After much talk last year about companies boosting their mental health offerings, those promises have materialized.

According to the Kaiser Family Foundation’s annual employer health benefits survey, 39% of mid- and large-sized companies reported making changes to their mental health benefits since the start of the pandemic. For the most part, those changes included letting employees access mental health services through telemedicine. Roughly 16% of companies also said they offered new mental health resources, such as an employee assistance program.

With the Rise of AI, What IP Disputes in Healthcare Are Likely to Emerge?

Munck Wilson Mandala Partner Greg Howison shared his perspective on some of the legal ramifications around AI, IP, connected devices and the data they generate, in response to emailed questions.

Employees also seem to be using those benefits. About 12% of companies with 50 or more employees reported an increase in use of mental health benefits, but the biggest company (with 1,000 or more workers) saw a 38% increase.

Mirroring broader coverage trends across the U.S., 65% of companies reported benefits changes related to telemedicine. And a little over a half also said they made changes to their wellness programs.

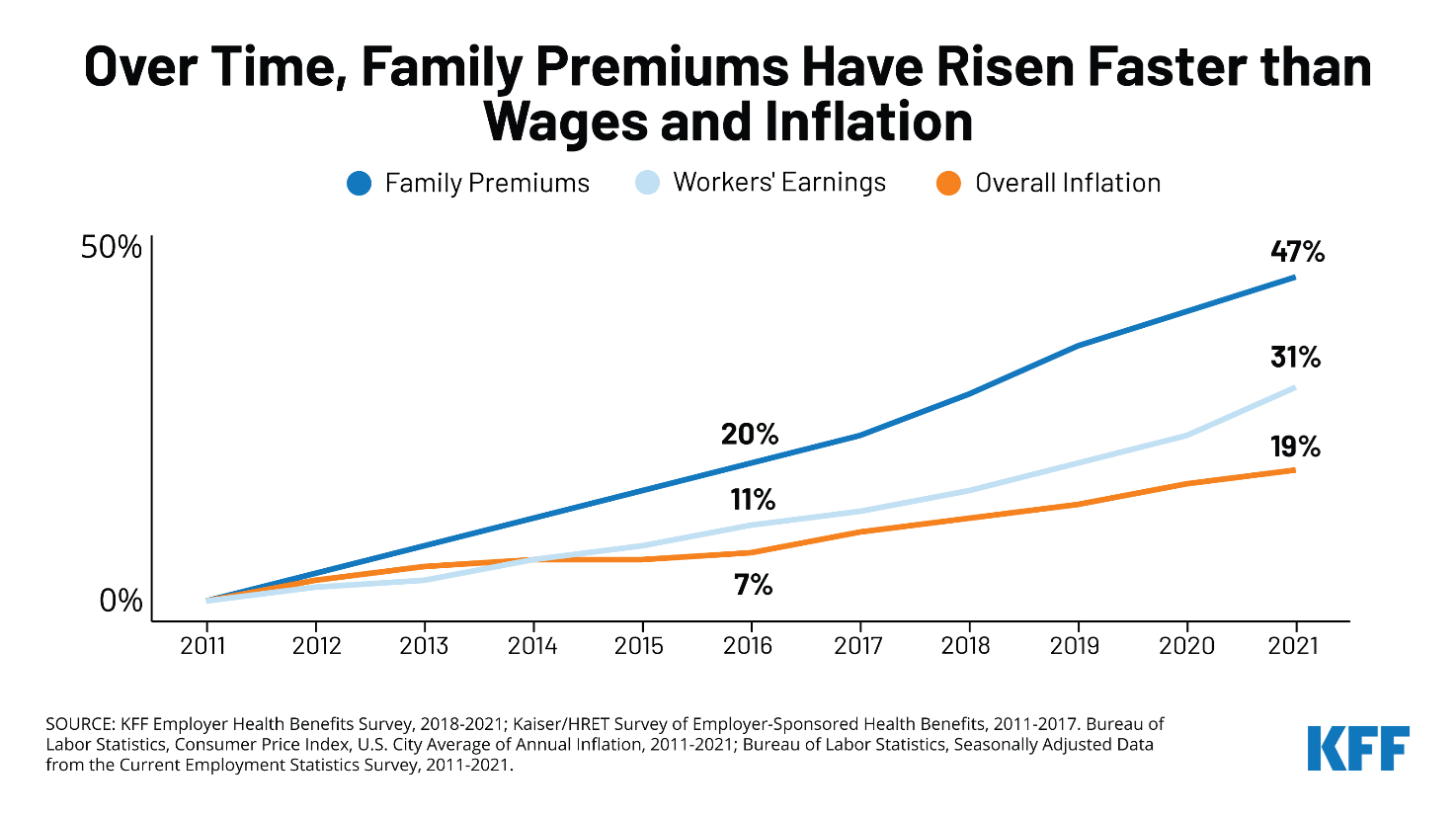

The average family premium for employer-sponsored plans has increased 47% over the last decade. Photo credit: Kaiser Family Foundation

Family premiums increase 4%

Even as healthcare utilization slowed last year, with procedures stalled as Covid-19 cases rose, premiums for the average family plan saw a modest increase of 4%. It’s about on par with what employers saw last year, going into the pandemic.

The average premium for a family plan rose past $22,000, according to the survey. On average, workers contributed $5,969 this year, with their employer covering the rest.

While the increase in premiums year-over-year is about on par with wages and inflation, looking back over the past decade, healthcare costs far exceed it. Since 2011, premiums have increased more than 47%, while wages have gone up by 31%, and inflation is up nearly 19%.

The average deductible for employees, of $1,669, also increased modestly from last year, but significantly over the last decade. More workers are also paying deductibles, with 85% of employees reporting paying one this year, compared to 74% in 2011.

The survey results were based on responses from nearly 1,700 small and large employers.

Photo credit: aurielaki, Getty Images