Bristol Myers Squibb is acquiring Turning Point Therapeutics in a $4.1 billion deal that brings a lung cancer drug candidate that could rival products now on the market from Pfizer and Roche.

The Turning Point drug, repotrectinib, is in Phase 2 testing for non-small cell lung cancer (NSCLC). The deal announced Friday comes nearly two months after the report of preliminary Phase 2 clinical data that the biotech said could make the drug the best in its class for treating cancer characterized by a particular genetic mutation. With the encouraging data, the biotech said it expected to start discussions with the FDA about a potential new drug application.

BMS is already penciling in a regulatory approval for repotrectinib, projecting an FDA decision in the second half of next year. Based on its expectations for the drug, BMS agreed to pay $76 cash for each share of Turning Point, a 122% premium to the stock’s $34.16 closing price on Thursday. But that price is still below the stock’s peak in early 2021, when it topped $133 per share. When Turning Point went public in 2019, it priced its shares at $18 apiece.

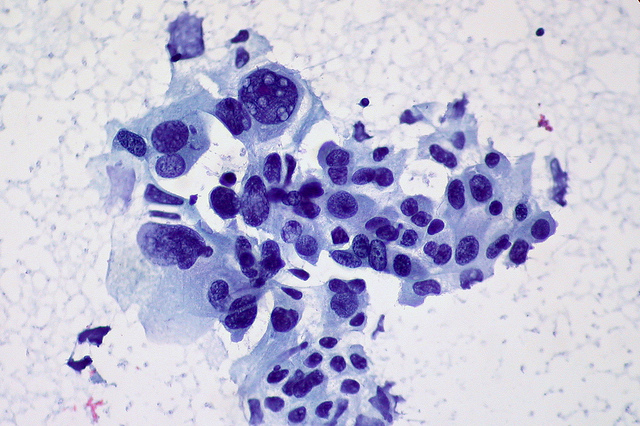

San Diego-based Turning Point develops therapies that address genetic drivers of cancer. Its small molecules are tyrosine kinase inhibitors, a type of drug that blocks enzymes that play key roles in various cellular functions. In cancer, overactivity of these enzymes helps tumors grow. This overactivation can stem from the fusion of one gene to another. Repotrectinib is designed to address two such genetic signatures: the fusion of the ROS1 gene with another gene in NSCLC, as well as NTRK fusions in solid tumors. Turning Point will bring other drugs to BMS. The biotech’s pipeline includes therapeutic candidates in earlier stages of development addressing other genetic signatures.

Pfizer’s Xalkori and Roche drug Rozlytrek have FDA approvals for treating ROS1-positive NSCLC that has spread. Meanwhile, Rozlytrek and Bayer drug Viktrakvi have accelerated FDA approvals for treating patients with metastatic solid tumors stemming from an NTRK gene fusion that does not have a known acquired resistant mutation. Mutations can make cancers drug resistant, which is a known problem with tyrosine kinase inhibitors. This drug class can also lead to toxic effects that limit how long a patient can be on the therapy. Xalkori’s side effects include vision disorders, nausea, diarrhea, vomiting, and dizziness. Adverse effects reported with the Roche drug include fatigue, constipation, dizziness, swelling, and muscle aches and pains. In cases where the cancer has spread to the brain, Pfizer’s drug has demonstrated limited activity in the central nervous system. With repotrectinib, Turning Point aims to offer advantages on all of those fronts.

A Deep-dive Into Specialty Pharma

A specialty drug is a class of prescription medications used to treat complex, chronic or rare medical conditions. Although this classification was originally intended to define the treatment of rare, also termed “orphan” diseases, affecting fewer than 200,000 people in the US, more recently, specialty drugs have emerged as the cornerstone of treatment for chronic and complex diseases such as cancer, autoimmune conditions, diabetes, hepatitis C, and HIV/AIDS.

In April, Turning Point reported a pooled analysis of Phase 1 and Phase 2 data showing that in 79 patients, the confirmed overall response rate was 79%. Four of those responders achieved a complete response while 52 achieves a partial response. The duration of responses ranged from 1.4 to 35.1 months. BMS said in the acquisition announcement that the duration of response observed in the study is longer that what currently available ROS1 drugs can achieve as first-line NSCLC treatments. But when these preliminary results were released, Turning Point said the data were not mature enough to report a median duration of response. On assessments of safety, Turning Point said its drug was well tolerated by patients. The most commonly reported adverse event was dizziness. The company said it expects to present more details at a medical conference in the second half of this year, but BMS has already seen enough to convince it to make the purchase.

“With repotrectinib, we have the opportunity to change the standard of care and address a significant unmet medical need for ROS1-positive non-small cell lung cancer patients,” Samit Hirawat, BMS’s chief medical officer said in a prepared statement.

In a note sent to investors Friday, William Blair analyst Matt Phipps wrote that the price for Turning Point is high, “given that recently approved therapies in these indications have not achieved meaningful commercial success to date.” But Phipps added that BMS believes the acquisition will start contributing to earnings in 2025—key timing as the company looks for additional revenue growth to offset patent expirations on products such as Revlimid, Pomalyst, and Abraxane.

“Therefore, while the deal is probably expensive on the basis of peak sales multiple on the lead asset, we are overall encouraged to see management continue to use the current strong free cash flow to acquire late-stage assets that will provide revenue in the 2025 to 2030 time frame, with potential upside from earlier-stage assets,” Phipps said.

The acquisition, which already has approvals from the boards of directors of both companies, is expected to close in the third quarter of this year.

Image by Flickr user Ed Uthman via a Creative Commons license