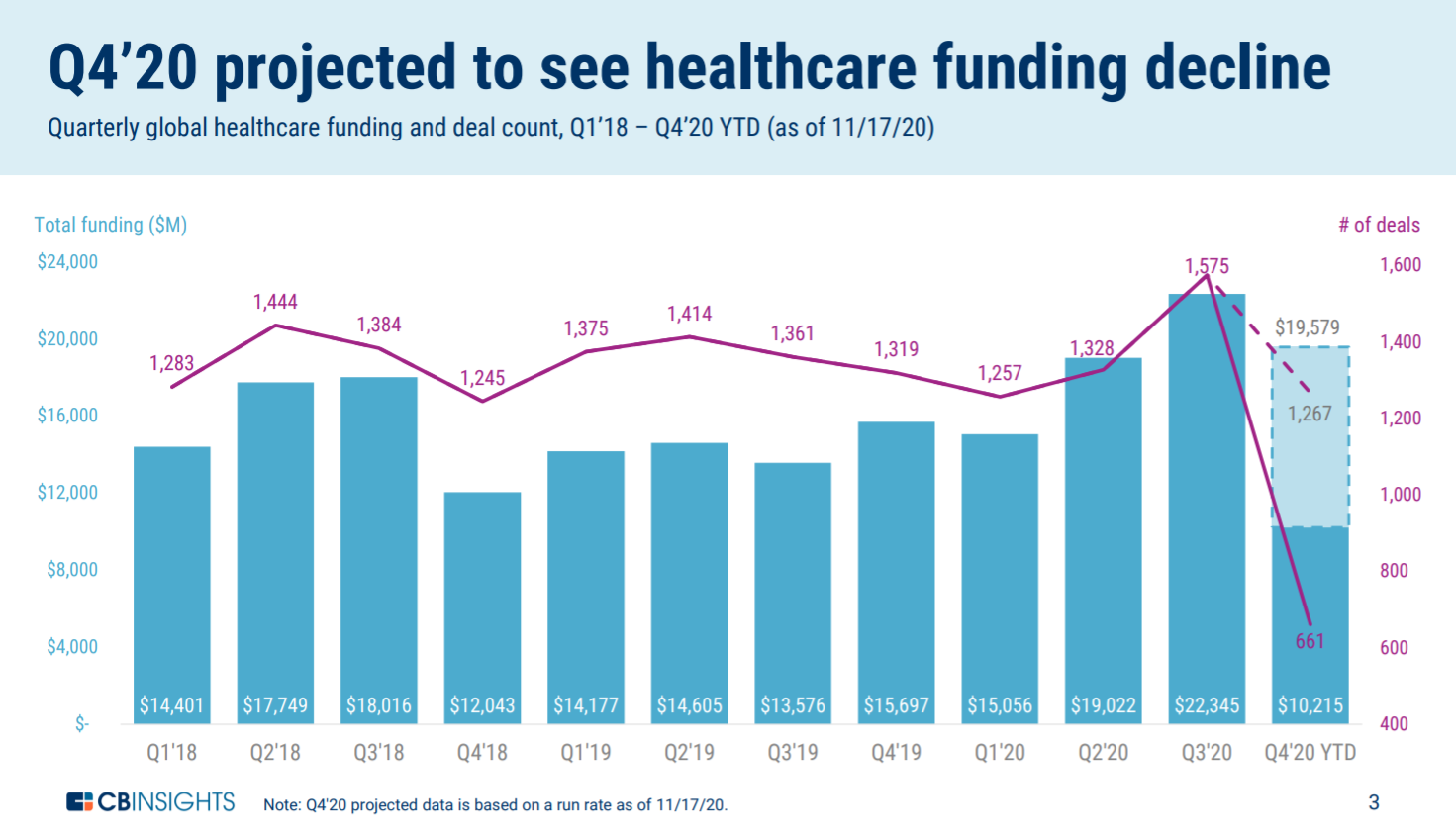

Digital health funding and deals are expected to dip after reaching record heights last quarter. CBInsights shared its projections for the end of 2020, showing a slight decline in healthcare investing overall.

For the third quarter of 2020 healthcare investing passed record levels of $21.8 billion. The end of the year is expected to return to normal levels, with a projected $19.49 billion in funding. CBInsights also forecasted fewer early-stage deals and more late-stage deals.

Behavioral Health, Interoperability and eConsent: Meeting the Demands of CMS Final Rule Compliance

In a webinar on April 16 at 1pm ET, Aneesh Chopra will moderate a discussion with executives from DocuSign, Velatura, and behavioral health providers on eConsent, health information exchange and compliance with the CMS Final Rule on interoperability.

The pandemic also shifted the spotlight on digital health companies, which raised a record of $8.4 billion last quarter, up more than 73% from the prior quarter. Going into the fourth quarter, digital health deals are expected to return to normal levels, with $5.54 billion in funding expected across 372 deals. As of Nov. 17, digital health companies had raised $2.89 billion across 194 deals.

CBInsights forecasts a slight decline in digital health funding for Q4. Photo credit: CBInsights

So far, there have been 30 reported healthcare “megadeals,” or rounds where companies raised more than $100 million. Most of them were for companies headquartered in the U.S. and China, with the U.S. seeing 16 megadeals and China seeing 11.

Here are some highlights:

A Deep-dive Into Specialty Pharma

A specialty drug is a class of prescription medications used to treat complex, chronic or rare medical conditions. Although this classification was originally intended to define the treatment of rare, also termed “orphan” diseases, affecting fewer than 200,000 people in the US, more recently, specialty drugs have emerged as the cornerstone of treatment for chronic and complex diseases such as cancer, autoimmune conditions, diabetes, hepatitis C, and HIV/AIDS.

- LianBio, a Chinese biotech firm, raised $310 million in private equity funding.

- PharmaPacks, a U.S.-based health and beauty online marketplace, raised $250 million in private equity funding.

- Caris Life Sciences, a Dallas-based molecular science company, raised $235 million in private equity funding.

- Minneapolis-based insurance startup Bind Benefits raised $105 million in a series B round.

- Carbon Health, which manages a network of primary care and urgent care clinics, raised $100 million in series C funding.

- Text-based primary care company 98point6 raised $118 million in a series E round.

Photo credit: TAW4, Getty Images