A targeted cancer therapy from Merus has early clinical trial results suggesting it can treat tumors characterized by a genetic signature that hasn’t been addressed before, and the biotech is eying ways these data could support filings seeking approval in one or more cancers. But the study is small and it’s an open question whether health authorities will view the data and the sample size as sufficient.

The Merus drug, zenocutuzumab (“zeno” for short), is in Phase 1/2 testing against several different types of solid tumors, including pancreatic cancer and non-small cell lung cancer (NSCLC), that is positive for a gene fusion called NRG1. The main goal is to measure overall response to the treatment. According to preliminary results presented during the annual meeting of the American Society of Clinical Oncology, the overall response rate was 29%.

“We believe that zeno has the potential to be the first and best in class for this new, clinically actionable target— NRG1 positive—in multiple cancer types,” CEO Bill Lundberg said during an investor call on Sunday. “Zeno can address an important unmet medical need, and there are no approved therapies that specifically target NRG1 fusions.”

NRG1 fusions are rare, but they are found in several different cancer types. When these fusions occur, they drive cancer growth through the HER3 receptor. Merus’s drug is a bispecific antibody designed to bind to NRG1 and HER3, disrupting the interaction of the two.

The Phase 1/2 study, and early access program, has enrolled 61 patients with tumors positive for NRG1. Those patients, who had previously received two earlier types of treatment, were assigned to three different groups: pancreatic cancer, non-small cell lung cancer, and other solid tumors positive for the NRG1 mutation.

A Deep-dive Into Specialty Pharma

A specialty drug is a class of prescription medications used to treat complex, chronic or rare medical conditions. Although this classification was originally intended to define the treatment of rare, also termed “orphan” diseases, affecting fewer than 200,000 people in the US, more recently, specialty drugs have emerged as the cornerstone of treatment for chronic and complex diseases such as cancer, autoimmune conditions, diabetes, hepatitis C, and HIV/AIDS.

A total of 45 patients had measurable disease that could be evaluated for a response to the treatment. The 29% overall response rate was across all tumor types at the April 13 data cutoff date. The median duration of the response was 5.5 months. In 34 of the 45 patients, or 76%, Merus reported a reduction in the size of tumors.

In pancreatic cancer, 5 of 12 patients showed a partial response to treatment, resulting in a 42% overall response rate. In NSCLC, 6 of 24 patients producing a 25% overall response rate. In all other solid tumors, 2 of 9 patients responded to the treatment for a 22% overall response rate. Across all tumor types, the drug was reported to be safe and well tolerated.

Merus is considering a tumor-agnostic indication for the drug, which means the therapy could address cancers characterized by the NRG1 genetic alteration regardless of the organ in which the tumor is found. Chief Medical Officer Andrew Joe said that tumor reduction was observed in pancreatic cancer, breast cancer, NSCLC, and cholangiocarcinoma. He added that the number of different types of tumors evaluated in the study could lead the company to either a tumor-agnostic or a tumor-specific registration—the clinical trial design may support either. For a tumor-agnostic approval, “[what] the FDA and other health authorities will be particularly interested to see is consistency, if activity can be demonstrated in multiple tumor types,” Joe said.

During the call, William Blair analyst Matthew Phipps asked what the company thought would be an appropriate trial size to support a regulatory filing for the drug. Joe responded that there are precedents for small sample sizes based on rare cancer subtypes, as well as for tumor-agnostic indications. But he acknowledged that the company would need to discuss those details with regulators.

Merus isn’t the only company developing an NRG1-targeting cancer therapy. New York-based Elevation Oncology is testing its drug, seribantumab, in solid tumors expressing the NRG1 gene fusion. The privately held company, which on Friday filed the regulatory paperwork for an IPO, designed the Phase 2 clinical trial for its drug to be a tumor-agnostic study. The company aims to enroll at least 55 patients and seek accelerated approval, pending discussions with the FDA, according to the IPO filing.

The zeno clinical trial is still enrolling patients, which Lundberg said is important to support continued evaluation of the drug’s efficacy and safety. He expects Merus will be able to provide additional clinical and regulatory updates for the zeno program at a major medical conference by the first half of next year. That update will include the company’s regulatory strategy and path to registration, he said.

