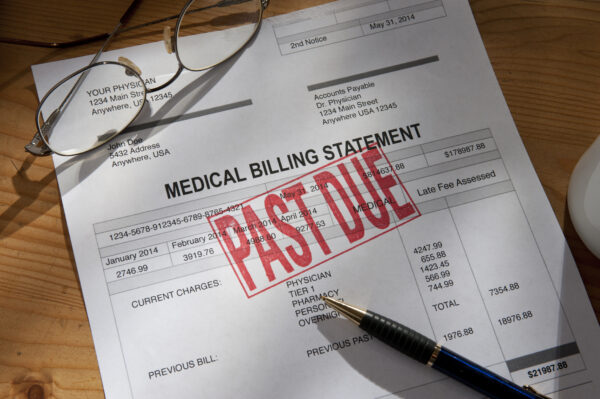

People continue to get “surprise medical bills” for unknowingly being treated by providers outside of their health insurance network even after Congress passed a law banning this.

On Friday, the Department of Labor, Department of the Treasury and Department of Health and Human Services took a step that is expected to prevent consumers from receiving them at all. It issued final rules concerning standards related to the arbitration process between providers and payers that is key to implementing the No Surprises Act.

“The final rules will make certain medical claims payment processes more transparent for providers and clarify the process for providers and health insurance companies to resolve their disputes,” the U.S. Department of Labor said in a news release.

These rules apply to group health plans and health insurance issuers offering group or individual health insurance coverage.

“The increased transparency required under these final rules will help providers, facilities and air ambulance providers engage in more meaningful open negotiations with plans and issuers and will help inform the offers they submit to certified independent entities to resolve claim disputes,” the DOL said.

The finalized rules are an updated version of interim rules issued in July and October 2021. They take into account relevant provisions from federal court decisions in challenges from the Texas Medical Association (TMA) and from air ambulance provider LifeNet Inc. In both cases, judges ruled that parts of the arbitration process outlined in the earlier surprise billing rules violated the Administrative Procedure Act which requires a public comment period when the government issues new rulings.

What Are Healthcare Organizations Getting Wrong about Email Security?

A new report by Paubox calls for healthcare IT leaders to dispose of outdated assumptions about email security and address the challenges of evolving cybersecurity threats.

In response to a MedCity News inquiry about the recent finalized rules, the TMA said, “We are reviewing the rule and considering next steps.”

The government finalized the arbitration process known as the Independent Dispute Resolution process, or the federal IDR process, to determine the total payment amount for out-of-network healthcare services for which the act prohibits surprise billing. The final rules also include guidance for certified IDR entities on how to make payment determinations and instructs these entities that they must provide additional information and rationale in their written decisions.

For example, if an insurer “downcodes,” or changes a billing code that would lessen how much a provider gets paid for a service, then the insurer must issue a statement showing that the billing code was changed and explain the rationale for the change.

In November, the departments issued interim rules related to prescription drugs and healthcare spending. The rules require group health plans and issuers to submit information about the most dispensed and costliest drugs and information about premiums, including the average monthly premiums paid by employers and employees.

According to the Centers for Medicare and Medicaid Services, “together, these lay the groundwork to provide consumers with protection against surprise billing.”

Photo: KLH49, Getty Images