When Travere Therapeutics initially fell short of providing sufficient clinical data to support an application seeking accelerated drug approval in a rare kidney disorder, the FDA told the biotech last year that carrying out a Phase 3 study could support an application seeking a traditional approval. Preliminary data now available show the drug missed the main goal in that pivotal test.

The biotech acknowledges the trial failure but points to encouraging trends in the data. Management of San Diego-based Travere said Monday evening that they plan to speak with regulators to determine a path forward for the drug, sparsentan, as a treatment for focal segmental glomerulosclerosis (FSGS).

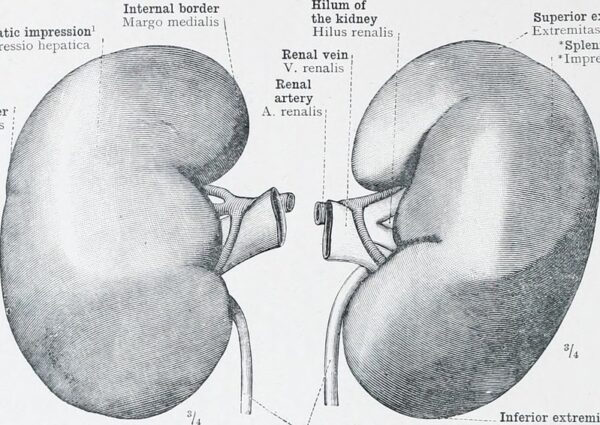

FSGS is characterized by scarring in small sections of the glomeruli, the tiny filtering units in the kidneys. The condition can progress to end-stage renal disease. There are no drugs specifically approved for FSGS, but the disorder is managed with off-label treatments such as anti-inflammatory and immunosuppressive drugs that stop the immune system from attacking glomeruli. Other treatments include blood pressure medications and diuretics.

Sparsentan is a small molecule designed to block two pathways associated with the progression of chronic kidney diseases. In February, the FDA approved the once-daily pill as a treatment for immunoglobulin A nephropathy (IgAN), where the drug carries the brand name “Filspari.” It’s projected to become a blockbuster seller in that indication. Separate clinical trials have been assessing the molecule in FSGS.

The Phase 3 test in FSGS compared sparsentan to irbesartan, a blood pressure medication used to treat the kidney disorder. The main goal was to measure the change in estimated glomerular filtration rate (eGFR) at week 108. A second main goal was to measure for changes in protein levels in urine.

Travere reported that results in the treatment arm showed improvement in eGFR, but not enough to be statistically significant compared to the active control arm. After 108 weeks of treatment, the average reduction in urine protein levels was reduced by 50% in the sparsentan arm compared to 32% in the irbesartan group. On measures of safety, the Travere drug was well tolerated and showed a safety profile comparable to irbesartan.

A Deep-dive Into Specialty Pharma

A specialty drug is a class of prescription medications used to treat complex, chronic or rare medical conditions. Although this classification was originally intended to define the treatment of rare, also termed “orphan” diseases, affecting fewer than 200,000 people in the US, more recently, specialty drugs have emerged as the cornerstone of treatment for chronic and complex diseases such as cancer, autoimmune conditions, diabetes, hepatitis C, and HIV/AIDS.

In an investor presentation, Travere said the next steps are to conduct a complete evaluation of data from the Phase 3 study. The company will also speak with the FDA about a supplemental new drug application (sNDA) submission in the U.S. Working with its partner, CSL Vifor, Travere will talk to the European Medicines Agency regarding potential conditional marketing authorization.

Speaking during a Monday evening conference call, Chief Medical Officer Jula Inrig said Travere will conduct additional subgroup analyses to better understand the results. These analyses will not be made available prior to discussion with regulators, though she said she expected that in time they will be presented at medical meetings and published in journals. Asked whether Travere expects another clinical trial would be needed, CEO Eric Dube said it’s too early to say.

“We have a lot to learn from what we would consider a landmark trial within this space,” he said. “This is the largest study ever conducted within FSGS. I think we have just started to understand what the disease, as well as what this mechanism with sparsentan can do, so I think it would be premature for us to talk about whether there’s a need to do a second study and also how we might go about that. But we definitely want to make sure we’re contributing to our understanding of FSGS, and certainly have discussions with regulators before commenting on a potential path.”

In a note sent to investors Tuesday, William Blair analyst Tim Lugo wrote that he does not see sparsentan’s clinical trial failure in FSGS reading through to the ongoing Phase 3 test of the drug in IgAN, which is expected to report data in the fourth quarter of this year. The FSGS study required a two-week washout period of prior therapies before patients were randomized, while the IgAN study requires patients to be on a maximally tolerated blood pressure reduction drug up to randomization. Lugo said this difference likely results in a larger effect on the blood flow’s effect on eGFR in the FSGS study than should be expected in the IgAN study.

In addition, Lugo said FSGS is more heterogeneous, meaning it has multiple root causes. Consequently, the disease progresses in a relapsing and remitting manner, which is different than the more consistent decline in IgAN. Lugo emphasizes the point by pointing to SLGT2 inhibitors, a class of diabetes that block glucose reabsorption in the kidneys. Studies of these drugs in FSGS have been more challenging than in IgAN due to the heterogeneity and variable progression of the disease. Despite the failure of sparsentan in the FSGS study, called DUPLEX, Lugo still sees a potential path forward for the drug.

“While the failure to meet the primary endpoint of DUPLEX certainly brings the likelihood of approval in FSGS into question, we believe the totality of the data suggest that sparsentan is having a therapeutic benefit in FSGS,” Lugo said. “Given that the FDA has acknowledged the high unmet need and lack of available therapies in this rare disease, and that this would be an sNDA and not a new application, we believe there is still a chance of approval and are lowering our probability of success in the indication from 85% to 40%.”

Public domain image by Flickr user Internet Archive Book Image