In the nearer term, the zeno data provide further validation for Eli Lilly’s partnership with Merus. In January, the pharmaceutical giant paid $60 million in cash and an equity investment to begin an alliance that could develop up to three bispecific antibody drugs based on the Merus technology. Those drugs would target a protein found on T cells called CD3.

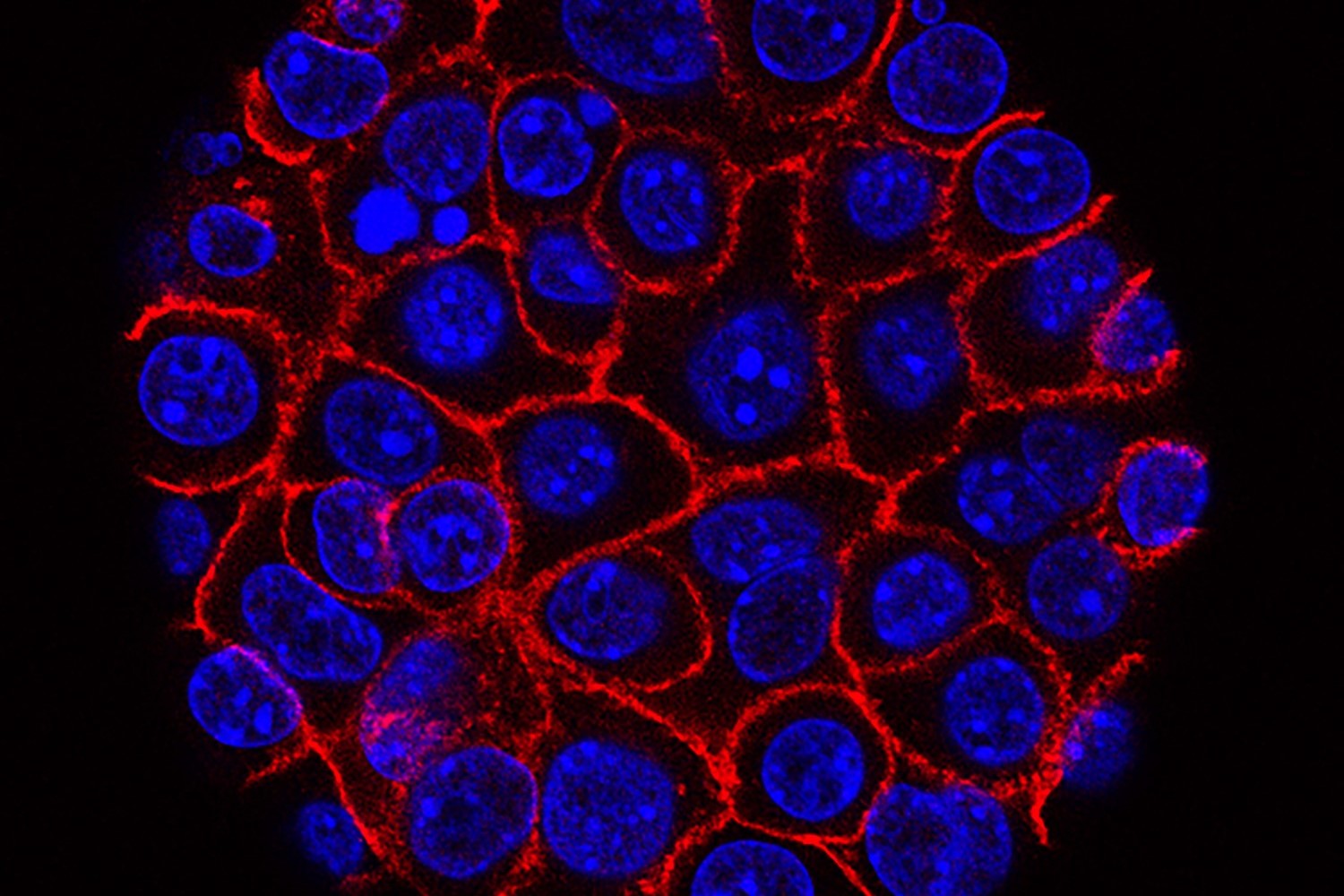

Public domain Image by the National Cancer Institute