MorphoSys, a company whose research has yielded programs placed with big pharmaceutical companies and upstart biotechs, is stopping all preclinical work to focus on cancer, particularly a late-stage drug candidate it acquired in a $1.7 billion deal.

In its announcement of the retrenchment Thursday, MorphoSys said data from its preclinical programs are promising, but they need substantial investment to bring them to human testing. Exiting preclinical research will lead to a 17% cut in the company’s workforce. At the end of the third quarter of last year, Planegg, Germany-based MorphoSys reported its headcount was 627.

Behavioral Health, Interoperability and eConsent: Meeting the Demands of CMS Final Rule Compliance

In a webinar on April 16 at 1pm ET, Aneesh Chopra will moderate a discussion with executives from DocuSign, Velatura, and behavioral health providers on eConsent, health information exchange and compliance with the CMS Final Rule on interoperability.

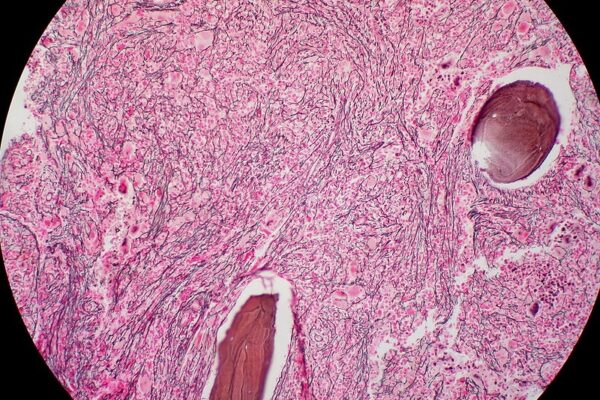

The spotlight now turns to pelabresib, a potential treatment for the bone marrow cancer myelofibrosis. This cancer can lead to severe anemia and an enlarged spleen. Pelabresib, which is in Phase 3 testing, joined the MorphoSys pipeline as part of the $1.7 billion acquisition of Cambridge, Massachusetts-based Constellation Pharmaceuticals in 2021. Constellation’s approach to cancer is based in epigenetics—turning on or off genes that play a role in disease. Pelabresib is a small molecule designed to block the function of bromodomain and extra-terminal domain (BET) proteins, which is intended to reduce the expression of abnormally expressed genes in cancer.

The Constellation acquisition also brought MorphoSys programs in earlier stages of research. But nearly a year ago, MorphoSys announced it would cut Constellation’s drug discovery research. Work related to Constellation’s clinical-stage cancer drugs was moved to Germany.

“Over the past year, we right-sized our cost structure and focused our resources on our core strategic priorities to ensure MorphoSys’s long-term success,” CEO Jean-Paul Kress said in a prepared statement. “Given the challenging market we are operating in, we need to continue to concentrate our investments on our most-advanced clinical programs that will have the greatest and most immediate impact on patients’ lives.”

The Phase 3 test of pelabresib is evaluating the drug in combination with ruxolitinib, a standard myelofibrosis treatment. Ruxolitinib, a type of drug called a JAK inhibitor, is marketed by Incyte in the U.S. and Novartis globally. MorphoSys’s placebo-controlled study is enrolling patients who have not previously been treated with JAK inhibitors. The main goal is to show a 35% or greater reduction in spleen volume.

A Deep-dive Into Specialty Pharma

A specialty drug is a class of prescription medications used to treat complex, chronic or rare medical conditions. Although this classification was originally intended to define the treatment of rare, also termed “orphan” diseases, affecting fewer than 200,000 people in the US, more recently, specialty drugs have emerged as the cornerstone of treatment for chronic and complex diseases such as cancer, autoimmune conditions, diabetes, hepatitis C, and HIV/AIDS.

Myelofibrosis, which has few approved treatments, has drawn interest from several large pharma companies. Last spring, GSK acquired Sierra Oncology and its myelofibrosis drug candidate in a $1.9 billion deal. The Sierra drug, momelotinib, is under FDA review with a June 16 target date for a regulatory decision. In November, Merck splashed out $1.35 billion to acquire Imago Biosciences and its lead drug candidate, bomedemstat, which is in mid-stage testing in myelofibrosis and another bone marrow cancer called essential thrombocythemia.

MorphoSys has said it expects its Phase 3 test of pelabresib will have preliminary data in early 2024. The company is scheduled to report its full year 2022 financial results on March 15.

Photo by Flickr user Ed Uthman via a Creative Commons license