Day One Biopharmaceuticals, now a commercial-stage company after landing FDA approval of its first drug two months ago, is building up its pipeline with a deal that gives it rights to a novel drug ready for its first test in humans. This molecule could compete with a clinical-stage drug candidate that recently joined Genmab as part of a $1.8 billion deal.

The deal announced Tuesday gives Day One rights to an antibody drug conjugate (ADC) from MabCare Therapeutics, a biotech based in Shanghai, China. Day One is paying $55 million up front for global rights to the drug candidate, which the Brisbane-California-based company has renamed DAY301.

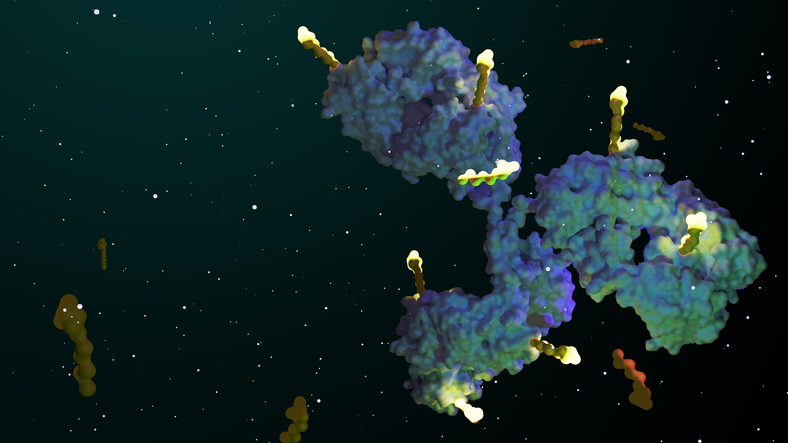

DAY301 targets protein-tyrosine kinase 7 (PTK7), a protein overexpressed on the surface of certain cancer cells and found in limited quantities in healthy tissue and organs, making it a valuable drug target. Adult cancers that carry PTK7 include esophageal, ovarian, lung, and endometrial cancers. It’s also found in pediatric cancers such as neuroblastoma, rhabdomyosarcoma, and osteosarcoma.

PTK7 has previously drawn research interest from others. AbbVie gained a contender with its 2016 acquisition of StemCentrx, though that program, in development for non-small cell lung cancer, was reportedly discontinued last year. Antibody specialist Genmab now has a PTK7-targeting ADC from its $1.8 billion acquisition of ProfoundBio, which closed in late May. While ProfoundBio’s lead program targets folate receptor alpha to treat ovarian cancer, its pipeline also includes PRO1107, a PTK7-targeting ADC currently in Phase 1/2 testing in a range of solid tumors. For Genmab, one of the key components of the ProfoundBio acquisition is the company’s platform technology, which includes linkers that enable a higher drug to antibody ratio. That means a therapy can be dosed higher within a wider therapeutic index, the dose range that balances both efficacy and safety.

MabCare’s ADCs also stem from a platform technology offering properties such as a higher drug to antibody ratio and improved stability. Preclinical research published last year in Molecule Cancer Therapeutics described how MabCare’s ADC was able to bind to PTK7 and release its drug payload, leading to tumor-killing activity across a range of solid tumors. In a prepared statement, Samuel Blackman, Day One’s head of research and development, said the company believes that the linker-payload technology in DAY301 will overcome limitations of earlier PTK7-targeted ADCs, offering the potential for a first-in-class drug against a clinically validated target. Day One expects the Phase 1 study will begin in the fourth quarter of this year or early next year.

Day One’s business model is to secure rights to drug candidates initially developed by other companies. Ojemda, approved in April for treating pediatric low-grade glioma (pLGG), was licensed from Takeda Pharmaceutical. The other drugs in the Day One pipeline are pimasertib, which is in early clinical development for MAPK-altered solid tumors, and a VRK1 inhibitor in preclinical development. The company is well capitalized to develop those drug candidates and others. FDA approval of Ojemda came with a priority review voucher. In May, Day One sold that voucher for $108 million.

“Our priorities for 2024 are to successfully launch Ojemda, to advance our existing programs and to expand our pipeline by in-licensing clinical-stage assets that have the potential to transform outcomes for patients of all ages living with cancers,” Day One CEO Jeremy Bender said in a prepared statement. “We are excited by the opportunity presented by DAY301, and we believe we have the right team in place to develop the program to its full potential.”

Under Day One’s agreement with MabCare, the California company gets global rights to DAY301, excluding Greater China, where Mabcare retains rights. Beyond the upfront payment, Day One could shell out up to $1.152 billion in development, regulatory and commercial milestone payments. MabCare is also eligible for royalties on net sales of an approved product.

Image: Getty Images