UnitedHealthcare plans big Medicare Advantage expansion for 2021

The insurer plans to increase the footprint for its Medicare Advantage plans by adding 300 additional counties to its service area.

The insurer plans to increase the footprint for its Medicare Advantage plans by adding 300 additional counties to its service area.

The CEO of the telehealth company that just went public said reimbursement has improved, but not to the point where it is interchangeable with in-person care. But he still has high hopes for the future as he sees more physicians turning to telehealth.

After raising $635 million last year, insurance startup Bright Health brought in another $500 million led by three private equity firms. Starting next year, the company said it will offer small-group plans and services for self-insured companies.

A growing number of patients with private coverage are underinsured, according to a new report by the Commonwealth Fund.

The new plan design incorporates some features from Aetna’s parent company. The plan lets members access appointments at HealthHUB and MinuteClinic locations with no copay, and get discounts on health-related items at CVS stores.

A Delaware judge ruled on Monday that neither Anthem nor Cigna will be able to collect billions in damages over their failed merger.

The two companies had been negotiating a six-year value-based contract prior to the start of the pandemic. Allina and BCBS of Minnesota expect the agreement will affect roughly 130,000 patients.

The Cleveland Clinic struck a partnership with CVS Health subsidiary Aetna to form a new accountable care organization (ACO). The two companies plan to launch a co-branded insurance plan this fall.

During the height of the Covid-19 pandemic, all of the seven largest commercial insurers saw their profits rise, with some seeing their profits double. Will they have to pay some of it back?

For the quarter ending on June 30, when many health systems face a rising number of Covid-19 cases, the Kaiser Foundation Health Plan more than doubled its net income to $4.5 billion. The nonprofit managed care plans attributed the increase to reduced operating expenses and “market fluctuations.”

A recently unsealed whistleblower case filed by the Department of Justice accuses Cigna of fraudulently overbilling for its Medicare Advantage plans. Allegations claim the company submitted unsupported diagnoses that resulted in “billions” in overpayments.

Insurance startup Oscar Health plans to expand to 19 new markets next year, pending regulatory approval. The company will offer individual and family health plans in four new states, and will expand its presence in existing states.

Humana will send 1 million screening kits to its members for managing diabetes and screening for colorectal cancer. The at-home tests are intended to offset screenings and other preventive care being pushed back due to Covid-19.

Clover Health said it plans to triple its footprint in the next year, pending CMS approval. But the insurer has also posted a net loss in recent years.

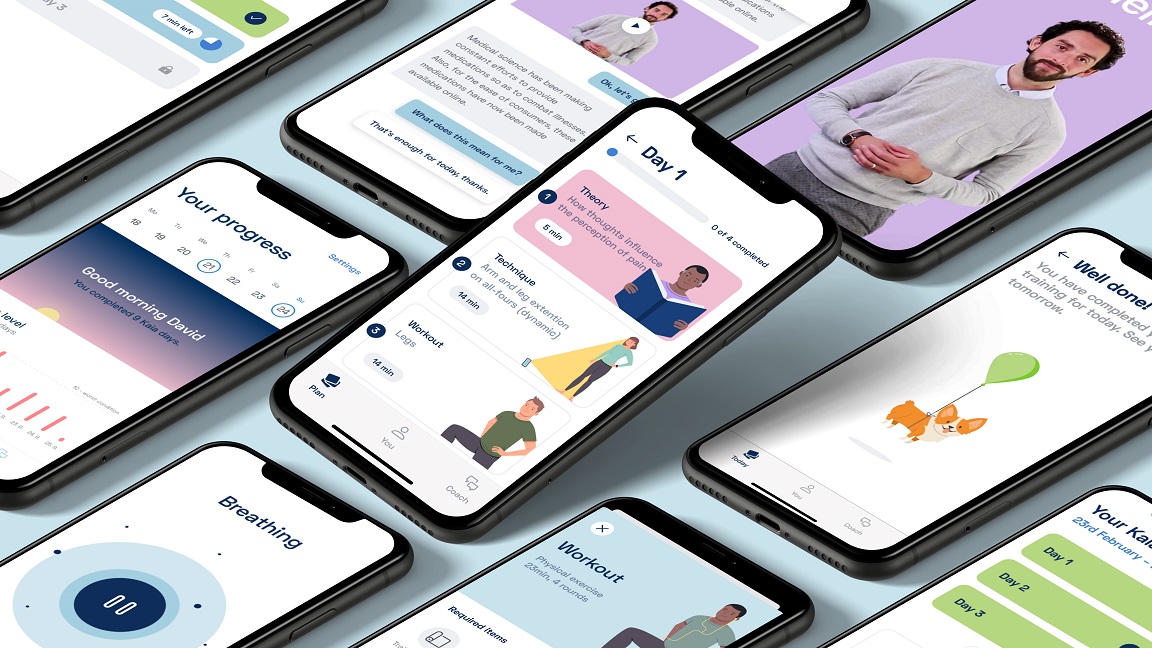

Kaia Health, a startup making an app to help users manage back pain, touted the results of a large, randomized controlled trial using its app. The company currently markets its system to employers, but hopes to make it available as a covered benefit in the future.