Autoimmune disease is active territory for drug research, and one reason why is that patients are poorly served by currently available therapies, contends Travis Murdoch, CEO of Human Immunology Biosciences. Many of these medicines bring a broad immunosuppressive approach that provides insufficient relief while introducing a range of side effects. Murdoch’s company is developing targeted alternatives. The startup identifies the cell type at the root of an autoimmune disorder, then develops drugs to either modulate those cells or eliminate them.

Human Immunology Biosciences, or HI-Bio, hinted at its strategy earlier this year when it in-licensed a MorphoSys drug that is now its most advanced program. But the South San Franciso-based company aims to show that it’s more than a one-drug company. On Tuesday it revealed $120 million in financing to support a pipeline of medicines it claims can address the root causes of autoimmune diseases.

HI-Bio was formed in early 2021, but Murdoch, a gastroenterologist, said he had been thinking about building this company since his time at the University of Calgary, where he focused on inflammatory bowel disease. The idea then was to develop drugs that take a precision approach to mediating disease that have known cellular drivers. Arch Venture Partners and Monograph Capital, where Murdoch is a partner, shared that vision, and the venture capital firms incubated the startup. HI-Bio’s internal research focused on a type of immune cell called the mast cell. But the biotech also scouted for a drug candidate that could address “a potential high value target,” Murdoch said. The company found that candidate at MorphoSys.

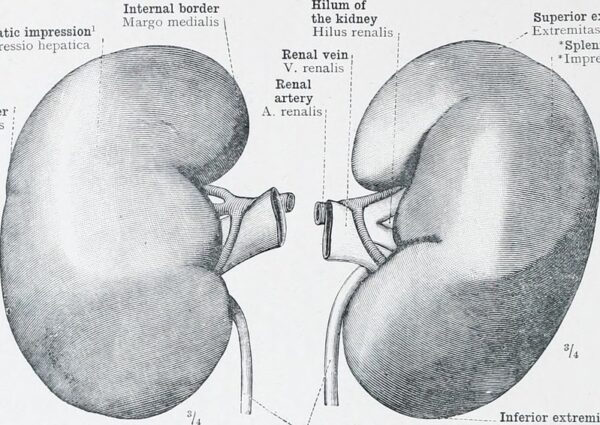

The MorphoSys drug, felzartamab, addresses plasma cells, a type of white blood cell found in bone marrow that produces antibodies key to immune response. Dysfunction of these cells is associated with multiple immune-mediated diseases. Felzartamab is designed to target CD38, a protein abundant on mature plasma cells. CD38-targeting drugs are already available. Uncontrolled growth of plasma cells leads to a type of blood cancer called multiple myeloma. Johnson & Johnson’s Darzalex and Sanofi’s Sarclisa are both antibody drugs designed to target CD38 on multiple myeloma cells. HI-Bio believes this target also holds promise for treating the kidneys.

“The link is a fascinating one,” Murdoch said. “Myeloma is a cancer of plasma cells. That marker is present on myeloma cells but it’s also present on normal plasma cells. There’s been much success in taking drugs that have been used for cancers of blood, lymphomas and the like, and applying them to autoimmune disease.”

Plasma cells are antibody factories. In some autoimmune conditions, those factories produce too much of a particular antibody. The kidney diseases HI-Bio aims to treat are immunoglobulin A (IgA) nephropathy and membranous nephropathy. MorphoSys initially developed felzartamab under a partnership with Celgene (now part of Bristol Myers Squibb). The alliance ended in 2015 with MorphoSys regaining rights to the antibody. In 2017, I-Mab licensed rights to that drug in mainland China, Hong Kong, Macao, and Taiwan. I-Mab began developing the drug for multiple myeloma and it also has regulatory clearance in China to test it in lupus. Outside of China, MorphoSys had developed the drug for autoimmune diseases. MorphoSys’s Phase 1/2a research in multiple myeloma suggested how it could work.

At the 2018 annual meeting of the American Society of Hematology, MorphoSys presented data showing preliminary efficacy against the trial’s multiple myeloma goals. The company also reported that felzartamab led to a reduction in M-protein, an abnormal protein fragment secreted by multiple myeloma cells known to have harmful effects on the kidney and immune system function. The immune system works by “memory” of sorts. When the immune system encounters an antigen it recognizes, it mounts a corresponding immune response. Antibodies produced by plasma cells are a source of this immune system memory. MorphoSys pointed to reduced tetanus antibody levels as a sign its drug had an effect on plasma cells.

“We believe that the ability of felzartamab to deplete plasma cells was indirectly demonstrated by a reduction of Tetanus Toxoid vaccination titers no later than 2 weeks after the treatment start,” MorphoSys wrote in its 2021 annual report.

In IgA nephropathy, HI-Bio needs to catch up to multiple contenders far along in development. Last December, Calliditas Therapeutics drug Tarpeyo became the first FDA approved therapy that reduces a protein associated with the kidney disorder. As a steroid, that drug offers a broad immunosuppressive effect. Vera Therapeutics’ aims to compete with mid-stage drug candidate atacicept, a fusion protein that’s designed to block two targets. Chinook Therapeutics has reached Phase 3 with atrasentan, a small molecule, and Phase 2 with BION-1301, an antibody. Novartis is vying to treat IgA nephropathy with iptacopan, a small molecule designed to block a complement system protein called factor B.

HI-Bio licensed felzartamab and another antibody, now called HIB210, for $15 million up front and a 15% equity stake in the startup. MorphoSys could earn up to $1 billion in milestone payments, plus royalties from sales if one or both of the drugs reaches the market. Potential indications for HIB210, which targets a protein on neutrophils called C5aR1, have not yet been identified. That drug candidate is in Phase 1 testing. The potential indications for the biotech’s mast cell research are undisclosed, but these cells are associated with a range of allergic and inflammatory diseases. Third Harmonic Bio’s early clinical research with a mast cell-targeting small molecule licensed from Novartis fueled a $183 million IPO in September.

Asked whether the $120 million in capital represents new money or cumulative financing, Murdoch declined to specify other than to say that Arch and Monograph are joined by Jeito Capital, unnamed institutional investors, and family offices. The cash will support the clinical development of the two lead programs as well as the ongoing discovery research in mast cells, he said.

Public domain image by Flickr user Internet Archive Book Images