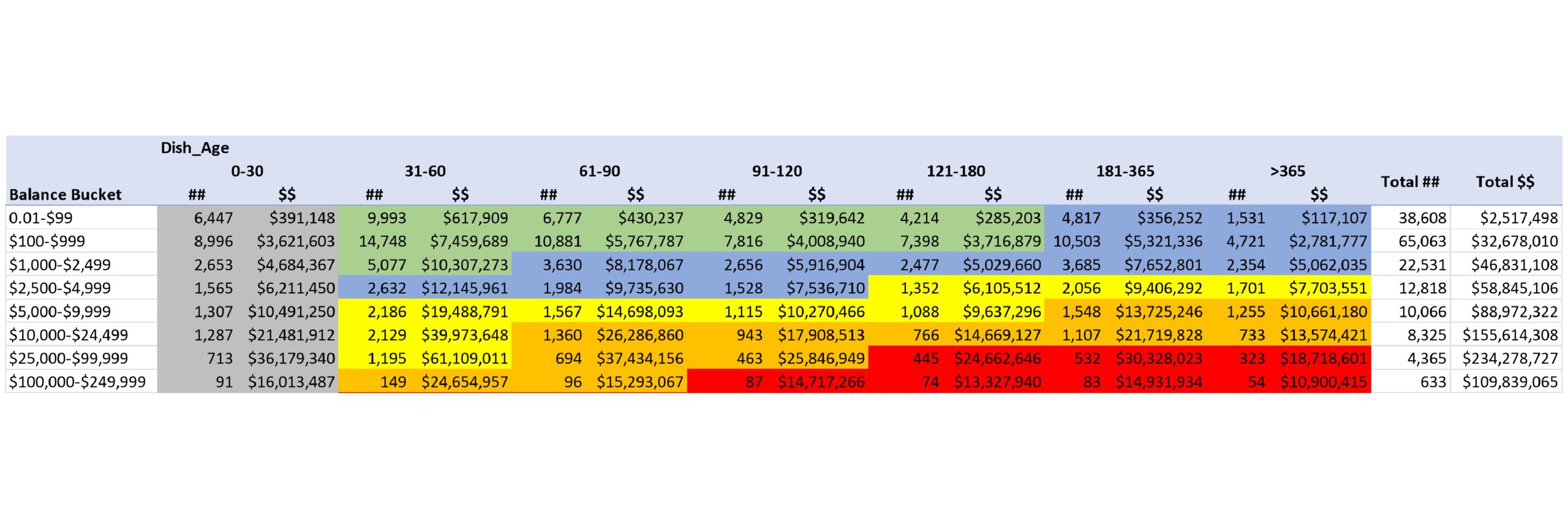

A desirable, risk-based approach segregates claims into risk buckets, incorporating both age and balance in prioritization. The highest and oldest claims are prioritized first, with a gradual reduction in priority as both age and balance decline. The result should look something like this [Click image to enlarge]:

Just 2% of the volume covers 38% of the balances, and just 24% of the volume covers fully 91% of the balances.

2. How frequently are my difficult claims presented to AR staff to be worked?

In choosing which claim to work next, staff tend to de-prioritize complex claims, which often also have high balances. A simple claim that is easy to collect may be chosen over a complex claim that requires more effort. Difficult claims can get ignored in favor of simple ones that can boost productivity measures but may not substantially improve financial outcomes. We recently worked with a health system with $27 million in balances that had not been touched in 60 days or more! The right work queue tool will provide reporting on timing and frequency of touches, but management should also be measuring outcomes and rewarding those who collect more. A combination of technology and oversight will ensure that older, high-dollar claims are regularly worked, which leads to healthier AR.

3. Is my staff touching claims aged less than 30 days?

The ability to identify when claims are touched also helps determine when claims are being worked that should not be. Barring a fundamental failure in the billing process, the risk of a single large claim not being received is less than the risk of smaller claims timing out. Medicare claims probably do not warrant attention until they are at least 21 days past billing, 30-45 days for most commercial claims. Any staff time spent checking claims before those time limits is likely wasted.

4. Do my work queues include any black holes?

The only thing worse than working a claim too soon is not working it at all. When an AR system user leaves the organization or changes responsibility, most of their worklists may be reassigned, but if one (or more) is missed, small slices of AR can remain unworked. Those claims are active and need attention, but never get presented to a user. Left unworked, they eventually time out.

The most effective work flow tools provide reporting on claims that are not assigned to any list, but a regular manual reconciliation between worklists and a detailed aged trial balance can provide proof positive that no accounts are languishing.

5. Which claims get touched most often?

The optimal case is to have a claim paid without intervention, but if an appeal is denied by the payer, the number of touches can rise quickly. For complex claims, staff may require 20 or more touches to resolve the claim.

When a single user has worked a claim unsuccessfully multiple times, a high number of touches could indicate a problem. Either the staff member is not doing a good job working the claim or perhaps they simply don’t know what to do.

Any claim with more than five follow-up touches is a candidate for further review and anything over 10 deserves management attention. A good workflow tool will provide reporting and insight on these populations, which enables a formal process of reviewing claims over a certain number of touches can identify training needs.

While these inquiries do not take the place of robust and regular dashboards or other reporting mechanisms, asking these questions helps identify pockets of AR that are not resolving appropriately. By understanding those deficiencies and taking action to solve them, you can collect more dollars, reduce aged balances and enjoy a healthier AR.

Photo: ipopba, Getty Images

Peter Angerhofer is a principal at Tegria, the healthcare technology and services company founded by Providence. Peter started his career in health policy but has spent more than 20 years in revenue cycle performance improvement. He has worked with a variety of hospital and physician clients, including prominent academic medical centers and local community hospitals, to deliver measurable financial improvements through operational changes.