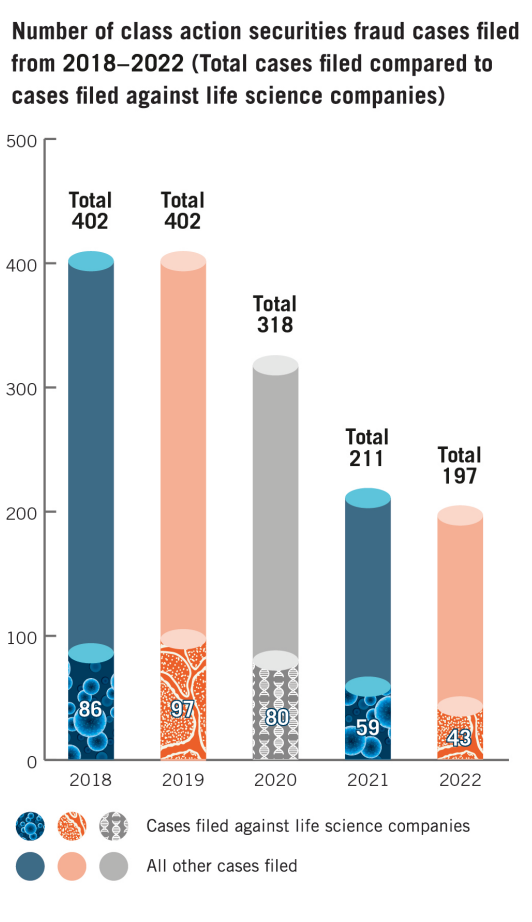

Life-sciences companies faced fewer class-action securities lawsuits last year, continuing a trend of declining litigation over the last few years, according to a report published in February by the law firm Dechert LLP.

Investors filed 43 class-action complaints against life-sciences firms in 2022, down from 59 in 2021 and 80 in 2020, according to Dechert, which produces an annual report on litigation trends for the industry. Life sciences firms represented 21.9% of total class-action securities lawsuits last year, compared to 28% in 2021.

While the numbers may be changing, the driving forces behind lawsuits remain relatively consistent.

Plaintiffs’ attorneys tend to target life-sciences firms following apparent stumbles in the regulatory approval process, for example, or when therapies do not appear to deliver as advertised.

Nearly half of last year’s lawsuits, or 21, involved alleged misrepresentation of product efficacy or safety. Seventeen included claims tied to alleged misrepresentations around FDA applications.

“These filings continue to show that negative side effects in clinical trials can create a claim for securities fraud if it appears that management is attempting to conceal or downplay these effects, or subsequently overstating the trial’s results and prospects of FDA approval,” wrote the co-authors of the report.

Eleven cases last year focused on Covid-19 products and services, including one alleging a company did not disclose plummeting demand for a Covid-19 test, according to Dechert.

In addition to industry-specific complaints, life-sciences firms confront standard-issue securities litigation honing in on alleged misrepresentations and omissions made in the context of mergers, acquisitions, IPOs and other transactions, according to Dechert. Roughly one in four lawsuits last year, or 25.6%, made such claims.

Complaints about illegal kickback schemes and other forms of financial malfeasance make up another category of class-action litigation lobbed at life-sciences firms. Such claims showed up in nine of the lawsuits filed last year.

Most cases were filed in in the Second, Third and Ninth Circuits, which cover areas where life-sciences firms are clustered. The Second Circuit, which covers Connecticut, New York and Vermont, heard 13 cases; the Third, which covers Delaware, New Jersey, Pennsylvania and the U.S. Virgin Islands, heard five; while the Ninth, which covers California and other western states, heard 10.

Dechert identified four law firms behind about three-fourths of the suits: Pomerantz LLP (18 complaints), Glancy Prongay & Murray LLP (five complaints), Bronstein Gewirtz & Grossman LLC (four complaints) and Kessler Topaz Meltzer & Check LLP (also four complaints).

The courts last year generally sided with life-sciences companies, with a majority of cases dismissed in full where they involved claims arising during or after the development phase for therapies, according to Dechert. Claims stemming from financial management were more likely to survive. Of the latter, courts dismissed five lawsuits in full, but eight survived in whole (two) or in part (six).

While litigation can be difficult to avoid, Dechert offered several recommendations designed to minimize the risks.

In particular, life-sciences companies should pay attention to the events and statements that often provide the trigger for class-action lawsuits. Bad news often sends share prices tumbling, prompting aggrieved investors to turn to the court system for compensation. Some law firms, meanwhile, actively recruit potential plaintiffs.

When it comes to regulatory setbacks, for example, companies should take care to disclose both the positive and negative results, including potentially negative information that was learned after the disclosure of preliminary results, Dechert said.

For deals, companies should ensure their disclosures contain detailed explanations about a transaction’s terms history, the potential alternatives and any fairness opinions, among other issues, Dechert said.