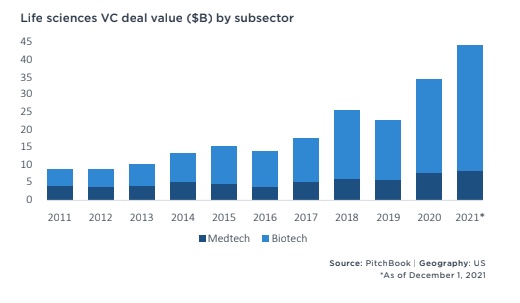

From groundbreaking human genome engineering to humanized antibodies used in cancer immunotherapy to wearables for continuous glucose monitoring, the life sciences exploded in the last two decades. Since 2018 alone, VC investors pumped at least $20 billion into life science companies yearly, according to a new report from PitchBook Data. That number rose to $44 billion in 2021, the report said. Venture-backed companies and startups, rather than large-cap multinational companies, spearheaded much of that innovation.

Several developments contributed to the growth of the field. For one, congress passed the 21st Century Cures Act in late 2016, authorizing $6.3 billion to speed up medical product development. More generally, advances in both the field’s understanding of the mechanism behind diseases coupled with digital advancements both expanded opportunities for novel drugs and devices to treat diseases.

With this boom, a notable shift occurred in recent years between the two industries within the life sciences: biotech and medtech. The latter comprises of companies producing medical devices for disease treatment, such as neuro cochlear implants or cervical artificial discs. The former pumps out biological drugs, the likes of gene therapies and antibody treatments, to treat diseases. Over the last few years, biotech in particular boomed, bumping medtech to the minority of the industry. Of the 4,448 VC-backed life science companies based in the United States, only 1,785 are medtech companies and 2,303 are biotech companies, according to the report from PitchBook Data. A mere 360 bridge both groups, dual-tagged as both.

The medtech funding by company breaks down as follows: 232 secured seed financing, 517 nabbed an early-stage VC financing round, and 620 raised a late stage VC financing round in 2021, the report said.

Comparatively, 310 biotechs gained seed financing, 919 got early-stage VC financing, and 617 landed late-stage VC financing the same year.

A Deep-dive Into Specialty Pharma

A specialty drug is a class of prescription medications used to treat complex, chronic or rare medical conditions. Although this classification was originally intended to define the treatment of rare, also termed “orphan” diseases, affecting fewer than 200,000 people in the US, more recently, specialty drugs have emerged as the cornerstone of treatment for chronic and complex diseases such as cancer, autoimmune conditions, diabetes, hepatitis C, and HIV/AIDS.

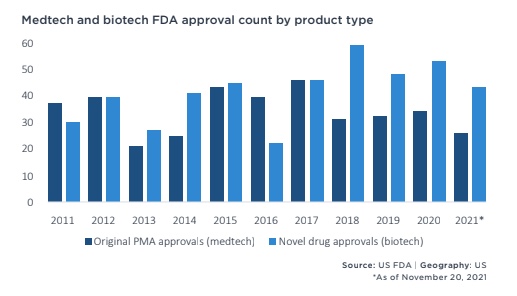

These biotech companies secured $35.8 billion – 80.7% – of the total $44.4 billion in life sciences VC funding, according to the PitchBook Data report. In fact, 2021 marked the largest percentage for that subsector to date. For example, in 2020 biotechs snagged $26.7 billion, a record at the time. By comparison, in 2020 medtechs raised $7.9 billion, a high record for them. From 2020 to 2021, funding for the field boomed in both subsectors.

Contributing to part of the shift, biotechs have a higher burn rate for their capital due largely to the process for drug discovery and development compared to that for medical devices. The deal size in each subsector reflects as much, with biotech boasting deals often double that of medtech. For perspective, in 2021 biotech had a median deal of $10 million and an average deal of $36.9 million, according to the report by PitchBook Data. Comparatively, medtech locked in an median of $3.9 million and $12.6 million average.

Valuing these privately backed startups proves challenging as they often have yet to generate revenue. Nonetheless, historically biotech startups land higher valuations than their medtech counterparts. In 2021, biotech valuation averages reached $145.3 million in VC pre-money valuations with $49.8 million median valuation, the report said. Medtech respectively earned $88.7 million and $22.5 million for their median and average valuations.

To determine value creation, investors utilize: velocity of value creation (VVC), determined by the dollar rise in valuation between from round to round; and relative velocity of value creation (RVVC), the percent rise in valuation from round to round. These show the growth rate of a startup’s valuation. For over 10 years, biotech consistently dominates medtech by both metrics. In 2021, biotech valuations clocked $24.1 million for VVC and 49.3% for RVVC while medtech financing only reached $5.7 million and 25.9%.

Between 2010 and 2015, investors equally funded biotech and medtech. However, in 2016 they shifted to predominately funding biotechs, a shift due both to heightened demand for therapeutics coupled with need for additional investors to syndicate for biotech’s increased capital investment needs.

However, in regards to patents, medtechs surpass biotechs. For example, in 2020 medtech companies earned 3,490 patents and biotech companies received 2,742. Of note, those numbers marked a record high in both subsectors.

Of note, valuations and funding are not the sole means of innovation. When considering the field of medtech holistically, they continue to bring value to public health by taking on formidable diseases, from cancer to sepsis. As such, medtech continues to offer valuable contributions, despite it holding a minority of the field. However, despite medtech companies producing products that impact health outcomes, there is a push from companies in that subsector to market their products, such as Apple Watch, not as medical devices to avoid resulting FDA regulations. The regulations may change in the near future.

In the end, both biotech and medtech offer profitable investment options and each comes with risks. Investors will have to decide which are worth taking.

Photo: gorodenkoff, , Getty Images; and PitchBook Data